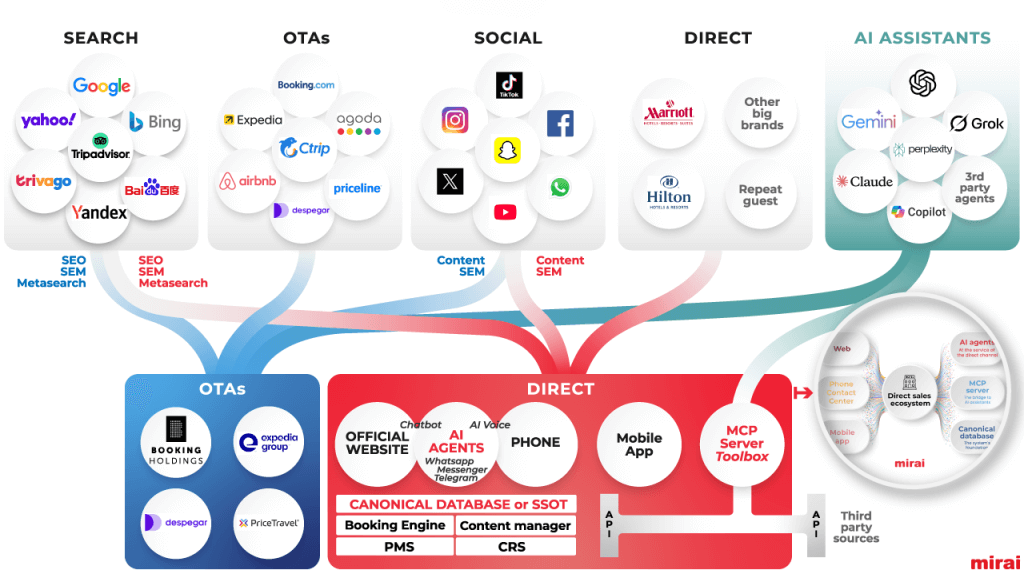

In response to DMA regulations, Google introduced several significant changes to hotel search result pages in January. Organic and unpaid traffic to hotel websites and booking revenue have fallen sharply while paid traffic and revenue have surged.

NB: This is an article from D-Edge

Subscribe to our weekly newsletter and stay up to date

The impacts are real. As it stands now, the winners from DMA regulations are the gatekeepers, not hotels or consumers. Recent changes to hotel search pages have increased OTA visibility and Google’s ad revenue, while hotels have lower visibility and receive less organic traffic.

As a result, direct distribution costs have become significantly more expensive for hotels in Europe and most probably for hotels advertising to a European clientele.

What Is the Impact of These Changes on Hotel Performance?

We analysed website traffic and digital booking data for a broad selection of independent hotels and small hotel groups in the EU. The data was drawn from the period January 1, 2024, when most of the changes took effect, to April 28, 2024, and compared to the same period last year.

Key findings

1- Significant drop in free traffic

The share of direct revenue from organic and unpaid traffic on Google has decreased from 66% to 57%

Organic Traffic Decline: There has been a 20% drop in organic traffic to hotel websites, likely due to organic links appearing much lower in search results.

Free Booking Links Revenue Fall: Revenue from Free Booking Links has dropped by 32%. Despite the placement remaining the same, changes in the overall page display could explain the 41% drop in clicks.

2- Increased dependence on paid traffic

The share of direct revenue from Google paid campaigns has risen sharply, from 34% to 43%, with Google Ads (Search Marketing) accounting for 39% of clicks.

3- Rising distribution costs

This shift has led to a 18% increase in direct distribution costs, with average direct distribution costs rising from 3.3% to 3.9% of revenue. However, direct costs remain three times less expensive than indirect costs on average.

4- Unfavourable shift in channel distribution mix

Direct booking revenue share has fell by 4.3% to an average of 28.1%, while OTA revenue market share has grown to 62.7%, and other indirect sources (mostly Hotelbeds) have increased to 9.1%.

Given that total digital revenue was up by 11% during this period, some hotels may have missed these important shifts in traffic, revenue, and market share.