Guest acquisition costs are rising, and the consequences for hotels seem obvious. Increased costs lead to decreased profitability, and a hit on asset value.

NB: This is an article from Rainmaker

To truly improve your hotel profitability, a little deeper digging is required. When things are rolling along smoothly in a buoyant economy, increased acquisition costs may be masked behind improved occupancy levels, and higher room rates. For instance, if your hotel RevPAR grows 5 percent, you may not notice the additional 1 percent in acquisition costs that’s eroding your bottom line.

A wise hotelier recognizes the importance of consistently tracking and managing acquisition costs in all economies. That way, when downturns occur (and those days will come!), instead of rushing to embrace high-cost channels, you’ll experience a much better and more stable outcome in terms of profitability and net asset value.

Why Direct Booking is Important

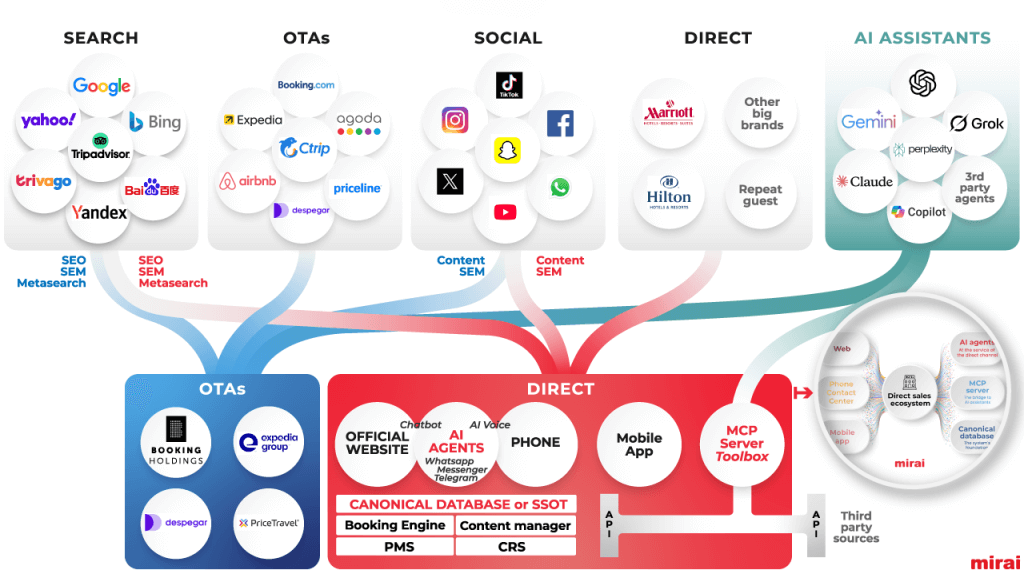

While there are times when direct bookings are not the optimal choice, in general, when guests book through third-party channels such as wholesalers, online travel agencies (OTAs), and global distribution systems (GDSs), hotel profitability suffers more. Hotels experience a revenue capture of about 95 percent from direct channels versus about 80 percent from indirect channels. A Kalibri Labs report titled “Book Direct Campaigns 2.0: The Costs and Benefits of Loyalty in 2018,” confirms that room night demand through brand.com in the U.S. is on average 50 percent higher than OTA room night demand, and about six out of ten room night bookings come through voice and proprietary hotel websites. Hoteliers building their bottom line through direct channels will achieve a 10 to 25 percent premium in comparison to revenues booked through OTAs or GDSs. Plus, when guests book direct, you “own” the customer data – gaining the ability to segment that information at a granular level, and use it for future targeted marketing and customer retention campaigns.

Be Aware of Acquisition Costs When Guests Don’t Book Direct

When your guests don’t book direct, you pay high commission rates and hefty transaction fees that influence the amount of revenue you secure. Between 2014 and 2016, OTA costs grew three times the rate of growth in guest-paid revenue. It’s important to be aware of the costs associated with each booking channel. But to clearly understand your guest acquisition efficiency – and the direction its trending – track net revenue performance based on the contribution to operating profit and expenses (COPE) as a percentage of guest-paid room revenue, and note changes relative to historic data.

You should also keep a closer eye on rate parity. Wholesalers have recently been causing problems by reselling rooms for bargain-basement prices on third-party OTAs. Out-of-parity rates not only negatively impact brand.com conversion rates, but increase costs per booking for hotels advertising on metasearch sites such as Google. Hotels that have prices undercut more than 40 percent of the time pay the equivalent of a third of their average daily rate (ADR) for rebooking acquired via Google Ads.

Be Aware of Acquisition Costs When Guests Do Book Direct

Direct bookings represent the lowest costs associated with acquiring new business, and are on average 12.5 percent more profitable than a booking made through an OTA. However, it’s just as important to manage acquisition costs for direct bookings as it is for indirect. Analyze your demand patterns to gain efficiencies with your marketing and sales efforts.

Loyalty program investment is paying off with net ADR for loyalty member bookings increased to 9 percent in 2018, up from 8.6 percent in 2016 when compared to OTA bookings. You can control costs by enticing new loyalty members with non-monetary benefits such as keyless entry, the ability to pick rooms, mobile check-in, and late checkout.

Given the thousands of room nights booked online within a typical hotel year, even small improvements in the average cost of acquisition, can add up over time. Rising guest acquisition costs require hotel revenue management strategists to take a closer look at metrics such as NetRevPAR, and maximize direct business, in order to realize a property’s full profit potential.