With our access to real-time traveller audiences and unmatched visibility into global travel demand, we’re in a unique position to share the current travel trends at the forefront of marketers’ minds.

NB: This is an article from Sojern

In this blog series, we’ll take a look at the data in order to aid travel marketers in their assessment of this worldwide event. They can use these trends to inform their marketing strategies during this period and be prepared for the recovery once the situation stabilises.

These insights are based on data collected on the 16th of June, 2020. We are reviewing our data on a weekly basis in order to provide a regular view of trends and patterns in consumer behaviour. Sojern’s insights are based on over 350 million traveller profiles and billions of travel intent signals, however it does not capture one hundred percent of the travel market.

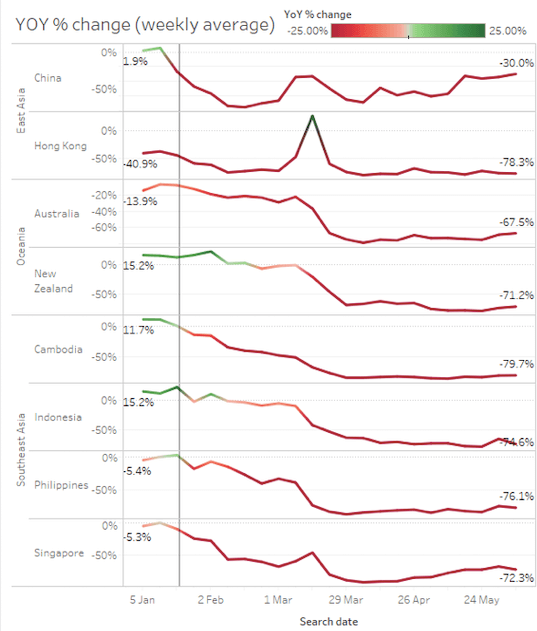

Travel Intent and Demand Sees Improvement Across APAC, Particularly to China

We are starting to see upticks in global travel intent to some countries across Asia Pacific. While numbers are still down in comparison to 2019, they are up considerably from February and March, when COVID-19 was potentially at its peak in Asia Pacific. In particular, it’s worth noting that China, which was impacted first and hardest by COVID-19 in the world, has seen a positive increase in travel searches. Intent to China is now only down 30% YOY.

Australia’s ban on international departures, which was due to run from 18 March to 17 June, has now been extended to 17 September. The Australian government has said that this would not prevent the proposed trans-Tasman (between Australia and New Zealand) travel bubble or partnerships with other nations that have control of their COVID-19 cases. Our data indicates that travel intent to Australia is now down 68% YOY.

Global Flight Searches to Key APAC Markets

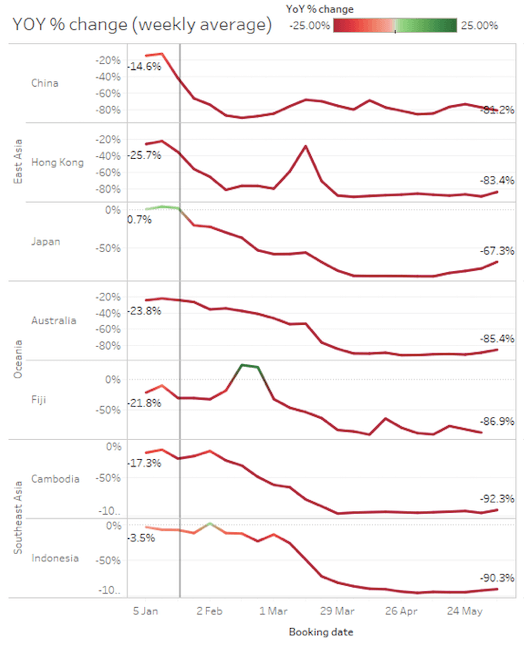

When looking at flight bookings, they remain lower than searches, which is still to be expected. The South East Asia region is where we are seeing the lowest amount of travel confidence in our data. This could be likely due flight and border restrictions being particularly stringent in South East Asia. Japan on the other hand is showing some positive changes and momentum in flight bookings.

Global Flight Bookings to Key APAC Markets

Malaysia, Paving the Way for Domestic Recovery

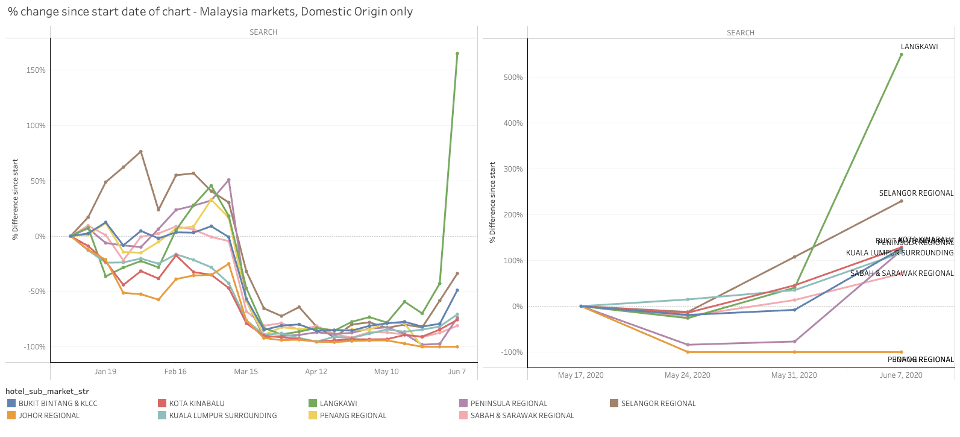

While Malaysians are still not able to travel out of the country, as the borders remain closed, domestic travel intent has seen some positive changes. When looking at our hotel search data, we can see that hotel searches within Malaysia have increased and Langkawi particularly stood out. Langkawi – the ‘Jewel of Kedah’ in the turquoise Andaman Sea can be reached by air and road (car, bus or train!) and it is evident that Malaysians are looking to get away there!

Domestic Hotel Searches Within Malaysia

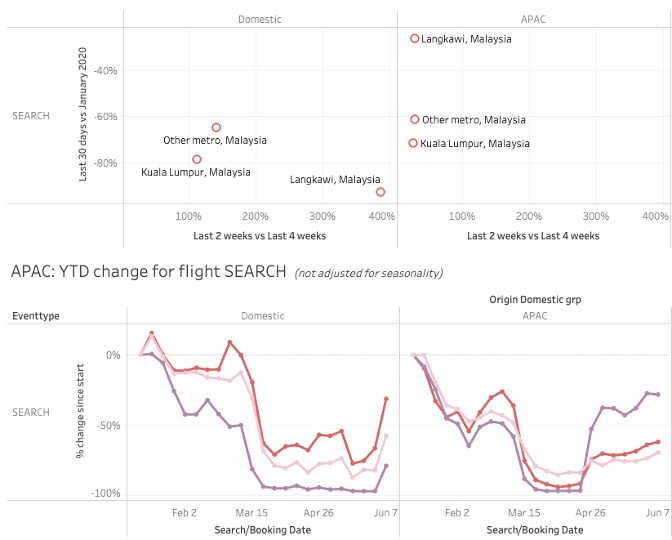

It was announced that Malaysia Airlines (MAS) will resume some of its international flights in July to allow for essential travel. And last week, kicking in from 10 June to 31 August, the recovery movement control order (RMCO) came into place which will see the easing of interstate travel. Our flight search and booking data in June has increased, which is a marked difference from April and May where flight travel intent was relatively low.

Malaysian Flight Searches – Domestic and from APAC

We will continue to share more APAC insights as we monitor the situation and find interesting trends, to help travel marketers shape their strategies when the industry starts to recover from this outbreak.