You wouldn’t trust a doctor’s mere intuition with your health, right? Of course not. You’d require testing and data.

NB: This is an article from Hotstats

Operational benchmarking is the hotel industry’s electrocardiogram (EKG), MRI, X-ray and ultrasound — the instruments that provide the cold hard facts. Isn’t your bottom line worth it?

Among industries, the impact of COVID-19 on the hospitality industry has been especially injurious: halting travel in its tracks, postponing conferences and gatherings and precipitating the furloughs and layoffs of thousands of employees within the space.

The unprecedented nature of the disease has rendered obsolete the budgets and business plans that were approved just months ago. Amid this new paradigm, the ability to adapt to change with alacrity will be the cornerstone of future recovery.

One way to tackle the new normal is through operational benchmarking, a process that allows for analyzing, interpreting and operationalizing relevant market data, which can help hotels protect the bottom line.

Here are three ways to advantageously use operational benchmarking during the COVID-19 downturn.

1. The Starting Line

In order to create effective contingency and recovery plans, it’s imperative that hoteliers understand their operations’ core strengths and weaknesses. What was your competitive position in the market before the downturn?

First, look at the historical trends from your competitive set to find the areas where you typically underperform and identify the costs that are hampering your flow-through. Using operational benchmarking has a dual effect, allowing you to both find cost-saving opportunities to make your operation nimbler during these leaner times and then come back stronger on the way back up.

Understanding operational strengths is likewise important. Where were you typically overperforming your competitive set and, more importantly, why? Identify the areas and traits that make you stand out from the competition and assess how you can share those best practices across all the departments in your hotel.

Understanding your competitive strengths and weaknesses is the first step toward turning your hotel into a leaner, more strategic business, which will ultimately contribute to a faster recovery.

2. Identify Opportunities

Demand for hotel rooms has been drastically reduced because of the COVID-19 pandemic, which is why now is the time to look at demand in a more granular way. Monitor your competitive set to see if there are any revenue streams that you haven’t tapped into. For example:

- Is there an opportunity in your market to offer day-use options to people who are working from home?

- Is your local government looking for hotel rooms to accommodate its homeless population, medical workers, first responders or recovering patients who don’t need to be hospitalized?

- Are there universities in close proximity? International students who can’t fly back home and who are not allowed to stay on campus can fill some of the rooms in your property.

- Can you transform your F&B outlets to handle delivery and takeout business exclusively?

Business is anything but usual, but that doesn’t mean you shouldn’t be actively looking for alternative segments that could greatly benefit from what your property has to offer.

When you have identified the type of business that exists in your market, analyze its contribution to your bottom line. Market data can be a guide to understanding the right rates to charge and the occupancy percentages to expect. Track how your operating costs will be affected by these new business segments (labor, cleaning supplies, breakfast items, amenities and so on) and plan accordingly.

Finally, conduct a short-term forecast for your gross operating profit per available room (GOPPAR) and see how it would fare against your competitive set to decide whether all the identified segments are worth pursuing or if there’s a subset that would optimize your profitability.

3. Crystal Balling

Yes, right now it may feel like all hope is lost. Chin up: A day will come when the tides will turn, people will travel more freely and the path to recovery will be in sight.

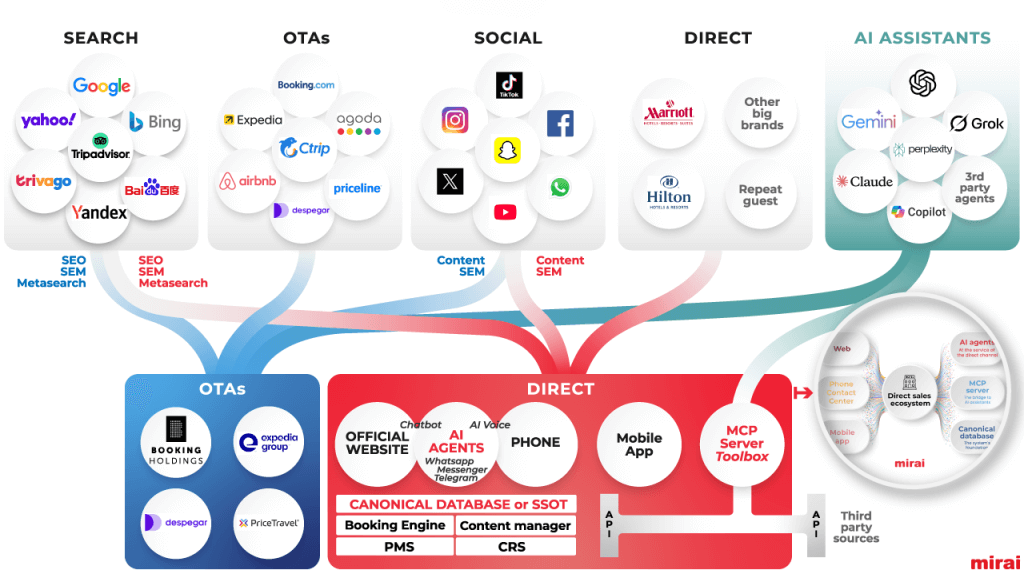

The “when” and “how” of the recovery process will greatly depend on the characteristics of each specific market. Tracking key performance indicators (KPIs) on a monthly basis is fundamental to increasing the accuracy of forecasts and creating relevant scenarios amid the fog of uncertainty. For example, based on the latest market trends, which traditional demand segments will come back first? Which distribution channels are recovering faster? How does this affect net revenue per available room (net RevPAR) and profit margin?

Think of this as your second opportunity to knock it out of the park. If your hotel is currently closed, you will need to design a detailed reopening strategy based on market data. Tracking the first signs of recovery is the preliminary step in the plan to reopen. It lays the foundation for scheduling the reopening date, rehiring staff, restarting vendor relationships, communicating to distribution channels and setting up preopening sanitizing and maintenance checklists.

In uncertain times, data is king. Hunch-based decisions don’t cut it in a time of unprecedented business contraction, in which every misdirected effort is not only a waste of precious time, but it’s also a drain on already limited resources.