Most Revenue Management (RM) systems in the travel industry are based on seasonality (e.g., the third Friday in December is a “good day;” so, keep your prices up; people will travel), and the “booking curve” (e.g., 30 days before departure last year you were 70% full, but now it’s only 50%; so, watch out).

NB: This is an article from Trivago Business

The pandemic has clearly ruined the first principle for the last two years (nothing was a good day, really), so now companies naturally want to recalibrate their systems to 2019 when everything was “normal.” While search volume traffic is picking up and is back to 2019 levels in some parts of the world, the pandemic brought two massive changes to traveller behaviour that will impact revenue management for travel businesses.

Subscribe to our weekly newsletter and stay up to date

To deep dive into this topic, we at trivago combed through the data to learn how emerging trends are influencing revenue management and what solutions trivago as a leading global hotel metasearch can offer to help revenue managers navigate this new era in travel.

What does it mean for hotel revenue management?

Due to the high uncertainty around border regulations during the pandemic, what we, at trivago, have observed in traveler search behavior is that 1) they book more domestic travel and much later than they would for a trip abroad, and 2) they book closer to departure when traveling internationally.

Both effects compound to “lowering the booking curve,” which will likely lead to bad pricing decisions if they aren’t dealt with carefully.

If you manage a hotel in London, for example, and your revenue management system tells you that you’re only 40% full 30 days before the check-in date instead of 50%, you may not have to do anything but wait a bit longer and potentially overwrite the recommendation to reduce room rates.

For illustration purposes, we looked at searches from multiple countries for a stay in London during Easter and used the following data sources:

- Searches as a proxy for demand

- Searches made for a check-in day on the second Monday of the Easter school holidays in the UK, which is the week before Easter weekend (in 2019 it was April 15. In 2022, it was April 11).

- Our own mix of points-of-sale, which will vary for every hotel.

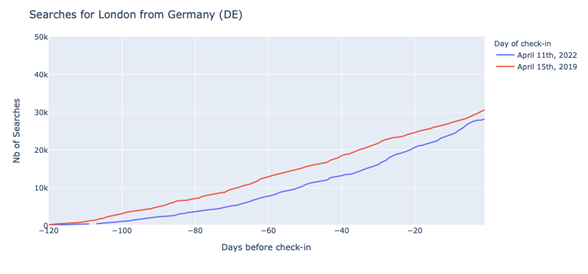

At first, the overall volume in 2022 appeared as if it were going to be lower than the start of April 2019, however the trend steadily surpassed expectations. 30 days before check-in, the volume of searches in 2022 appeared 10% lower than in 2019, and even 20% lower 60 days before the arrival date. Eventually, the cumulative search volume was 7% higher in 2022 than in 2019.

In figure 1, we see the cumulative number of searches for the two time periods.

What are the two factors that are playing a role here?

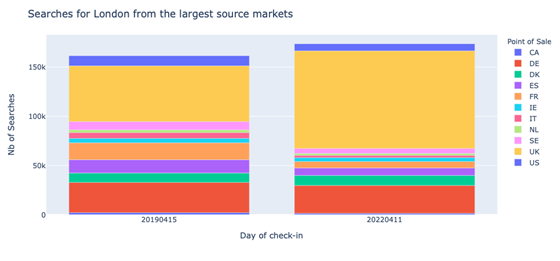

- The mix of travelers’ origins, with more domestic searches in the mix (fig. 2) by those who naturally planned their trips closer to their travel date. (fig. 3).

- International travelers booked later than they used to. Figure 4 reflects searches made on trivago’s DE platform.

What to do about it?

Although we can’t think we’re going back to 2019 levels anytime soon, it isn’t all doom and gloom. Travel volume is picking up, and that’s already a big win this year. Yet, it isn’t the only metric to look at it.

Revenue Management needs to evolve, and systems need to start learning to adapt to recent trends to build better forecasts. Even though it may take some time to implement those, the focus should be on the most recent data on traveller behaviour to recalibrate the expected booking curve that matches the “new normal.”