Investors have been consumed with the notion that Airbnb is gunning for the online travel agencies and that it will eventually turn from apartment rentals to hotels and steal those big, fat hotel margins and profits from Expedia and Booking.com.

A new analyst report attempts to shoot down that argument. Financial services firm PiperJaffray argues that Airbnb would not be adept at selling hotel rooms over the next five years, likely won’t pursue it heavily, and therefore will not have a significant adverse impact on online travel agencies’ room-night bookings.

In addition, hotel expansion isn’t part of Airbnb’s core strategy as it focuses instead on expansion in China, business travel and vacation rentals, the report states.

The PiperJaffray report, “Airbnb Becoming a Powerful Force in Travel, But Impact to OTAs Minimal,” written by Michael Olson and Samuel Kemp, forecasts that while Airbnb will make share gains in vacation rentals, supplementing its foothold in urban, shared-space dwellings, and will expand the travel market with its apartment inventory, but its adverse impact on the hotel bookings of online travel agencies such as Expedia and Priceline will be merely 5.3 percent in the 2016 to 2020 period — or just 90 basis points per year.

“Therefore if Airbnb hits its 2020 targets [$10 billion in 2020 revenue], the impact to global hotel growth will be a headwind of less than 100 bps each year which, we believe, is not meaningfully impactful to the multiple investors should be willing to pay for Priceline and Expedia,” the report states.

PiperJaffray characterizes investor concerns that Airbnb will threaten major online travel agencies as “overblown.”

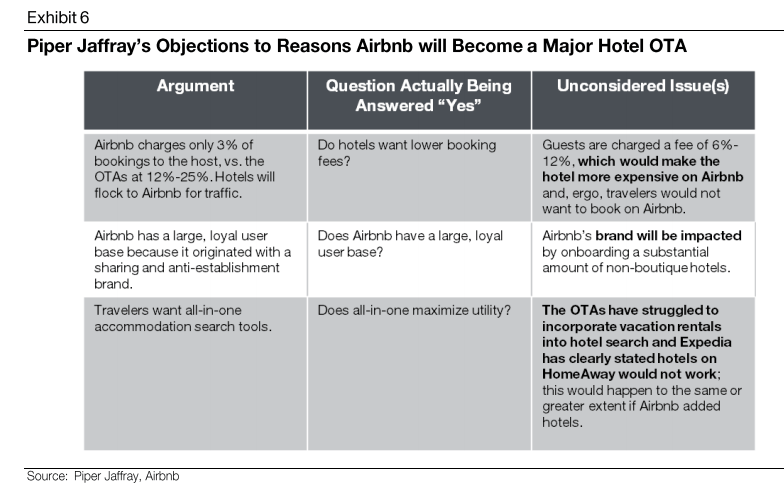

Among the factors that PiperJaffray cites as limiting Airbnb’s potential growth in hotels are that its hotel rates for consumers would not be competitive because it charges travelers a 6-12 percent booking fee while online travel agencies don’t; guests would be turned off if a currently “altruistic” Airbnb brand starts integrating those big, bad corporate hotels, and even the online travel agencies have had difficulties mixing together vacation rentals and hotels.

PiperJaffray outlines some of its arguments in the following graphic:

In addition, PiperJaffray argues that Airbnb wouldn’t have the resources to competitively market hotels head-to-head against the well-established online travel agencies as it has heretofore benefited from low customer acquisition costs because it basically created a new lodging category in shared-space accommodations.

Rather than compete against Expedia and Priceline in the hotel sector, “Airbnb is more likely to find other ways to partner with hotels, in our view, such as merging a future loyalty program, promoting Airbnb as an overflow option for hotels, or, in select instances, expand hotels’ investments in boutique accommodation options,” PiperJaffray states.

Au Contraire About Airbnb and Hotels

There are plenty of questions that can be raised about PiperJaffray’s analysis, which at times seems to suffer from a static view of the world.

Read rest of the article at: Skift