Municipalities across the United States are seeking approvals, funding or public-private partnerships to develop or redevelop their convention centers with attached, big-box hotels.

City councils in Kansas City and Oklahoma City are in process of getting approvals and funding secured while Portland, Oregon, and Chicago have such projects underway. One of the latest convention center hotel openings in the United States was the 600-room Hilton Cleveland Downtown, which opened on 1 May 2016.

We analyzed supply and demand of four comparable tracts before and after development of their attached convention center hotels to determine the impact on the central business district tract. The analysis focuses on aggregate supply and demand changes rather than occupancy levels. The rate of absorption affects occupancy levels and will vary in each market; therefore, only considering occupancy levels can mislead investors and municipalities.

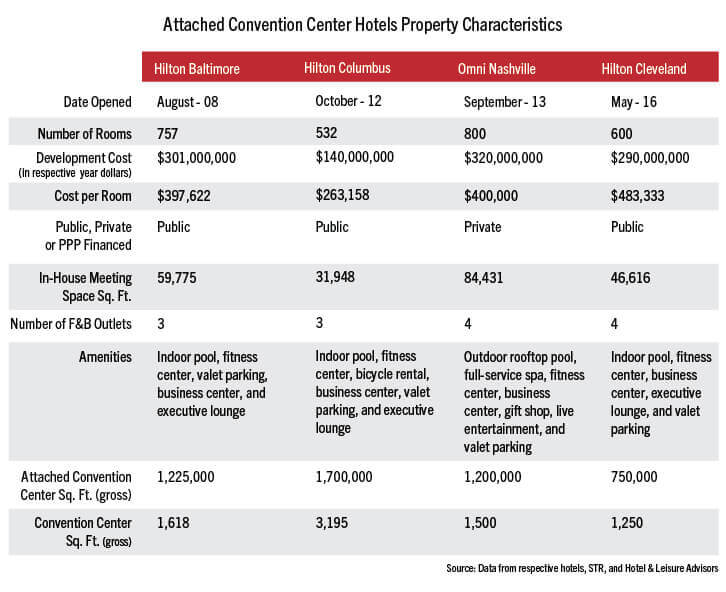

Characteristics of the four comparable hotels are described in the following table:

The comparable properties were selected since they are attached convention center hotels developed within the last 10 years and their respective markets are considered comparable. Destination Cleveland, greater Cleveland’s convention visitors’ bureau, includes Baltimore; Nashville, Tennessee; and Columbus, Ohio, in its benchmark TAP reports. TAP is an industry-relevant report generated by Strategic Data Resources that provides vital strategic data for convention bureaus around the U.S. and Canada, benchmarking and measuring performance demand pace and other metrics regionally and nationally.

Supply analysis

Year-over-year room supply percent changes for the comparable tracts and Cleveland are shown in the following graphs. Pre- and post-convention center hotel trends are highlighted and compared to the year-over-year supply changes for urban U.S. markets, according to STR. (STR is the parent company of Hotel News Now.)