Projections for 2017 and beyond by STR, CBRE and PKF all call for anemic occupancy growth at best, notwithstanding record occupancy levels for the U.S. hospitality industry. With Revenue Per Available Room (RevPAR) growth projections at inflationary levels (2.5 – 3.5 percent, or so), it is clear that expectations call for Average Daily Rate (ADR) growth to continue, but will it?

Coal miners used canaries to warn them of lethal gasses they couldn’t smell, see or taste. And, while we can’t rely on canaries to help us stay out of trouble as hospitality operators, we may be able to rely on history. It is oft-quoted tenet that history is the best teacher and, if that is true, then we’d be well served to reflect on what we can learn from our past.

The Good

While factors that contribute to demand (or lack there of) for a specific property or market are vast, we can point to some common measures that serve as indicators for overall health of the hospitality industry-absent any readily identifiable external shocks. Gross Domestic Product (GDP) movement historically has had the strongest correlation to changes in RevPAR. The challenge is that GDP movement is a coincident indicator and not a leading indicator, so this puts a premium on the need for operators to make appropriate decisions in real-time. Employment levels and personal income (both contributing to overall consumer confidence), plus corporate profits are admittedly lagging indicators, but are useful in providing some degree of guidance as to what GDP performance may look like in the months ahead.

Unfortunately, the stock market, which is usually a clear leading indicator, is unreliable-particularly when it comes to investment behavior surrounding hospitality stocks, as there historically hasn’t been a strong correlation between stock price movements and actual sector performance. The silver lining in all this is that, according to the pundits, U.S. GDP is projected to continue to grow in 2017, albeit at a lackluster pace just shy of 2 percent.

The Bad

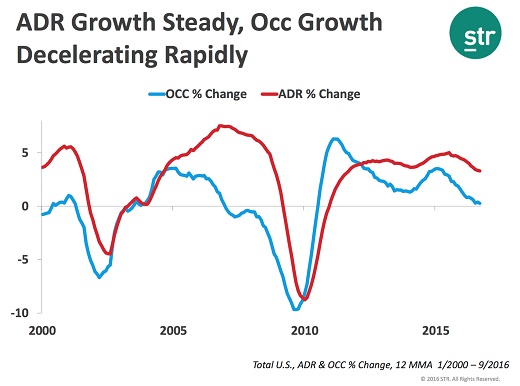

- Disproportionate Responses in ADR – When a trend indicating a change in demand is ultimately recognized by those in the industry, ADR will typically (not always) move in the same direction, but ADR will always lag changes in demand-sometimes by several months. The chart from STR, Inc. illustrates this point nicely.

To simplify the reasons behind this phenomenon, we can point to booking lead times associated group and wholesale contracts, plus annually negotiated corporate rate programs, as examples. When this on-the-books demand “burns off”, it is replaced by new demand, which books at the then prevailing market levels.

Read rest of the article at Revenue Matters