The summer travel outlook report reveals that in the third quarter of the year, July, August and September, global air travel is set to reach 65% of where it was before the pandemic in 2019.

NB: This is an article from ForwardKeys

However, the revival is patchy, with some parts of the world doing much better than others and some types of travel, particularly beach holidays, being much more popular than urban city visits and sightseeing.

Subscribe to our weekly newsletter and stay up to date

The region of the world that is on course to recover most strongly is Africa & the Middle East; its arrivals in Q3 are expected to reach 83% of 2019 levels. It is followed by the Americas, where summer arrivals are expected to reach 76%, and then by Europe, 71%, and Asia Pacific, just 35%.

Beach destinations lead, as city tourism lags in summer 2022

The current preference for beach holidays is well illustrated by a comparison of the top ten beach and urban destinations in Europe, ranked by Q3 flight bookings compared to 2019. All those in the beach list, which is led by Antalya, 81% ahead, Tirana, 36% ahead and Mikonos, 29% ahead, are showing extremely healthy demand, whereas, in the urban list, only Naples is ahead. Furthermore, the four leading urban destinations, Naples, 5% ahead, Istanbul, flat, Athens, 5% behind, and Lisbon, 8% behind, are all also gateways to beach resorts too.

A similar trend is exhibited in the Americas, where Q3 bookings for air travel to the Caribbean, Central America and Mexico are 5% ahead of 2019 levels, whereas flight bookings to South America and to the US and Canada are, respectively, 25% and 31% behind. The destinations which are set to perform most strongly are Costa Rica, 24% ahead, Jamaica, 17% ahead and the Dominican Republic, 13% ahead.

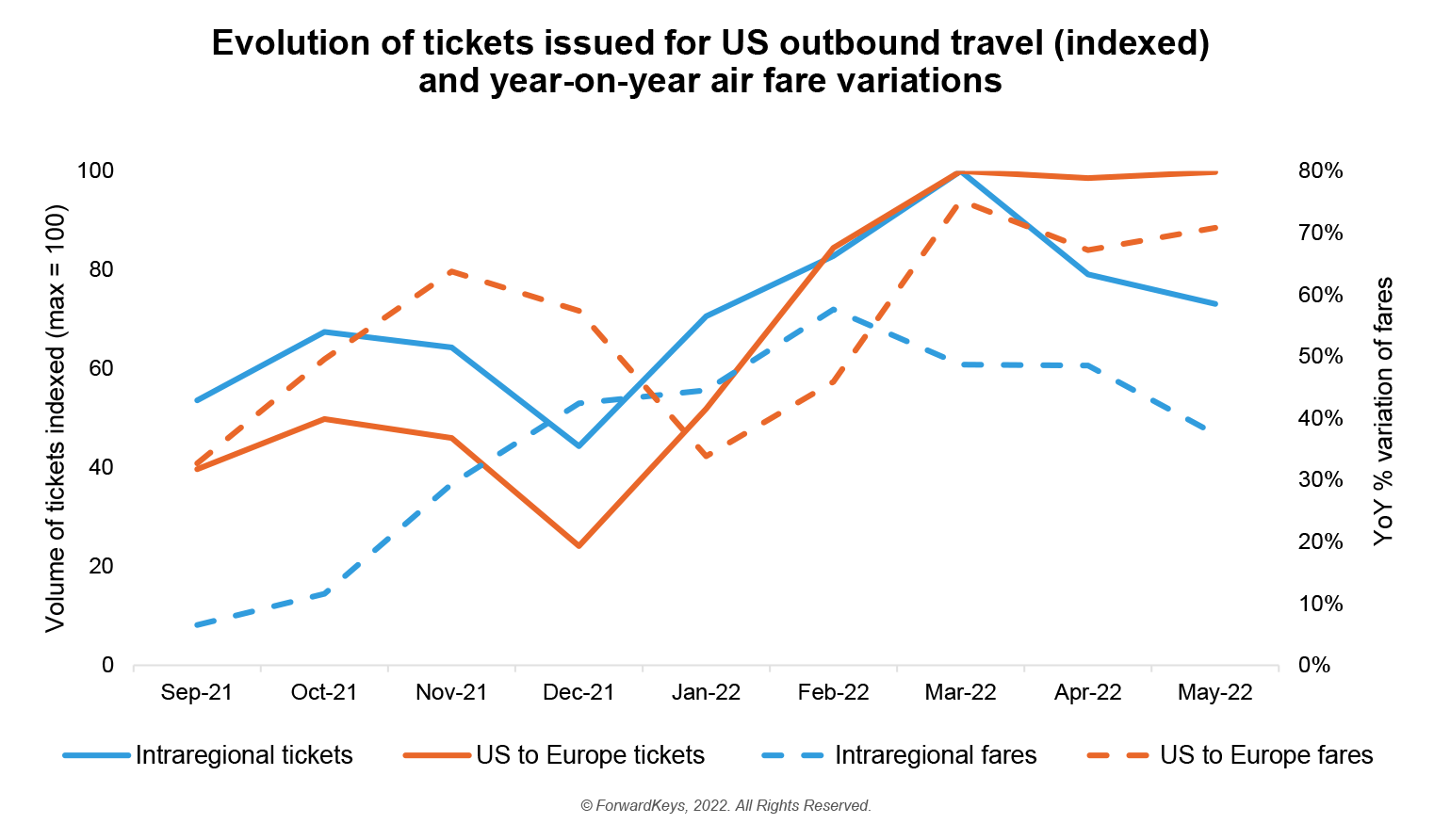

Rise in air fares does not dampen demand

Enthusiasm to travel again internationally is so strong that a rise in air fares has done relatively little to dampen demand. For example, the average fare from the US to Europe climbed by over 35% between January and May with no noticeable slowing in booking rates. And these fares were nearly 60% above the previous year. Fares for shorter haul, intraregional travel (ie: within the Americas) also increased substantially, by 47%, which is less than for long haul. However, the demand for those tickets peaked in March.

Helpfully for the travel industry and for many destinations, American travellers are planning to stay longer and spend more than they did in 2019 but not as much as they did during the pandemic. The average planned length of stay in Q3 is 12 days, up from 11 days in 2019. Last year, it was 16 days, but fewer people, with a more affluent profile, were travelling then. The proportion of people flying in premium cabin classes in Q3 is also set to rise, from 12% in 2019 to 15% this year. (Although, it reached 19% in 2021.)

The relatively promising outlook for summer travel to Africa and the Middle East is due to a combination of factors. Several Middle Eastern airports act as hubs for travel between Asia Pacific and Europe, which has led to the Middle East benefiting from the revival of intercontinental travel, particularly driven by people returning to Asian countries to visit friends and relatives. The closure of Russian airspace has also contributed to the uplift in hub traffic. Cairo, 23% ahead, has increased connectivity to European markets. Nigeria, 14% ahead, Ghana, 8% ahead, and Ivory Coast, 1% ahead, with large diasporas in Europe and the US, are seeing expats return to visit friends and family. Tanzania, 3% ahead, Cape Verde, flat and the Seychelles, just 2% behind, are successfully attracting long haul visitors from Europe.

Travel to and within the Asia Pacific region is recovering more slowly, owing to stiffer COVID-19 travel restrictions remaining in force for longer.

Olivier Ponti, VP Insights, ForwardKeys, said: “With 2022 seeing travel restrictions lifted, connectivity re-established, and consumer confidence regained, demand for international travel is on the rise once more, marking a departure from the domestic travel trend that dominated in recent years. In Q3 this year, holidaymakers are relatively much keener to leave the pandemic behind with a relaxing break on the beach than they are to consume culture, cities, and sightseeing.”