If booking direct is so attractive and several hotels are joining the movement, is it universally attractive? Would every single hotel benefit from a book direct campaign?

NB: This is an article from OTA Insight

The answer lies in the specifics. Discounting direct booking has an immediate hit on the revenue. True, hotels save on commissions, but marketing is now required. It’s not enough to have the discount; the hotel must make sure customers know about it.

Against the massive marketing done by the OTAs, the brand is often at a disadvantage. The price discount and these marketing costs combined must be less than the OTA commission. Marketing costs for acquisition and retention can be very different and this will influence what the brand can do.

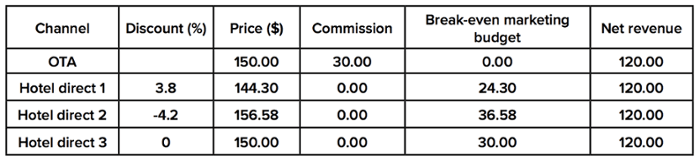

When the hotel offers the best price, the Piper Jaffray study found that the average book direct price was 3.80% less than the OTAs. When OTAs offer the best price, they were 4.2% lower than the book direct price. The rest had rate parity.

Let’s look at some numbers for perspective. We’ll consider all three flavours of book direct pricing against the OTA pricing of $150.

Assuming a 20% OTA commission rate, the following table illustrates the break-even marketing budget for the hotel in each of these cases:

The larger the hotel, the easier to control the per room marketing spend as the total marketing costs can be amortised over many rooms. Marketing for initial customer acquisition may be challenging for smaller hotels.

While the commission for an OTA is a significant cost of acquisition, they are good at what they do. It may make sense for a brand to concentrate on the retention side of the customer relationship. Brands of all sizes can invest in building a seamless customer journey from the Brand.com website displaying rooms and services clearly, offering an easy and secure booking process, all the way through providing a great stay experience so that the customer is more likely to return or post a positive review online.

Direct booking is an essential part of this relationship building. But managing it in the midst of other distribution channels is complex.

For example, metasearch sites like TripAdvisor and Trivago operate with a lower commission schedule. While this comes out of revenue and hence doesn’t require a marketing budget, they may involve bidding for placement. Even OTAs like booking.com, Expedia, HRS, Ctrip, and others come in different sizes and contractual terms. Google and Facebook advertisements do require the brand to have a marketing budget in mind. They would require decisions on where to target the ads. Future options in the marketing model will require constant tuning of the hotel’s distribution mix for channel optimisation.

To harness this complexity and establish a revenue strategy, revenue managers can turn to a specialised platform like OTA Insight.

Where’s direct bookings headed?

In the span of just over two years since Marriott launched their campaign, several hotels have joined the fray in the move towards direct bookings and loyalty clubs.

A quick scan online turns up the following programmes: Best Western, Choice Privileges, Club 5c, Club Carlson, Fairmont President’s Club, Hilton Honors, IHG Rewards Club, iPrefer Hotel Rewards, Kimpton Karma Rewards, Leaders Club, Le Club AccorHotels, Marriott Rewards, Omni Select Guest, Ritz-Carlton Rewards, Starwood Preferred Guest, Stash Hotel Rewards, World of Hyatt, Wanup and Wyndham Rewards, plus many more.

With the ever changing hotel brand and group landscape, big mergers are bringing big changes to loyalty programmes. Marriott announced in 2018 the Marriott Rewards programme is merging with its counterparts at Ritz-Carlton and Starwood, unifying guest benefits across its 6,500+ combined properties. The highly anticipated merge is being watched anxiously by consumers, as the Starwood Preferred Guest Programme (SPG) has long been considered one of the more popular loyalty programmes in the industry.

The message here is that this trend is here to stay. Loyalty programmes are still booming. Direct booking is an essential part of the distribution strategy for hotel marketing, and can only help, over time, in nibbling bit by bit at the OTA cake.

However, as we saw, there is a place for OTAs as well in the overall scheme, and it takes careful analysis by revenue managers to strike the proper balance between these options. As the landscape gets complex with new entrants in the mix, a platform like OTA Insight, designed to analyse your options, becomes essential.