Each day brings new challenges as organizations cancel conferences, businesses suspend travel, and airlines cut services related to the spread of the Coronavirus and its new official label as a “pandemic.”

NB: This is an article from Knowland

These strategies are proactively trying to manage the situation. It’s more about taking control to prevent community spread and halt the dissemination of the virus than panic. So, let’s treat it that way. It’s good decision making. If we all do our jobs, we will contain the virus, stop it in its tracks and return to normalcy quicker than expected.

How do we separate the doom from the gloom and walk away with a sense of what we can do to help our hotel? Our advice is to stay calm and prepare for local, smaller business.

Today, many of the restrictions established are around cross-border travel and with an expiration date of approximately eight weeks. Obviously, this could extend but it does show companies are hoping for the best outcome.

History Sets the Stage: Global vs Local Views

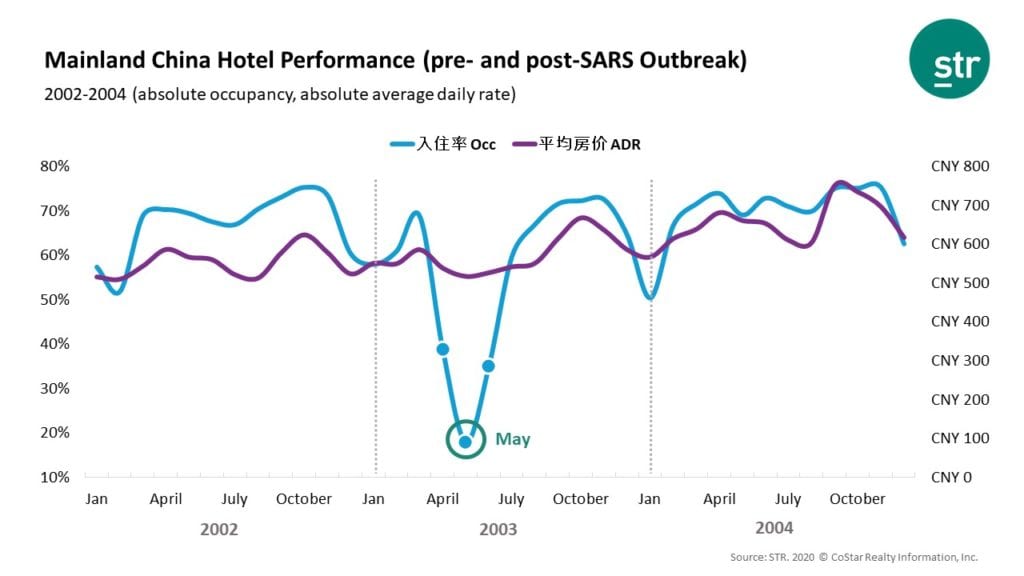

Looking to the SARS outbreak of 2003, the full cycle from alert to recovery took just around four months. After the World Health Organization (WHO) issued the global alert on March 12, 2003, occupancy bottomed out in May of 2003. However, by July of 2003, the market had stabilized and was within 11 points of the prior year and by August 2003, the market had exceeded the prior year occupancy. [1] As you can see in the chart below, the recovery period was a perfect “V” shape.

If this same pattern were to repeat, we should see the Chinese region begin to recover sometime in May. Currently, new cases in China have dropped to less than 0.10% per day, while cases outside of China have continued to grow with the 7-day average of new cases hovering at 15.6% day-over-day increase. [2]

This means there is cause for caution but not panic. Looking at the global numbers makes it easy to overreact, but realistically, we should be looking and responding locally.

Regional Perspective: Source market experiences bigger impact, other regions follow as virus response lags

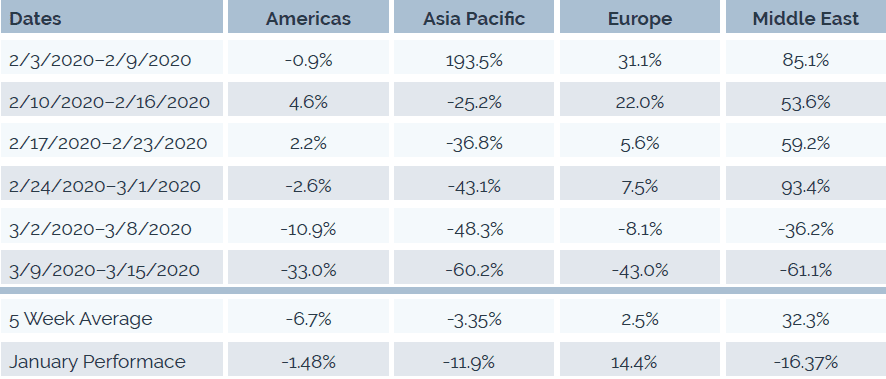

We examined the number events by global region in the weeks since the WHO declared Covid-19 a pandemic (January 30, 2020), then compared those to the same day pattern from the prior year (Monday – Sunday). Additionally, we only considered hotels we collected data from during the same period in 2019.

The table below displays the percentage of change for each week by region. In the first week after the announcement, each global region is either flat or well ahead of the prior year. Performance then weakens as the news and the virus spread with each progressing week.

We also looked at the performance for January by region to see if the trends of the last five weeks were part of a larger pattern or related to the pandemic. The bottom row of the table below reflects the percentage of change in January 2020 by region.

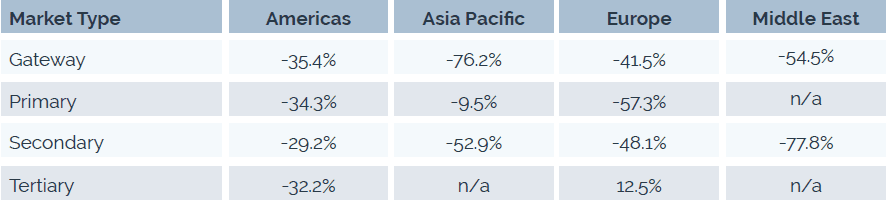

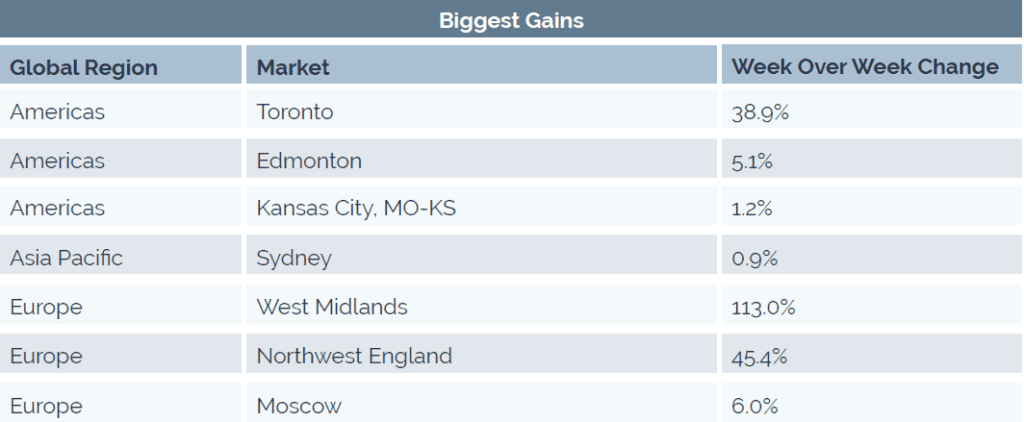

These numbers set the stage by region, but what does this look like when you unpack it into individual markets? For our purposes, we focused on the last week in the range. Our first task was to look at performance based upon the type of market: Gateway, Primary, Secondary, and Tertiary. Europe was the only global region with growth.

Local Perspective: Mix of gains and losses as responses vary by market

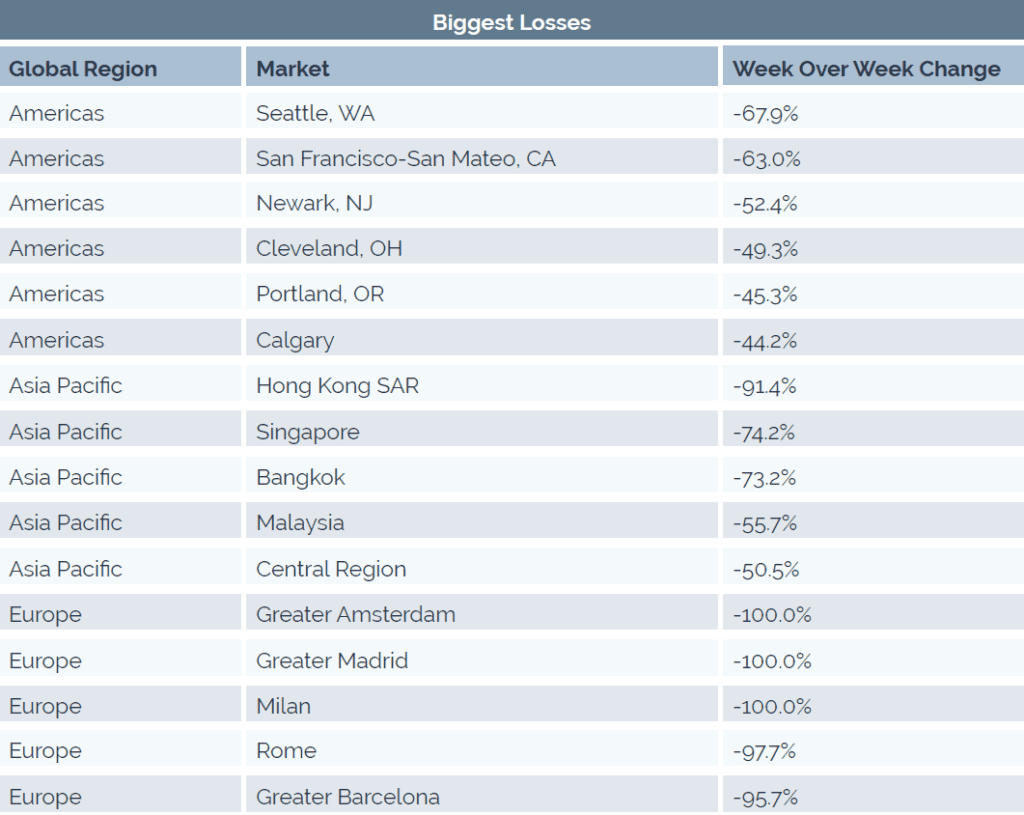

Furthermore, we examined individual markets. One hundred fifteen (115) of the 179 markets (compared to 130 for the week of March 2 – 8, 2020) we track were down for the week of March 9 – 15, 2020. On both sides of the spectrum, the losses were mixed across the type of market. This is indicative of the first flush of panic from companies. We anticipate this will stabilize in coming weeks.

Impact by Business Type: Corporate business may be recouped

At a final glance, we looked into what types of business drove the declines. Corporate and Social business were the primary culprits. Social is not surprising as much of it is discretionary spending. However, this business will likely not be recouped.

On the other hand, Corporate should be tracked carefully as it has more potential to rebook, whether exactly as is or as smaller versions across multiple markets. Capturing that potential lies with each individual property.

How Hoteliers Can Prepare

With the above trends and indicators in mind, hoteliers have the information to make good decisions. Here are the questions to consider:

- How many cancellations have you received?

- What’s the time frame for the cancellations (90-days, greater than 90 days, etc.)?

- What’s the average size/value of those cancellations?

- Are they cancelling or rescheduling to later in the year?

- Have you received any short-term bookings during this time frame?

- What’s the nature of those bookings?

Chances are, your hotel has experienced a run of cancellations, especially if you are in a gateway or primary market. Those cancellations are likely within a 90-day (or less) horizon. Now is the time to focus your sales teams. Focus on local meetings and the business that still exists.

There are three things guaranteed to happen in the coming weeks:

- Inbound RFPs will slow if not trickle to a halt

- Passive hotels dependent on those RFPs will struggle

- Hotels with the strongest local relationships will prosper during and beyond recovery

The major events will cancel, and hotels have no control over that. Now is the time for your sales teams to focus on developing what will replace those large events. Here are some sales strategies that can help capture the business in your market:

- Many larger events will likely be replaced with smaller, regional meetings. Companies will choose to have meetings within drive markets that allow them to limit exposure for their employees but still offer face-to-face meetings that foster collaboration and team engagement.

- Add a Live Stream to a local event; a hotel can partner with A/V providers to create virtual meeting environments that are interactive and safe by bringing in remote attendees using video technology.

- Enable speakers to present remotely; no need to cancel if you can help your planner facilitate a remote speaker with Skype or Zoom meetings over WiFi.

Think small, act local. This is where your team will need to focus. Companies with offices in your market will be the epicenter of these meetings. Fostering your local relationships with those companies will position your hotel to benefit from these events.

Develop a specific action plan geared towards uncovering, researching, and targeting all local businesses in the area.

Panic at times like these is somewhat inevitable. Misinformation and general trepidation will drive early cancellations. However, as the situation stabilizes, companies will settle and allow business to return to normal. Hotels who don’t panic and prepare with local strategies will benefit the most.

Summary: Keep Calm and Prepare for Local, Smaller Business

Yes, conditions will likely worsen before they stabilize. The most important strategy a hotel can employ is to focus your Sales teams on the right type of business for the environment we are in. That means Sales teams should still be selling, developing relationships, and prospecting. The only thing to consider changing is where you focus. Localization in your sales processes is the key to minimizing COVID-19 impact to your meeting business in the short term.

Developing local business will not only give your hotel the cushion to survive the Coronavirus scare, but also provide a foundation for long term business relationships that will grow beyond this blip in hotel industry growth.

Sources:

[1] Coronavirus Disease 2019 Situation Report

[2] The survival of hotels during disaster: A case study of Hong Kong in 2003.