As the economic fallout of 2020 lingers over the industry, our ongoing industry research consistently reveals that the majority of Hoteliers expect to decrease Hotel ADR.

NB: This is an article from Guestcentric

In this blog, we analyze the competitive challenges of hotel ADR in the current climate. We also explore what Hotels can do to overcome these hurdles as they prepare for the upturn.

The Competitive Challenges of Hotel ADR in the Current Climate

Subscribe to our weekly newsletter and stay up to date

The crisis exerted sudden and unprecedented disparities between supply and demand across all hotels worldwide. Sharp drops in demand, excess capacity, and heightened price sensitivity are converging to drive down prices and destroy value.

Further exacerbating the problem are competitors who have rushed to make aggressive pricing decisions, which in turn creates pressure on other hotels to follow suit.

The disparity between supply and demand is unsurprisingly pronounced across the City Center Hotel segment. Of the three property segments (City Center Hotels, Resorts, and Bed & Breakfasts) observed in our ongoing Hotelier PULSE research, City Center Hotels are the most likely to decrease hotel ADR in the next 12 months. However, Resorts & Bed & Breakfasts continue to maintain a more stable pricing strategy.

To Decrease or not to Decrease Hotel ADR?

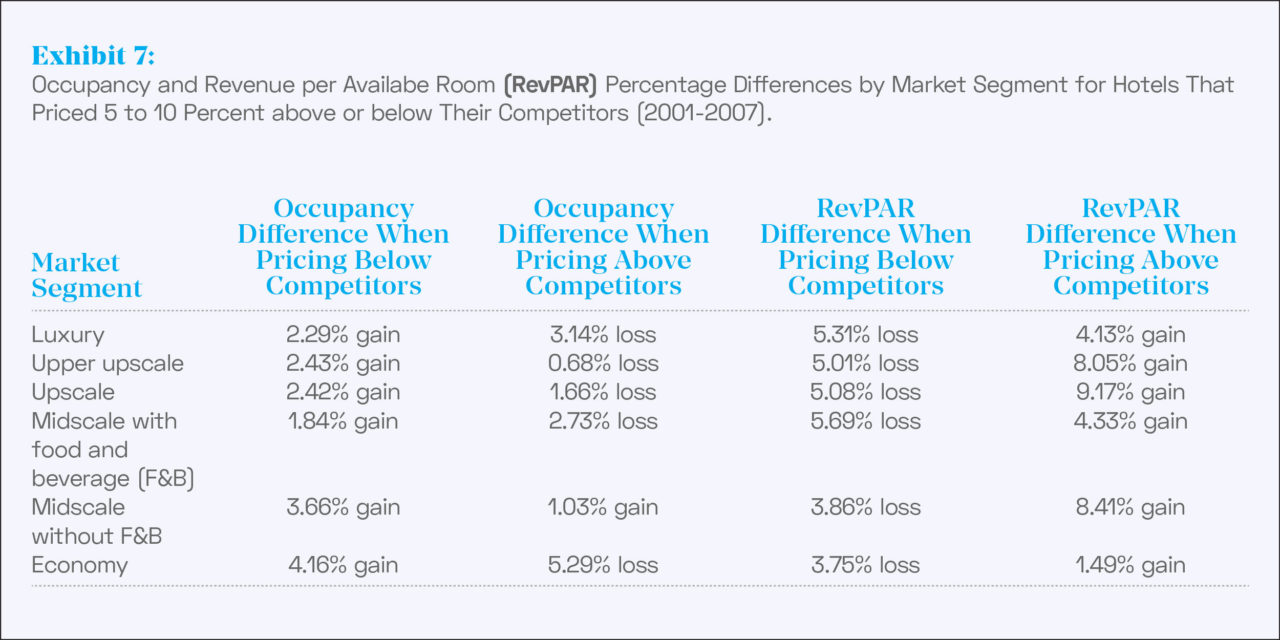

History and research suggest hotels that hold the line on price tend to recover faster from recession. In cooperation with the Center for Hospitality Research at Cornell University and Smith Travel Research (STR), researchers explored pricing behavior using 67,008 hotel observations over a seven-year period, from 2001 through 2007.

The study was extremely robust, covering a diverse range of property segments and pricing behavior during both turbulent times of 2001 until 2003 and the good times of 2004 until 2007.

The results, as shown in the table below (*Exhibit 7 in the Research Paper), show that regardless of price segment, RevPAR gains came to hotels that priced above their competitors. On the flip side, consistent RevPAR shortages fell to hotels that priced below their competitors.

The percentage differences in RevPAR losses for discounters were similar across all market segments and highest for midscale full-service hotels and luxury hotels.

The general pattern of results was consistent. Whether hotels face good or bad times, pricing above direct competitors yields higher room revenue. On the other hand, pricing below competitors does not stimulate sufficient demand to give the hoped-for revenue boost to make up for the lower rates.

Guests of luxury hotels appear to be less sensitive to price discounting, while customers of economy hotels are quite sensitive to small price increases.

But what are Hoteliers saying About Pricing & Hotel ADR in the Current Recession?

When asked about pricing and ADR in the current climate, Jorgen Christensen, CEO at Small Danish Hotels in Denmark said: “Obviously price is a huge factor at the moment, and I am sure many Hotel Managers are considering lowering prices to remain competitive. In Denmark however, we have the highest VAT for hotels in Europe at around 25%. All the countries around us have lowered the hotel tax due to Covid-19. So, therefore, if Danish hotels lower their prices even more, well they may as well close their doors now.”

Kyp Charalambous, VP of Sales at Atlantis the Palm in Dubai, agrees that hotels should maintain prices to uphold brand integrity when demand picks up again. “I am proud to say that at Atlantis, The Palm price integrity is extremely important to our brand,” he said.

Rather than lower prices, Kyp strongly believes Hoteliers should use this period of low demand to invest in planning for the upturn. He says, “Instead of compromising the price, we have used periods of lower occupancy to upskill our workforce, prioritize their wellbeing, redefine our offers and services, and enhance our resorts and hotels. I firmly believe hotels should hold the line on price whilst striving to be unique with the products offered.”

Daniela Hupfeld, Commercial Director at Pierre & Vacances España in Spain agrees. Despite the long road to financial recovery, she believes the speed of a hotel’s recovery will largely depend on their pricing strategy now. “To return to 2019 levels, it will take us two to three years for sure. Then there is always the question of how you recover that returning demand,” she said.

She maintains that hotels that compromise on price during low levels of demand will be severely left behind financially when the upturn comes. “We will see some hotels doing really well and recovering earlier because they managed to convert that demand at the right time. Others will lose out simply because they have not been ready or they simply panicked and slashed prices far too early – ending up with a lot of low-rate business which may not have been necessary at that point.”

Hotels should focus on Long-Term Value instead of Price

But how can hotels overcome the issue of pricing? When neighbouring competitors rush to lower their prices, pressuring others to do the same. Well, we have a few suggestions that could help you keep revenue flowing during this time – none of them involve drastically lowering your prices.

1. Reduce Inventory but Add Extra Value to Rooms

In our February 2021 Hotelier Spotlight event, co-hosted with Techtalk.Travel and paneled by our CEO Pedro Colaco and Aviation expert, Gavin Eccles, the talking points highlighted the striking similarities between aviation and hotels currently.

Much like airlines that are opting for smaller aircraft to implement point-to-point routes and meet the current demand, hotels may want to consider reducing their inventory (and costs), whilst maintaining pricing. Hotels may want to consider lowering availability, perhaps closing off rooms for refurbishment, for example.

With the remaining rooms, hotels could offer longer-term leasing contracts, or provide an escape for remote professionals to work. Hotels could add a little extra value to rooms. For example, a “Stay the Night and We’ll Let You Use our Conference Hall for Virtual Meetings.”

2. Focus on Leisure & Target New Markets

In our Hotelier Spotlight Interview with Joao Corte-Real, General Manager at Hotel Tivoli Mofarrej in Sao Paulo, Brazil, he shared his experience on how his City Center hotel is responding to the changing demand: “The local market is extremely important for us. Therefore, we continue to shape our sales and marketing strategies around local tourists and guests.”

When asked how his city center hotel continues to adapt and revamp their offer, he added: “In the past we predominantly serviced groups and corporate segments, providing short stays during the week for professionals traveling to Sao Paulo on business.

But currently, we’re seeing an increase in leisure guests, including families. As a result, we have had to reshape our offer to meet this new demand – offering suites and family rooms – which are in even greater demand during weekends. So our commercial activity has also shifted from weekdays to weekends.”

3. Collaborate with Local Hotels & Businesses to Brand your Destination

In the hospitality industry, competitors and partners operate interchangeably. In these times of economic uncertainty, it’s important for industry leaders to work together for a brighter future. “Together we stand, divided we fall,” as the old adage goes.

In one of our very first Hotelier Spotlight interviews with Nienke Badia, Director of Sales at Hotel Okura Amsterdam, highlighted a positive element from the crisis – the industry’s deeper focus on sustainable tourism and destination branding.

“Now that global tourism has stopped, Hoteliers are now looking closely at bringing local tourism back in ways that are beneficial to both the economy and social cohesion. There is also a deeper awareness of the impact of travel and what it means for destinations and local residents,” she said.

When asked how hers and other local hotels have contributed to this trend, she added: “Since the start of the pandemic here in Amsterdam, we have frequently engaged with other hotels, partners, venues, and governing bodies to strategize how we can promote this destination and attract visitors who will contribute to its sustainability and social cohesion. I expect this will continue after the crisis blows over.”

Conclusion

When demand is close to zero, price is not a factor. So, make sure you hold the line on price, now and when the rebound comes. The data tells us that destinations and properties that compromised on price in past recessions took significantly longer to recover in the upturn that followed.

Therefore, we recommend that hotels focus on long-term value rather than slashing prices to stimulate demand. Remember, the demand will return. Do you really want to generate high volumes of low-rate bookings when that day comes? We didn’t think so.