Expedia Inc reported its second quarter earnings today, and it had a rosy picture on many metrics. But one metric stood out to investors for its sluggish pace, namely, the pace of room night growth.

In the second quarter, the dollar volume of room nights booked through Expedia Inc brands (excluding eLong, Orbitz, and HomeAway) grew only 12%, compared with a growth of 35% in the same period a year earlier.

On a related point, Expedia Inc anticipates that another metric, revenue per room night, will decrease year-over-year through 2016.

The company chalked up some of the sluggishness to a falloff in bookings because of the recent terrorism attacks in Europe.

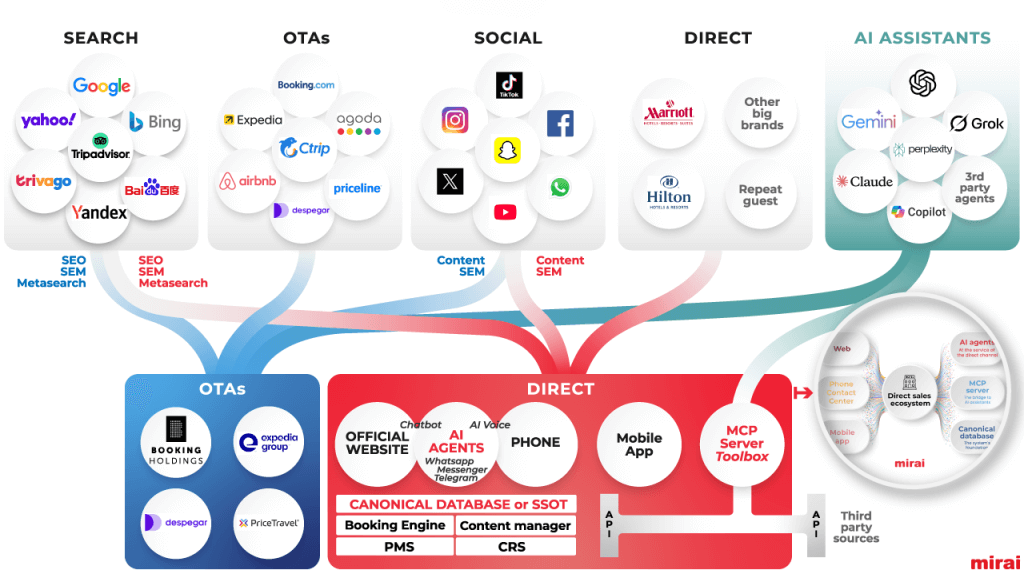

But some investors were concerned about whether some of the slowed pace was due to major hotel chains launching a marketing campaign in favor of direct bookings and cutting out middlemen agencies. This year Hilton and Marriott began offering loyalty rates that underprice the online travel agencies (OTAs).

The level of the discounting is disputed, but one investment analyst, Kevin Kopelman of Cowen and Company, estimates the typical discounts to be 2%-20% off the rates available on the OTAs.

One analyst raised this question on today’s earnings call. Chief executive Dara Khosrowshahi responded:

“We haven’t seen any real correlation in our performance in chain-heavy markets versus chain-light markets. You would think that in a market that has lots of chains, you would see some commercial or performance degradation to the extent that inventory quality is lessening. But we haven’t seen any of that whatsoever….

What we have seen is a shift of our bookings from some of the chains that are discounting to independents and chains that are not discounting. So there has certainly been a share shift, and that may be affecting Marriott average daily rates. The share shift, actually in an interesting way, is giving us a margin upside….”

Read rest of the article at Tnooz