After 20 months of lockdowns and travel restrictions, it’s clear that we’re living in a world where planning for the unpredictable is part of the norm.

NB: This is an article from Expedia Group

In the first quarter of the year, we saw several positive signs, with vaccines becoming more available and hope on the horizon. In the second quarter we continued to see encouraging trends, with higher traveler search volumes and longer search windows. As we moved into Q3, however, we started to see the COVID-19 Delta variant and other global factors impact performance. Yet we’re still seeing several positive signs overall.

Subscribe to our weekly newsletter and stay up to date

The third quarter of 2021 saw sustained momentum for the industry, with progress at the regional level, including new vaccination corridors and the rise of business travel demand as offices started reopening. These insights and others are highlighted in the Q3 Travel Recovery Trend Report, in which we analyze our findings and share actionable insights to help travel brands continue on their road to recovery. Below is a snapshot of the key findings.

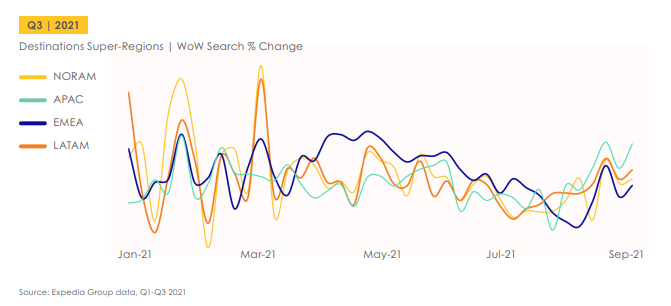

Search Volumes Are Holding Steady

The first half of the year was strong, with search volumes up between Q1 and Q2. In Q3 we saw search volumes from travelers across the globe hold steady, with little change quarter-over-quarter. However, Europe, the Middle East, and Africa (EMEA) and Latin America (LATAM) saw increases of 50% and 10%, respectively, compared to Q2. Asia Pacific (APAC) and North America (NORAM), on the other hand, saw modest decreases – which could be attributed to the emergence of the COVID-19 Delta variant in late summer. However, as border restrictions started to lift in many places in September, so, too, did global travel searches once again.

Looking at year-over-year numbers, the third quarter of 2021 delivered triple-digit growth compared to 2020. Even in North America, where the Delta variant had one of the strongest impacts, we saw search volumes increase 80% year-over-year. This appears to signal that, despite these still-uncertain times, people are eager to see the world once again.

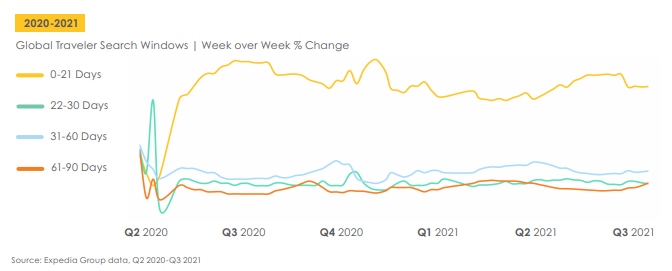

Search Windows Shortened in Most Regions

While global search volumes held steady overall, we did see a shift in the kinds of searches travelers were making compared to Q2. In the third quarter, nearly 70% of global searches were made 0 to 30 days out, which was a 15% increase compared to the previous quarter. Compare this to the longer 31- to 90–day window, which dropped slightly from 25% to 20%.

This change in traveler behavior suggests shoppers reverted once more to planning trips at the last minute, when they can be more certain of the conditions of travel.

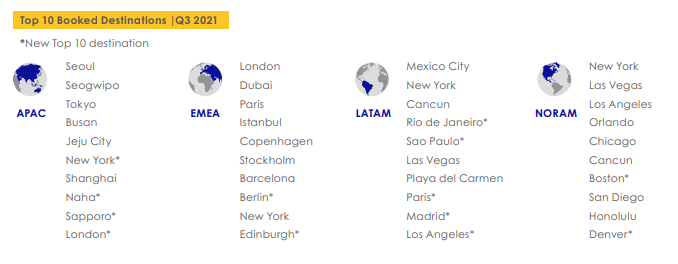

Bookings for Several Cities Surged

There was a lot of movement in the top 10 destinations booked between Q2 and Q3, both globally and within each region of the world. At the global level, we saw several cities spike in popularity, entering the top 10 for September bookings when previously not on the list. These include Dubai, Paris, London, and Istanbul – with Dubai having an especially strong showing. It ranked at number 33 in July but moved all the way to the 10th position a couple months later.

At the regional level, travelers were more interested in international destinations compared to the previous quarter. New York City topped the list for both global bookings and those from NORAM-based travelers, and it was also a top destination for travelers from APAC, EMEA, and LATAM.

Demand for Holiday Season Travel Is Up

After the lost time with loved ones during last year’s holiday season, travelers are eager to make the most of the 2021 Thanksgiving (U.S.), Christmas, and New Year’s holidays. Compared to 2020, Q3 searches for November and December travel dates in NORAM and EMEA saw triple-digit growth, while LATAM saw double-digit growth.

When it comes to actual demand for stays in November and December we also saw triple-digit growth in most regions compared to the previous year. Vrbo data shows that travelers were booking December stays as far back as July, with demand up even compared to 2019. This is a strong sign that travelers are starting to feel safe spending time with friends and family again and are looking forward to a more joyous holiday season.

Business Travel Is on the Rise

With offices reopening and in-person events reconvening in many parts of the world, business travel is also on the rise. Egencia data shows that business travel demand was up over 40% globally in Q3 compared to Q2, and more than 110% compared to the same period last year.

These trends are just a fraction of the insights we gather from our more than 300 petabytes of Expedia Group traveler intent and demand data. To see further actionable insights, download the full Q3 2021 Travel Recovery Trend Report.