Now that the first half of the year (H1) is over, hoteliers are reviewing their numbers. Is your property on track to close the year with a 15%-40% increase in revenue from 2019? Over 400 revenue-managed hotels can say, “yes.”

NB: This is an article from Revenue Team by Franco Grasso, one of our Expert Partners

Compare such performance with STR reports. In a recent webinar the industry benchmark showed the hotel recovery is going strong though Revpar (Revenue per available room, one of the main top line indicators) is still lower in many European urban markets than it was in 2019.

Subscribe to our weekly newsletter and stay up to date

Some hoteliers will shrug and blame the pandemic (or the war in Ukraine, the inflation, the chaos in airports etc.) for the lower numbers. Yet, the research below shows hotels that have consistently implemented revenue management methodology are exceeding their 2019 numbers by 15%-40%.

What Makes the Difference?

STR represents a large sample of properties with varied performance. As expected, some of them are “underperformers” that lower the average, with a low brand reputation (below 8 on Booking.com or 4 on Tripadvisor/Google.) Additionally, some of these have been closed for 1 or 2 years due to the pandemic. The low brand reputation and closures mean these properties have lost visibility and ranking compared to properties that have remained open.

In fact, if your property has remained open or only closed for a couple of months at the beginning of the pandemic, then you’re in a different category than those hotels that closed and haven’t reopened for a long time.

Rather than trying to rebuild your former reputation, you’ve remained open and if you’ve included revenue management methodology you’re reaping the rewards.

In this article, we’ll share a performance overview in the first half of the year (H1) 2022 using European and South American hotels practicing revenue management. We’ll compare their recent results with a comparable period of 2019. We’ll also provide a focus on specific Italian and Argentinian cities. For context, these trends mirror those of other countries in Europe and South America.

The report isolated a limited sample of properties for comparison. These 400 properties all use the consulting services and revenue management system of Franco Grasso Revenue Team. Other commonalities include:

- Never closed during the pandemic

- Revenue management as a profitability strategy (even in times of crisis)

- A reputation score of 8 or more on Booking.com and 4 or more on Tripadvisor/Google

- 3-star category (from 20 to 200 rooms)

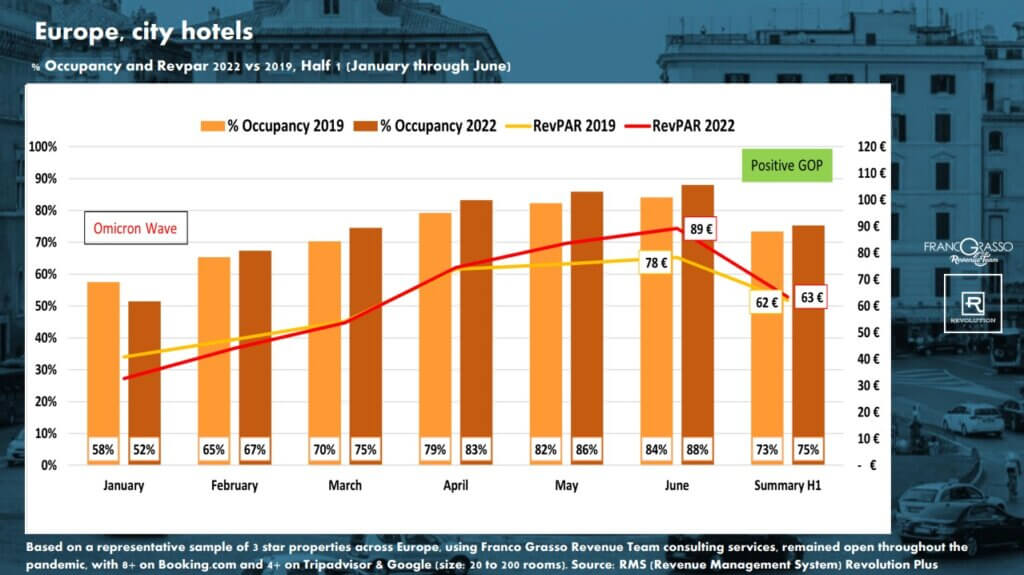

European city hotels: Performance 2019 vs 2022

In this graph, we can see the results of European city hotels from January to June 2022. As you can see, the Omicron wave partially affected the results of January and February. Not so much due to travel restrictions but rather the contagiousness of Omicron meant many people had positive tests prior to travel they had to cancel or move their reservation.

However, come March, things started to change. You can see the results crept up past 2019 numbers and kept rising in April, May, and June. These past three months compensated for the decreases of the first 3 months, and it was due to the ability to maximize revenue through revenue management. As a result, the properties closed this period with a total turnover higher than that of the same time frame in 2019. (+2%.)

Of course, location plays an essential role in hotel revenues. One in-demand location this year is Rome, Italy.

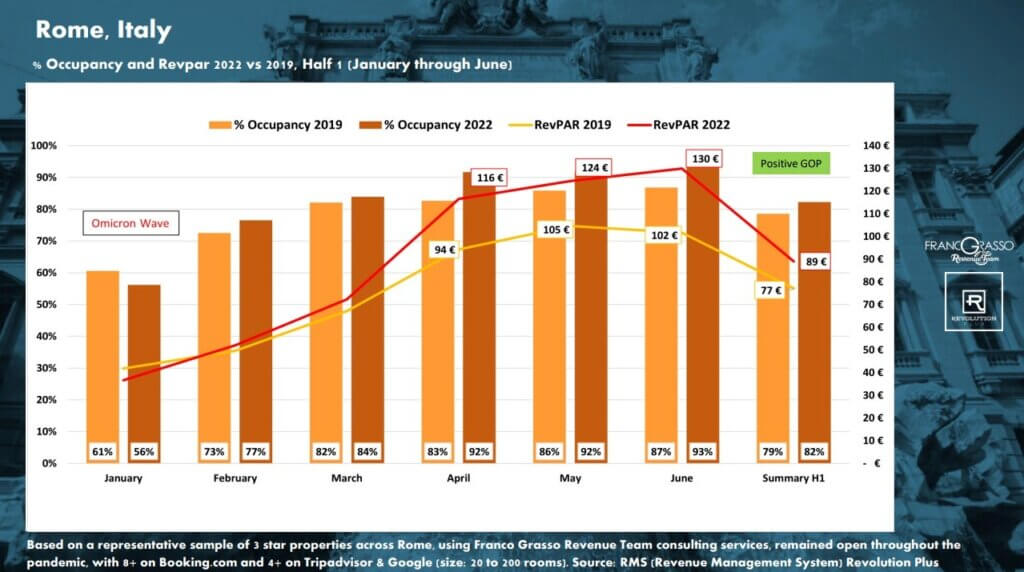

Rome

The Italian capital always attracts tourists. According to worlddata.info, the city was 17th in the world and attracted 10.32 million tourists in 2019.

As travel was stifled for two years due to the pandemic, when travel restrictions were relaxed and borders reopened, Rome saw a surge of tourists. Additionally, there were fewer hotels to house them. The president of the local hoteliers association, reported at least 350 hotels out of more than 1200 have been closed since March 2020 for almost two years, and around 200 are still closed or will never reopen. This change is visible by doing a simple search on Booking.com to analyze the number of properties listed.

Those hotels still open were able to welcome these tourists.

As you can see in the chart below, the revenue increases for hotels in the second quarter (compared to 2019) were exceptional, which allowed them to minimize the losses of the first quarter and close with a half-year turnover of +15% compared to 2019.

In addition, the pandemic has swept away many alternative accommodation facilities (B&B, guest houses, etc.) that were not even lawful but had an online presence and inevitably conditioned the local market.

As you can see, a significant increase in demand matched with a reduction in supply means that the remaining hotels are well-positioned to reap the benefits. Additionally, these hotels adhered to revenue management methodology throughout these past two years, which has positioned them to thrive in the current climate.

In fact, during 2020 and 2021, revenue management allowed these properties to:

- Capture alternative demand (essential or transient business travelers) during periods of increased restrictions on leisure travel

- Maintain an operational break-even

- Maximize revenues during periods of relaxed restrictions to recoup previous losses

- Collect positive reviews

- Keep the ranking and online visibility always high

- Maintain their staff

- Acquire new clients from hotels that were closed during the pandemic, and retain them post-pandemic

- Achieve a positive GOP (Gross Operating Profit) at the end of the year

- Analyze the market to predict demand in the short, medium, and long term

- Invest in service improvements

- Surpass competitors

As a hotelier, you know there’s a tremendous staff shortage and some hotels that fired staff earlier in the pandemic are now forced to operate at reduced capacity because they don’t have enough staff. Clearly, revenue-managed hotels that remained open and have stable staff can operate at 100% of their capacity and get the benefits.

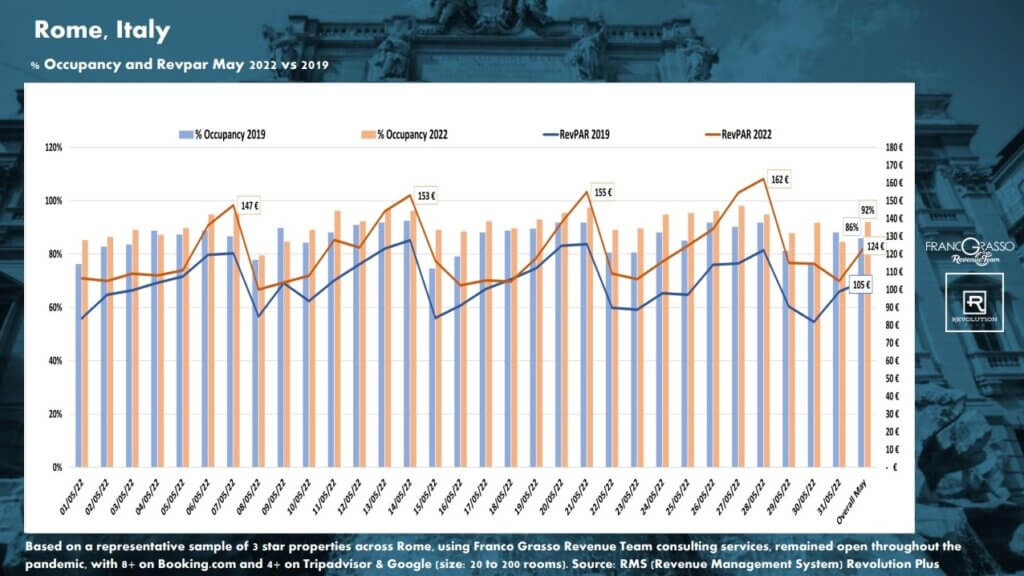

When we look closer at the May numbers, we can see a familiar trend for the main European art capitals before Covid and now. In Rome, Saturdays continue to be the most requested day of the week when there is a peak occupancy and ADR (average daily rate). Rates continue to grow week after week, Saturday after Saturday keeping with progressive easing of restrictions and the traditional summer travel season.

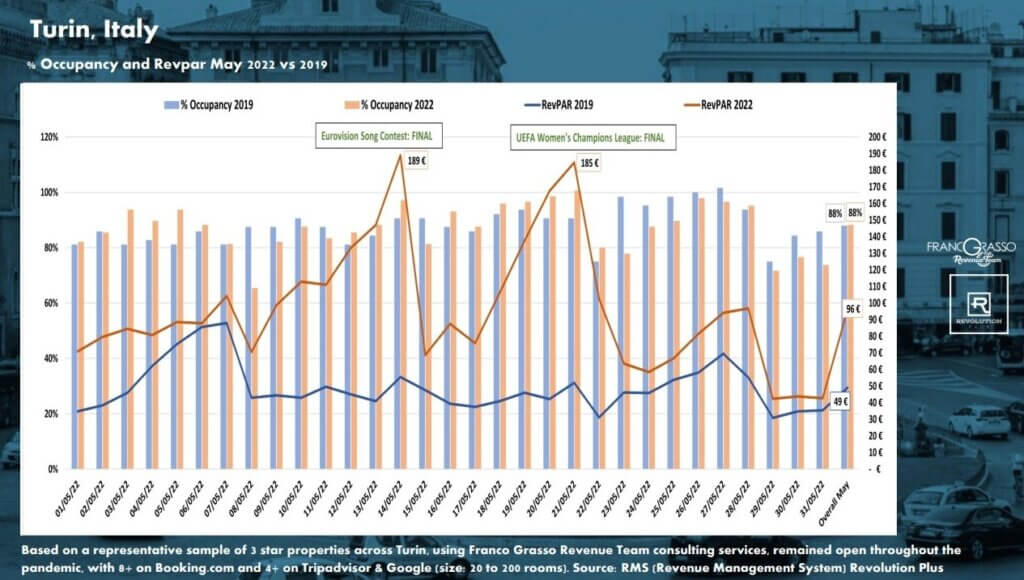

Turin and Milan

Now, let’s compare data from two other important Italian cities, Turin and Milan. Examining the data from Turin in May we can see how major events are generating a huge demand in this post-covid phase, and hotels that apply revenue management can push rates towards levels they were not always accustomed to before Covid.

It is interesting to note that two events, in particular, have generated a huge demand for Turin. These events turned into significant peaks for occupancy and ADR on Saturdays 14 May and 21 May. The first predictably was the Eurovision Song Contest, one of the most-watched international music events in the world. The final on May 14 generated a significant peak for accommodation facilities. Equally remarkable and partly surprising was also the peak of the following Saturday, when the city hosted the final of the Women’s Champions League, the major football tournament featuring Barcelona and Lyon. Hoteliers know that the Men’s Champions League Final is one of the most anticipated events for cities hosting the event.

While it’s still unknown if the Women’s Champions League will draw as much demand as the men’s in future years, we do know the stadium was full as were the hotels this year. Of course, the final overlapped with other weekly events (fairs, sporting events, etc.), but it is interesting to note how women’s football is gradually gaining an increasingly large following among football lovers and recording record attendance in stadiums during big matches. Recognizing such demand can have an important repercussion on revenue management.

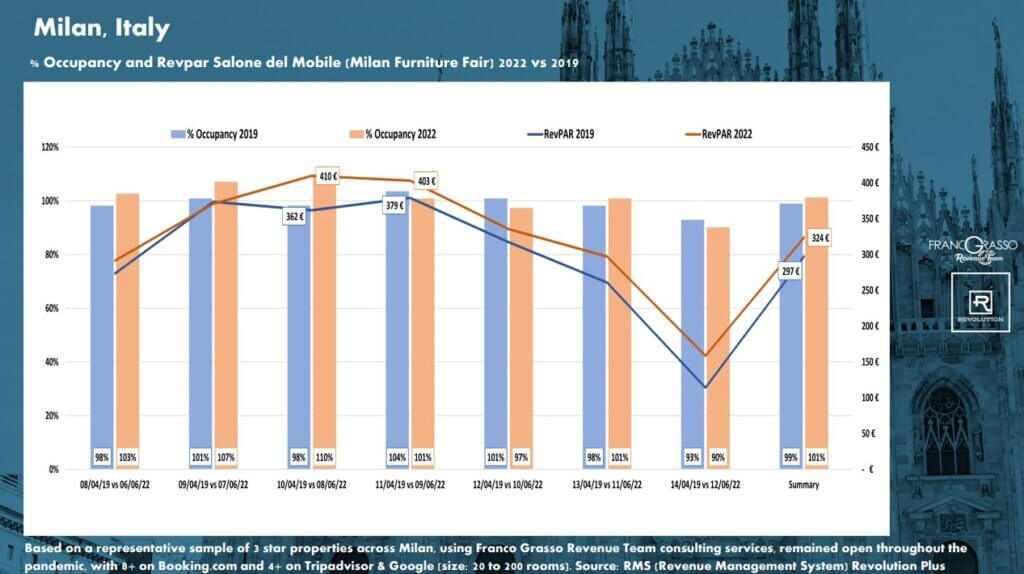

Turning our attention to Milan, the Salone del Mobile is the largest and most important furniture and design fair in the world. It’s a classic super event where there is an excess of demand compared to supply, and even 3-star hotels can reach rates normally allotted to 5-star hotels. There is spillover to nearby towns too.

In 2020 the event was canceled due to Covid. In 2021 it was held in a reduced format for the number of participants and exhibitors. 2022 marked the return to normality for this event, which is generally held in April, but this year took place in June. In the chart below we can see the results of the week in which the event was held (6-12 June 2022), compared to the week in which the event was held in 2019 (8-14 April 2019.)

As you can see, the request was so great that on some days occupancy went beyond 100% (with a peak of 110%). In these cases, although the demand is higher than the supply, not everyone reaches 100% organically. In-demand hotels can strategically overbook themselves beyond 100%. They know which other hotels still have free rooms and can lend a portion of their extra occupancy to these underperforming hotels which help them reach 100% occupancy.

The calculated overbooking accounts for which customers they can redirect to another property without turning this into a stressful time for the staff and a bad experience for the guest resulting in a negative review.

Through this strategic overbooking, these hotels manage to earn extra money by leveraging the price difference between them and underperforming hotels.

Seasonal hotels: mountain, beach, and lake

Let’s take a trip outside of the city and see other destinations.

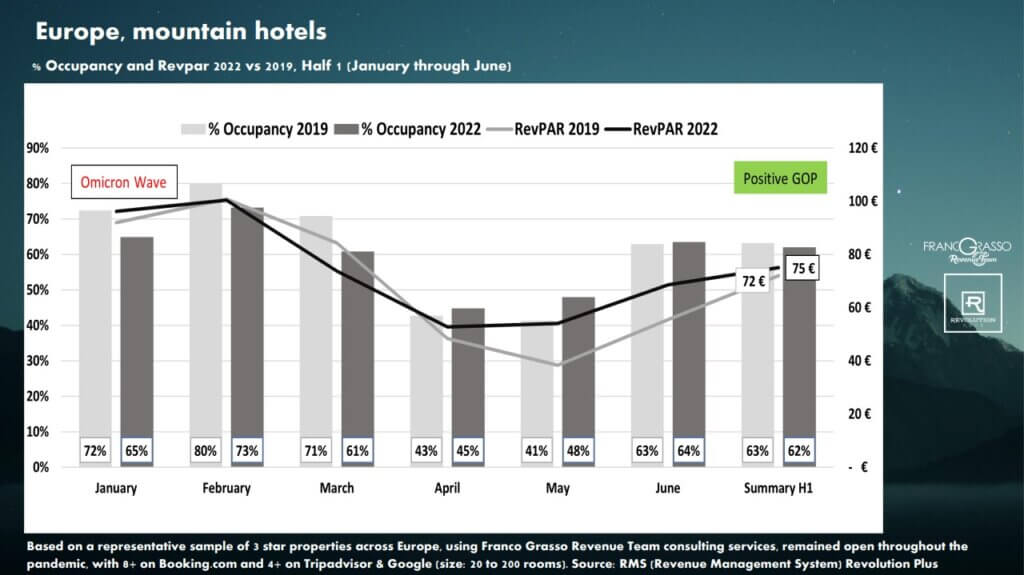

Even European mountain hotels, as visible from the graph below, were impacted by the first 3 months of the year (high winter season) due to Omicron. The Omicron wave caused several cancellations close to the occupancy date because of positive cases or logistical restrictions. However, despite lower occupancy than in 2019, mountain hotels still managed to surpass 2019 Revpar thanks to a higher ADR. And the second quarter (generally considered the low season for mountain facilities) ended with results higher than the pre-covid period, so the entire H1 was better (+5%.)

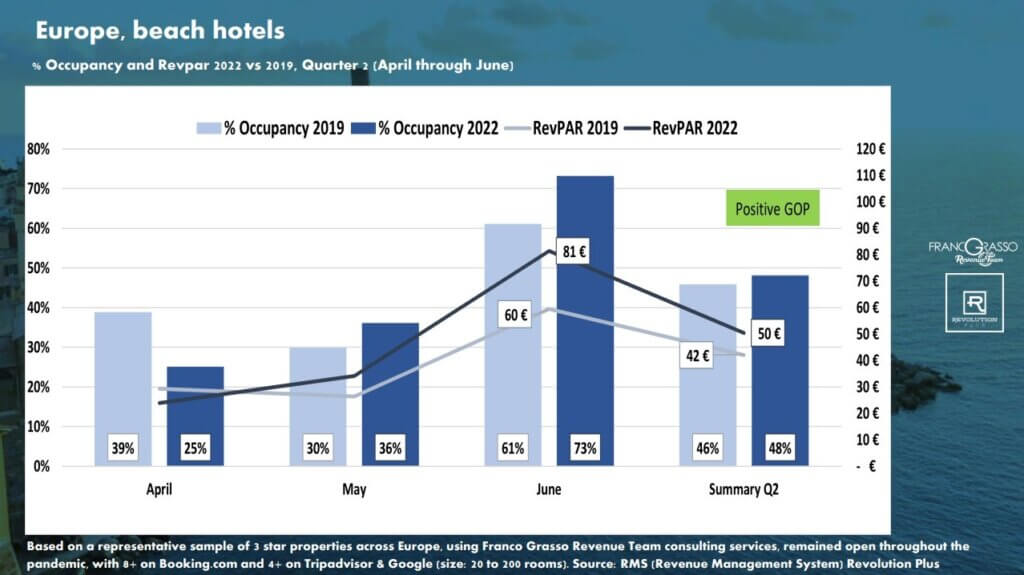

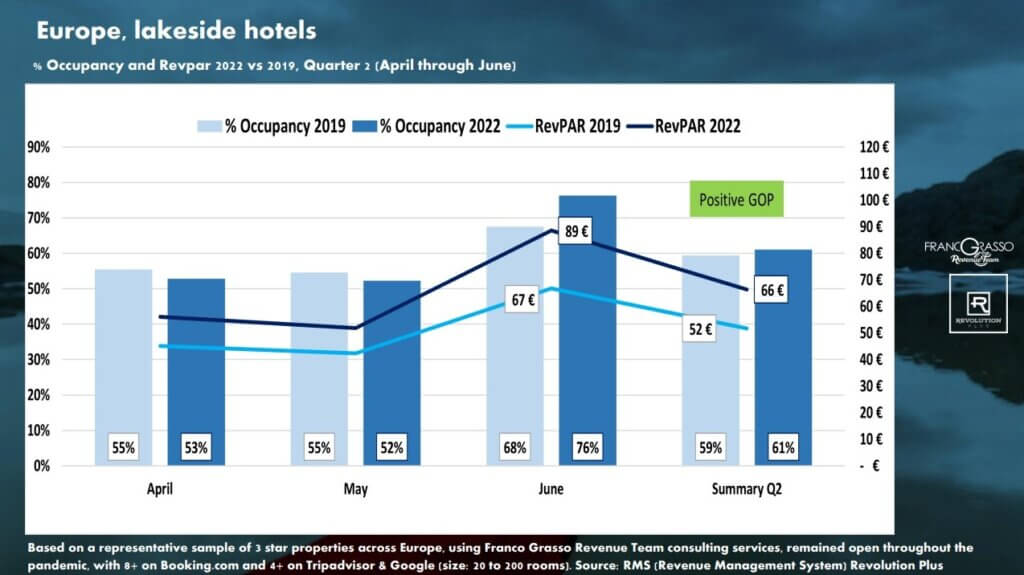

Below you can see the trends of mainly seasonal and summer properties in Europe, close to the sea, lake or countryside. These hotels, thanks to the easing of restrictions, were able to open as early as April 2022 with the beginning of spring (similarly to 2019) and recorded results higher than in 2019 (between 10 and 45%) in the entire quarter.

By now you may be wondering if these samples hold outside of Europe. The answer is, “yes.” Let’s take a look at the Southern Hemisphere for comparison.

The southern hemisphere: Argentina

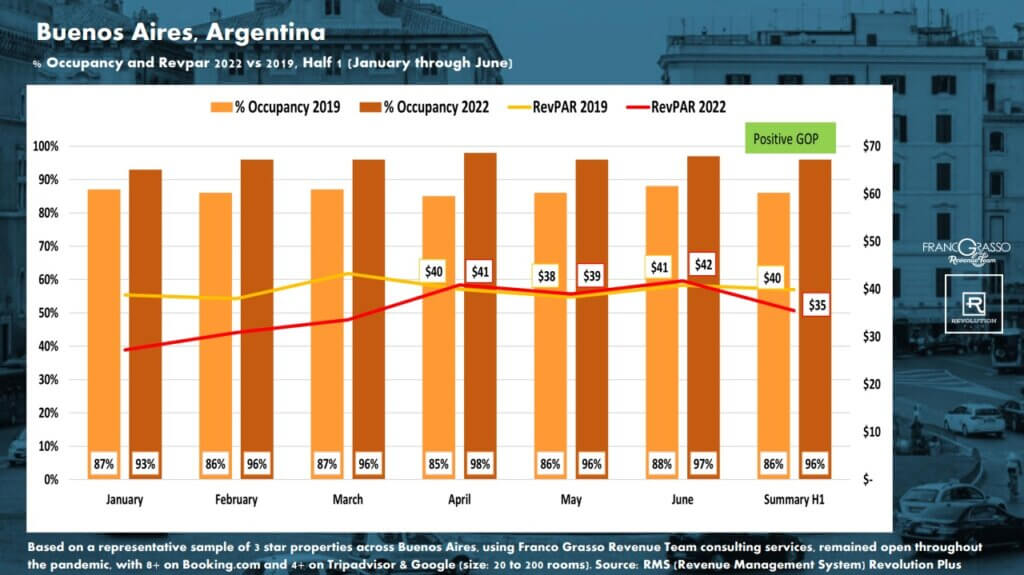

The Argentinian capital Buenos Aires maintained excellent levels of occupancy throughout the first half of 2022. However, Revpar surpassed 2019 only in the second quarter thanks to a further easing of restrictions and the return of foreign travelers, especially from neighboring countries.

In fact, while occupancy was higher than in 2019 during Q1, due to some restrictions most of the guests were domestic guests who pay in local currency, therefore ADR was affected by a heavy devaluation of the Argentinian peso compared to 2019. So revenue and revpar were higher in Argentinian pesos (more than double vs 2019), but not in US dollars. With the return of more foreign travelers who pay US dollars from April onwards, the ADR, revpar, and profits started to outperform 2019 again. And the positive trend in H2 suggests the entire year’s results will surpass 2019 too.

On the other hand, other locations saw a different trend.

Below is a graph of the results of Villa General Belgrano, one of the most popular leisure destinations in Argentina. The first 3 months of the year are considered summer, then high season. The results were much better than in 2019, thanks to strong domestic demand, and the trend was repeated in the second quarter even with lower absolute occupancy and revpar due to the low season. This is a typical example of a natural spot (mountains, forest, rivers, countryside, hills) that domestic travelers favored during the pandemic.

As predicted in a previous article, hotels that have always (or almost always) remained open during the pandemic and that have never stopped practicing revenue management during the crisis, managed to close the first half of the year better than in 2019. And the outlook for the second half of the year is just as exciting.

Conclusions

As you can see, both the mid-year (H1) numbers and the forecast for the second half (H2) point in the same direction. As expected, these revenue-managed hotels could close the year with increases between 15 and 40% versus 2019. Revenue management guides strategic decisions so hoteliers know what to do to maximize revenue no matter what’s going on in the world.

In this free ebook you will find more information and practical advice on strategies adopted by beach, city, mountain, lake, and countryside hotels to outperform competitors and watch their revenues soar.