“Booking what?!” – you might ask exasperated and you would not be the only hotelier to do so.

NB: This is an article from Aro Digital

Booking.com has quietly introduced a new rate option, called Booking.basic that displays cheaper inventory from other OTAs on their own site. The emphasis is on quietly as many hotel managers yet to hear about this release. There was no public announcement – just a quick switch of a button and customers can now reserve heavily discounted rates on the biggest 3rd party platform.

While Booking.basic still appears to be in a preliminary phase, it is sign of a tumultuous trend that has been tormenting the travel industry for years.

Start With The Basics

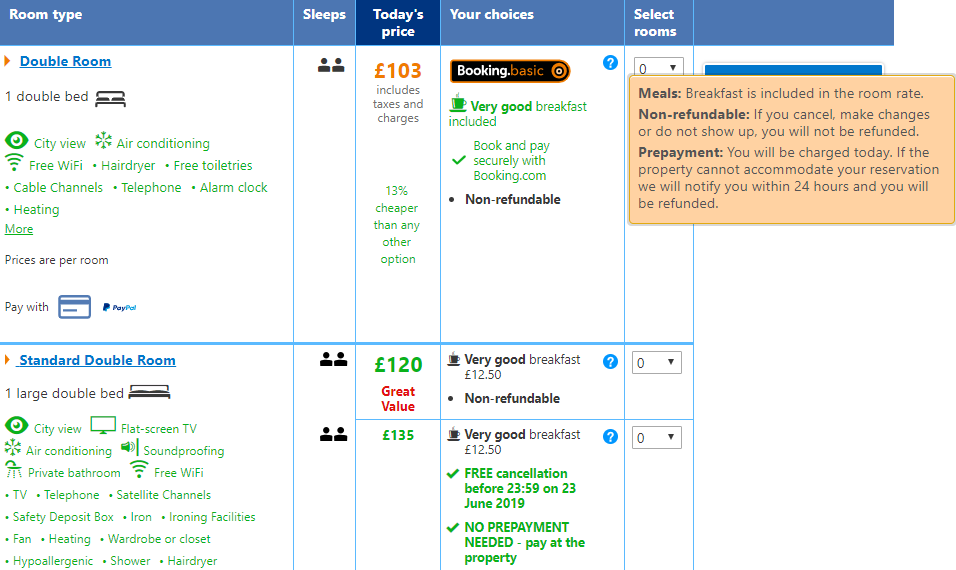

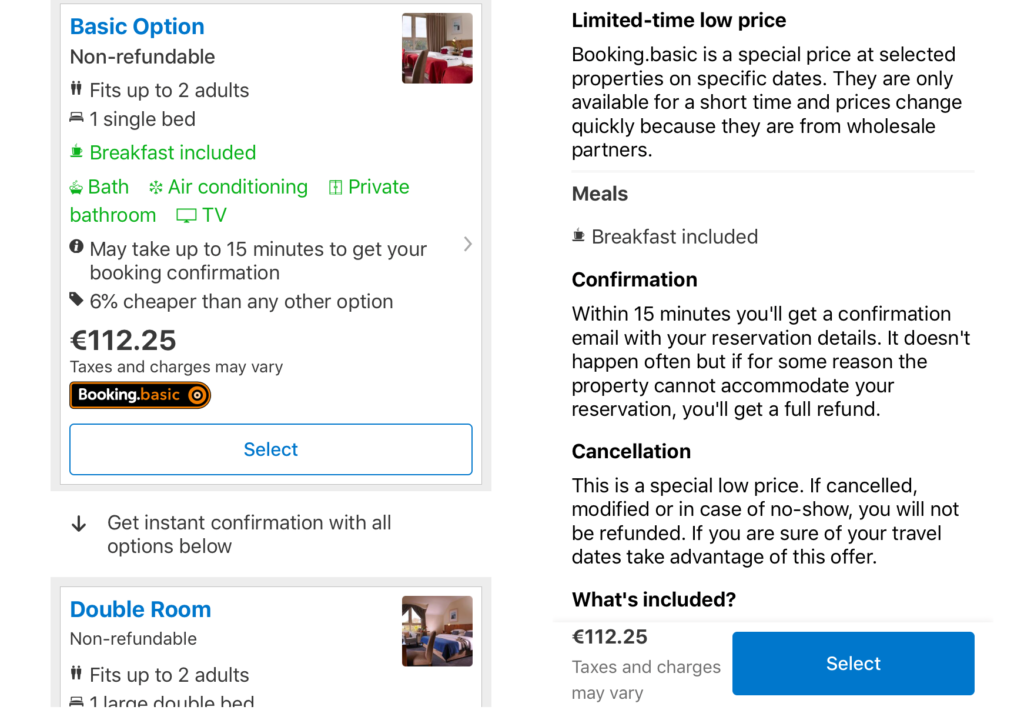

What exactly is Booking.basic? In addition to offering its own inventory, Booking.com now presents rates from other online travel agencies. When travellers search for a hotel, a special tier may appear above the property’s regular rates. This happens if the rate supplied to Booking.com is not the cheapest available online.

An orange and black badge clearly indicated that this is a unique option. Since inventory is pulled from elsewhere, sometimes it takes a few extra seconds for this rate to appear on the page.

The room’s supplier is not immediately visible to guests – it is only revealed to after the booking have been completed. After some investigative work, industry experts identified Agoda and Trip.com (formerly known as CTrip) as the third party partners supplying Booking.com with discounted inventory. Both businesses are owned by or linked to Booking Holdings, that just happens to be Booking.com’s parent company.

Tricky Tracking

Booking.basic is elusive. It was first spotted in the summer of 2018 for properties based in Asia, then slowly released in Europe towards the end of last year.

There is no option to search specifically for this rate so it is challenging to track it. As an added twist, users browsing from the same location at the same time may be presented with different options.

During our own research, we have spotted several premium city hotels with Booking.basic rates in the UK and Ireland as well as across other popular European destinations. If you would like check it for yourself, try searching for a low demand rate in a major city in Europe, select deals from the filter and you will likely spot a Booking.basic rate amongst the first 10-15 hotels.

You may not even be aware that your hotel has Booking.basic rates listed because confirmation would come from another 3rd party site.

Interestingly, while Booking.basic is cheaper than the supplied Booking.com rate, it is not necessarily the lowest online rate for that hotel on a certain date. This probably due to the fact that the OTA only works with selected partners.

It’s All In The Details

Guests are always looking for the cheapest rates so it would be fair to assume that Booking.basic is good news for them. But is it?

Booking.basic rates are restricted by rigid terms and conditions that can be easily missed by less tech-savvy travellers.

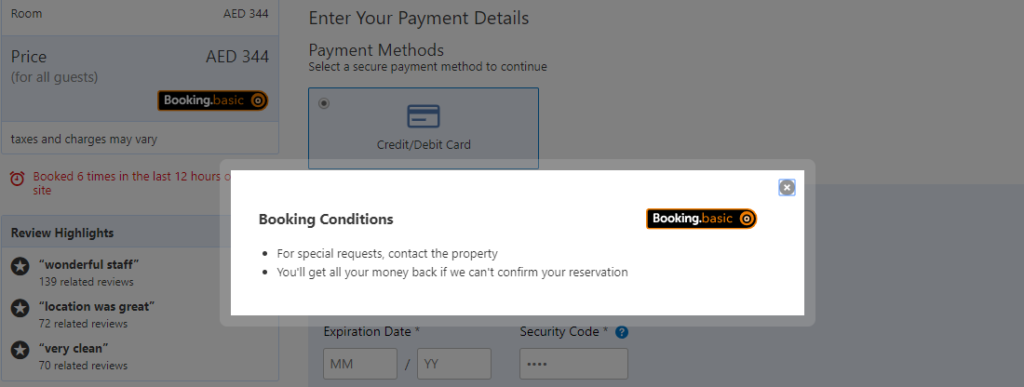

- Accommodation must be prepaid and customers are charged immediately.

- In case of no-show, cancellation or amendment, customers will not be refunded.

- As a special price, Booking.basic will only appear at selected hotels on specific dates.

- Prices changes quickly as inventory is provided by wholesalers.

- Receiving a confirmation email may take up to 24 hours.

- The property may not accept the booking (in this case, money is refunded within 24 hours).

- Bed type might be selected by the property.

- No invoice can be requested for these reservation.

Booking.com is gambling with its brand name as irate guests may turn away from their platform.

“Booking.com will take your money and refuse to help you. Unless you don’t mind not knowing if you have a room or not, I would never book this option.” – wrote one traveller on an online forum.

“We book with Booking.com because we trust them. I certainly wouldn’t book with CTrip on purpose.” – said another one.

Of course, hoteliers may also run into guest relations issues as they need to answer questions from confused callers.

In Or Not – That Is The Question

How is a hotel selected for inclusion? It all appears to be based on the hotel’s Price Quality Score (PQS) – a determination used by Booking.com to see how attractive a property’s rates are to customers. With other words, if you offer much cheaper rates on other 3rd party sites, Booking.com will try to make sure that they are bookable on their channel too.

Travel news sites cite hoteliers who have been advised by the OTA giant if their PQS falls under 70 out of 100, they will qualify for Booking.basic listing. But information is scarce and confusing.

Management of Booking.basic is entirely within the OTA’s power. Hoteliers can do little to nothing to put a stop to it. While Booking.com is eager to portray itself as a hospitality partner, the serious lack of consultation (or even information) points away from that image.

In Pursuit Of Parity

So can we lay all the blame at the door of the OTA’s Amsterdam head office? No quite.

Managing rate parity has become a mammoth task for hotel managers in recent years. Wholesale prices that were never intended to be sold to the public routinely appear in online searches. The key difference is that now not only no-name sites offer unauthorised rates but leading brands such as Booking.com and Expedia. With the Add-On Advantage Program, Expedia too enabled customers to book discounted hotels after they purchased their airfare.

After all, these businesses just take advantage of existing industry flaws. Can we really condemn them to want to maximise their own revenue?

The only way out from this mess is to demand stricter conditions from wholesale partners. Hotels must penalise them if industry rates are sold on to the public without permission. While monitoring rates is a time-consuming and thankless task, it is now an essential one. Industry experts also agree that dynamic packaging as opposed to static rates can also combat this trend.

Hotels must live up to their best rate promise – otherwise consumer trust will be lost and their direct strategy will suffer irreversible damages.