Budget season is upon us, and around the world hotel owners and operators are buried deep in data trying to come up with 2024 performance numbers.

NB: This is an article from Hotstats

What unique challenges are hotels facing in the 2024 budgeting and planning process? HotStats reached out to global hotel leaders to find out.

Subscribe to our weekly newsletter and stay up to date

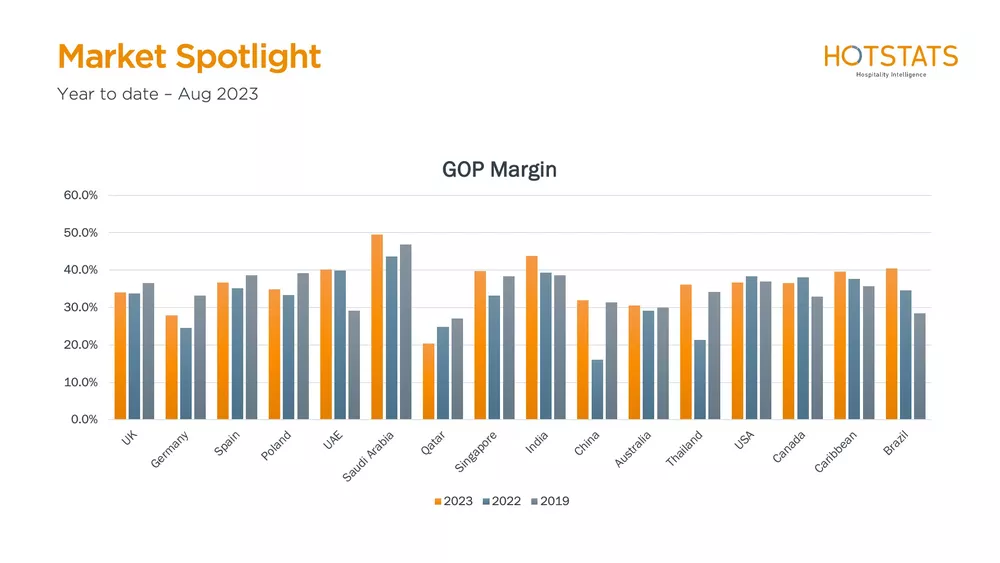

GOP Margin by Country 2019 – 2023

1. 2023 Hotel Performance: Growth Is Slowing

In UAE, Saudi Arabia, India, Brazil, and the Caribbean, hotel profit margins in the first half of 2023 well surpassed 2019 levels, whereas they lagged in the UK, Germany, Spain, Poland, and Qatar. In China, hotels experienced tremendous growth relative to 2022, while in the U.S. GOP margins have remained relatively flat since 2019.

“2023 has been a phenomenal year in so many ways, positive and negative,” said Neetu Mistry, chief commercial officer at Cycas Hospitality. “We’ve had the cost pressures, but on the flip side we’ve had so much demand and as a result some exceptional performance across our hotels. Nobody really knows what’s going to happen next, but sentiment remains positive. We could continue on this trajectory because there’s still a lot of distressed demand out there. However, supply is increasing too, and that could end up dampening some of that demand.”

Many of the experts we spoke with shared similar concerns about predicting hotel performance in 2024. “For me, the thing that’s slightly more unique this year is the expectation that things will vary far more significantly than they may have done previously,” said David Hart, chief executive officer of RBH. “In years gone by, we budgeted with the assumption of 2 or 3 percent inflation … This year, there’s an expectation that you may be off by 5 or 10 percent on some of the big numbers. So, there’s a requirement to robustly challenge and defend the evidence as to why you think a certain outcome will arise.”

2. The Economy: Recession or Soft Landing?

After over two years of anticipating a global recession, economists shifted gears earlier this year, with many predicting a “soft landing.” In July, the International Monetary Fund (IMF) raised its global growth forecast to 3.0 percent per year in 2023 and 2024, although it cautioned that the forecast remains weak by historical standards. More recently, however, the talk has returned to expectations of a mild recession.

Flip-flopping on the economic outlook hasn’t made budgeting any easier for hotels. “It has been a really tough budgeting process the last three years or so, and I don’t think next year is going to be any different,” said Joe Pettigrew, chief commercial officer at Starwood Hotel Asset Management. “Now that we’re out of the pandemic, we’re faced with inflation, interest rates, and other macro headwinds like the war still happening [in Ukraine]. So, it’s difficult to understand what next year is going to look like.”

At Fairmont Hotels & Resorts, business on the books for the rest of 2023 looks positive. “We are trending better than 2019, and ADR is strong,” said Ajay Singla, senior vice president of finance. “Most of the time business today is driven more by ADR than volume, but volume is strong too. We are looking at the momentum continuing in 2024.”

Rooms Profit Margin by Country 2019 – 2023

3. Inflation: Is Relief in Sight?

Inflation is top of mind for everyone we interviewed. At many properties, the food & beverage department is of particular concern. In 2023, F&B profit margins have fallen well short of 2019 numbers among hotels in several countries, particularly the UK, Germany, Spain, Qatar, and China, according to the HotStats’ data set.

“We’re trying to forecast the inflation effect next year and understand how it’s going to drive overall food cost and margins,” said Paul Nisbett, chief financial officer, EMEA, at Valor Hospitality Partners. “It’s challenging because everyone thought food cost was going to come down, but it’s not coming down as quickly as expected.”

At Brookfield Asset Management, “We’re looking at costs very carefully and trying to find ways to minimise the impact of inflation through either increased productivity or finding alternative products that are more cost effective,” said Elena Ladisova, vice president. She added that managing energy costs and minimising risk is a key concern.

There may be some relief in sight. Global headline inflation is expected to fall from 8.7 percent in 2022 to 6.8 percent in 2023 and further to 5.2 percent in 2024, according to the IMF.

F&B Profit Margin by Country – 2019 – 2023

4. Pricing: Have We Reached a Ceiling?

Over the past two years, hotels have managed to partially offset the impacts of rising costs with increased pricing, but how long can that continue? “Obviously, in 2022 there was really high ADR growth compared to pre-pandemic,” said Ladisova. “In 2023, we’ve seen most of our locations sustaining that growth, especially in cities, whereas some of our resort destinations are not really growing the rate. So, for us, the biggest challenge is trying to forecast where ADR will be in the markets in which we operate.”

Nisbett of Valor Hospitality Partners would agree. “How far can prices be pushed up, especially around food and beverage?” he wondered. “There is a point where you feel like you’re getting towards the ceiling, and it’s very challenging.”

“We’ve all come off a prolonged period of very strong ADR growth coupled with increasing cost of living factors and inflation and cost structure,” said Amy Stevens, group director revenue and distribution at Rocco Forte Hotels. “As an industry, we cannot sustain that pace of ADR growth. But costs don’t seem to be slowing down. So, it’s about figuring out how we maintain or increase our bottom line in that very challenging environment going ahead. We also must recognise that certain markets are more impacted by the cost of living than others.”

5. Reigning in Labour Costs

Inflationary pressures have heightened the need to find cost efficiencies in 2024 budgets, and nowhere is this more pronounced than in labour. Hotels are operating with fewer employees but at higher costs due to staffing shortages and climbing wages. Measures like reduced operating hours, leaner staffing, and scaled-back housekeeping services have helped maintain profitability, but how sustainable are they in the long term?

“One of the biggest problems which we—and everybody else—are facing is the labour shortage,” Singla of Fairmont said. “We are finding it difficult to get skilled people who are willing to work in the industry, and that’s a bit of a challenge for us from the point of view of managing expectations of the guest experience. And [labour] is also the largest expense.”

6. Shifting Market Dynamics

She added, “From a budgeting perspective, the model is not as simple as it used to be, when we were very clear in terms of guest profiles, target audience, and business mix. The last few years have really changed the diversification of that type of modelling.”

7. Data: Finding Room for Improvement

A key advantage in 2024 planning is that hotel owners and operators have access to more data than ever. “Our commercial team performs a lot of research, working with organisations like Oxford Economics, STR, and HotStats,” said Singla. “We want to understand where the market is going, what new demand is coming in, what new hotels are coming into the market, what the local tourism authorities are doing, and what the airlines are doing in order to bring business back to the destination.”

To analyse and benchmark performance, a hotel must go beyond basic metrics like ADR, occupancy, and RevPAR to more meaningful metrics like profit margins by department. With over 550 KPIs in HotStats’ reports, the benchmarking opportunities are virtually endless. The challenge is to drill down in areas with high potential for revenue growth, greater cost efficiency, and improved profitability.

He added, “We tend to use our benchmarking tools as aspirational. So, we have very competitive comp sets. And we want to continuously identify opportunities to be more efficient compared to some of our competitors.” While the company benchmarks a range of metrics, from market indexes to TrevPAR, “in the end we’re always targeting and growing our GOP margins,” he said.

8. The Upshot: Many Reasons to Remain Optimistic

Among the experts we spoke with, the general consensus was that, despite the potential headwinds, hotels have navigated more turbulent times before and will always find safer ground.

“Sometimes as an industry we tend to be more pessimistic than we should be,” said Dimitris Manikis, president, EMEA, at Wyndham Hotels & Resorts. “Back when Covid started, we all thought the industry was dead and people weren’t going to travel. And that wasn’t the case … We don’t want to allow pessimism to take over in our industry, because then I think we’re in trouble.”

He added, “Overall, we’re cautiously optimistic about 2024,” he said. “We’re making sure we account for the challenges, but at the same time, we want to keep our optimism for the great future the travel industry holds for all of us.”