Most hoteliers understand how metasearch advertising influences the deals visible to consumers. Bid too low and your listing won’t show. Bid too high, and your customer acquisition cost is out of line.

To further understand this dynamic with an eye on how hoteliers can compete in metasearch, we turned to the data to see just how the big players dominate the metasearch listings. With that information, we can see where hotels stand the best chance of being seen.

The Maturation of Metasearch

Metasearch sites account for over 45% of global unique visitors in travel, according to PACE Dimensions’ analysis of SimilarWeb data for the top 10,000 travel websites. This is greater than the proportion of unique visitors for OTAs, both globally and in the US.

In fewer than ten years, hotel metasearch comparison has progressed from nothing to a sector that generates in excess of $6BN in advertising.

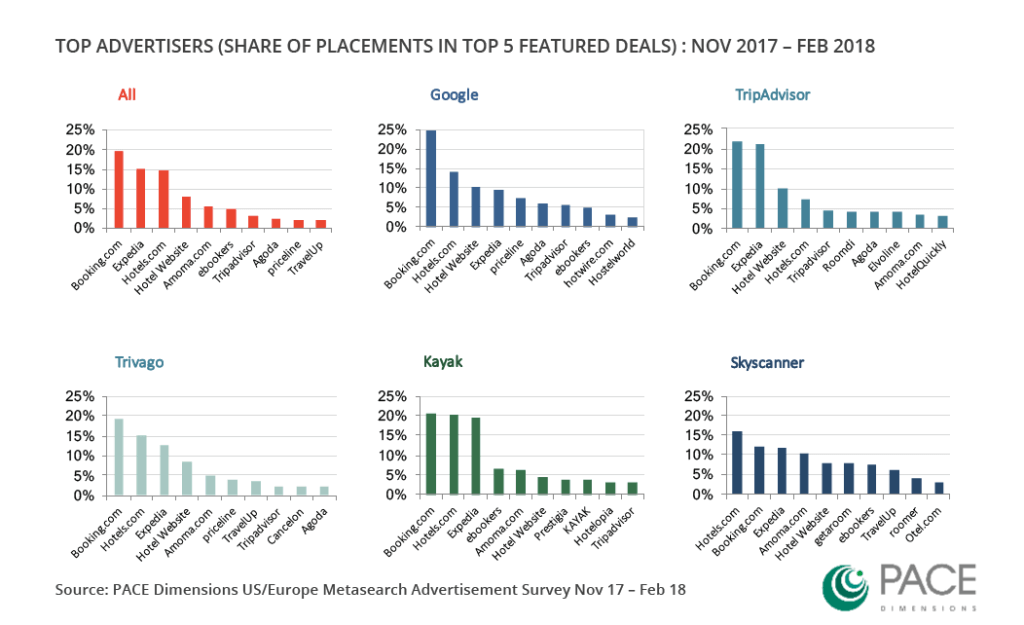

As part of a wider piece of research into digital media and online retail for travel and hotel bookings, PACE Dimensions analysed the top advertisers by metasearch site. This included over 10,000 metasearch results for the share of featured (i.e. easily visible) deals attributed to leading advertisers. The assessment was conducted in October 2017 and reviewed the top five hotels listed in each search for each of the leading metasearch comparison tools: Google, Trivago, TripAdvisor, Kayak and Skyscanner.

Here’s the share of placement mix across popular metasearch platforms, which informed the analysis that follows:

Implications for hotels

Booking.com remains the leading retailer in metasearch. Despite reports that Booking.com pulled back on digital advertising spend at the end of last year, it still retained a 20% share of top placements averaged across all metasearch sites. Booking.com had the highest presence on Google, with a 25% share of top placements.

The two biggest players outspend all hotels combined. Booking Holdings and Expedia outspend all hotel brands combined. Hotel company advertising generates only an 8% share compared to a 52% share for Expedia and Booking Holdings companies.