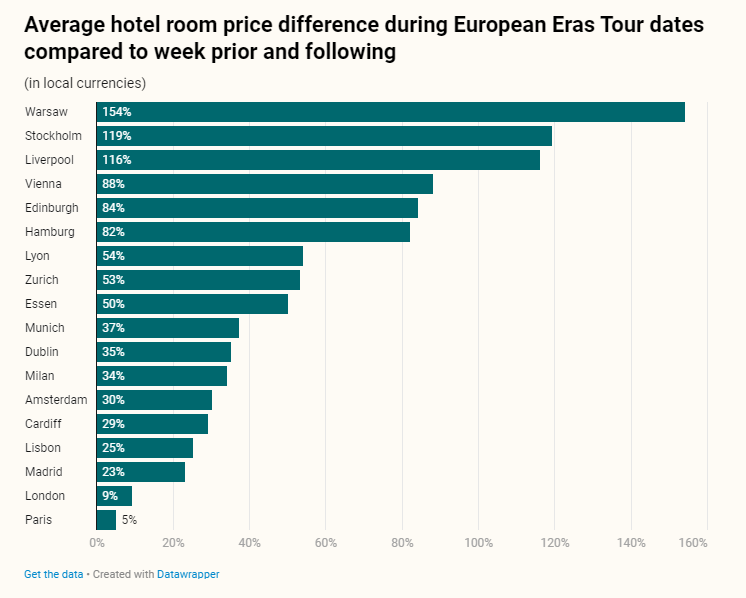

Overall, the arrival of Swift is positive for pricing in every hotel market we look at, although the level of variation from destination to destination can be quite extreme, for reasons we will discuss later. Given that this most mammoth of tours stops at an impressive 18 European cities for a combined total of 51 shows, we have condensed the analysis somewhat to show the effect Swift has on local markets.

NB: This is an article from Lighthouse (formerly OTA Insight)

Subscribe to our weekly newsletter and stay up to date

We compared rates when the tour is in town to a combined average of posted prices for the same days a week before and after Swift is the city in question.

We can see that the effect on hotel room pricing in some cities is staggering. Most visitors are solely interested in the event’s tour within the specified dates, with limited spillover demand.

However, the effect is not universal and there is massive variation between locations.

These go from a more than threefold increase for Warsaw and a more than doubling compared to adjacent weeks in Stockholm and Liverpool, to very limited bumps of +9% in London and +5% in Paris.

Overall, the median increase in rates for a standard hotel room compared to those nearby weeks was 44%, which is a huge boost to local hotel rates and indicative of the continuing star power Swift has in every geography she has visited so far.

In general, the wider trend is for the larger tourism markets to be noticeably less price-sensitive than less commonly visited cities.

Powerhouses London, Paris, Madrid, Lisbon, Amsterdam and Milan all sit in the bottom half, while smaller markets are much more likely to see a major boost. Cardiff is a noticeable outlier here, but Swift has only one date in the city, which is unique not just in the European leg of the Eras Tour but the complete global list of stops. This reduces the overall effect on local pricing.

We will go further into what drives this disparity later.

Short-term rentals appear to be substantially less price-sensitive

When it comes to Short-Term Rentals (STRs), the pricing gains are much less substantial in general, likely reflecting a lower price sensitivity than within the hotel industry, especially where supply for tourism accommodation is high overall.

However, the top and bottom of the chart for price growth as a result of the Eras Tour are broadly similar, showing that it is largely the magnitude of change that varies between hotels and STRs rather than totally different forces at work.