August marked the 12th consecutive month of profit decline at hotels in the Middle East & North Africa, as profit per room fell by 7.0% year-over-year to $58.06.

NB: This is an article from Hotstats

This is in stark contrast to the last time the region saw positive profit growth, when in August 2018 GOPPAR was up 24.8% over the same time the prior year.

As in times before, decline in profit was led by a drop in RevPAR, which fell by 4.2% YOY to $107.26. This was impacted by a 4.4% drop in average room rate to $161.10. Occupancy increased by a marginal 0.2 percentage points to 66.6%.

Typical of August, the market mix was dominated by the leisure segment, which accounted for 48.4% of total roomnights sold.

This was in contrast to volume in the commercial segment, which comprised just 24.9% of all roomnights sold, down from an average of 31.1% for YTD 2019.

The shift in demand contributed to a decline across all revenue centres, including food & beverage (down 2.7%) and leisure (down 1.2%). As a result, TRevPAR at hotels in the region fell by 3.8% to $173.34.

Despite the decline in revenue, MENA hotels successfully recorded a 1.6% YOY saving in payroll, which fell to $52.10 per available room.

Profit & Loss Key Performance Indicators – Middle East & North Africa (in USD)

| KPI | August 2019 v. August 2018 |

| RevPAR | -4.2% to $107.26 |

| TRevPAR | -3.8% to $173.34 |

| Payroll | -1.6% to $52.10 |

| GOPPAR | -7.0% to $58.06 |

“Hotels in the Middle East & North Africa have endured a spate of monthly declines in profit per room. Now more than ever, it is key that hotels in the region watch and manage costs to try and preserve eroding profit levels,” said Michael Grove, Managing Director, EMEA, HotStats.

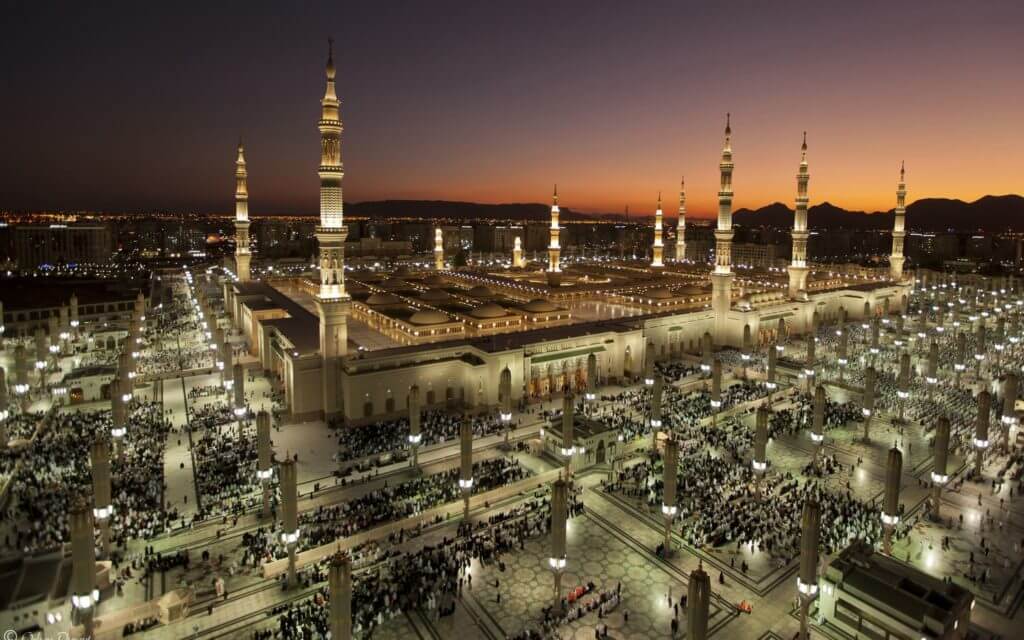

It was a mixed month of performance for hotels in Medina, which failed to capitalise on the annual bump from the five-day Hajj holy pilgrimage.

The uplift in demand did fuel a 5.9% YOY increase in RevPAR, which was led by a 5.3% increase in average room rate.

However, plummeting ancillary revenues, which included a 22.8% decrease in food & beverage revenue, contributed to a 13.1% YOY decrease in TRevPAR.

As a result of the movement in revenue and costs, profit per room at hotels in Medina fell by 14.9% in the month to $231.13, which contributed to the 11.8% YTD decline in this measure.

Profit & Loss Key Performance Indicators – Medina (in USD)

| KPI | August 2019 v. August 2018 |

| RevPAR | +5.9% to $249.12 |

| TRevPAR | -13.1% to $341.99 |

| Payroll | -2.1% to $52.77 |

| GOPPAR | -14.9% to $231.13 |

One of the few markets to have a positive month in the region was the Egyptian coastal resort of Alexandria, where profit per room increased by 7.4% YOY to $82.07, a peak for the year.

The increase was led by a 15.2-percentage-point YOY increase in room occupancy, which hit 85.0%, and cancelled out the 13.7% YOY drop in average room rate to $111.75.

The 4.9% growth in RevPAR was supported by a 13.6% increase in ancillary revenues, which grew to $68.29 and comprised 41.8% of total revenue this month.

However, hotels in the city are facing challenges to payroll, which increased by 12.7% YOY, and has almost doubled on a rolling 12-month basis over the last three years.

Still, profit conversion was recorded at a robust 50.2% of total revenue.

Profit & Loss Key Performance Indicators – Alexandria (in USD)

| KPI | August 2019 v. August 2018 |

| RevPAR | +4.9% to $94.99 |

| TRevPAR | +8.4% to $163.28 |

| Payroll | +12.7% to $24.22 |

| GOPPAR | +7.4% to $82.07 |