Are you ready for the ‘Alternatives?’

NB: This is an article from Right Revenue

This week, there has been further confirmation from two very well respected bodies (not just me, ranting about what I think will happen in our industry but actual cold, hard facts) and I thought it was worth bringing this back to the table.

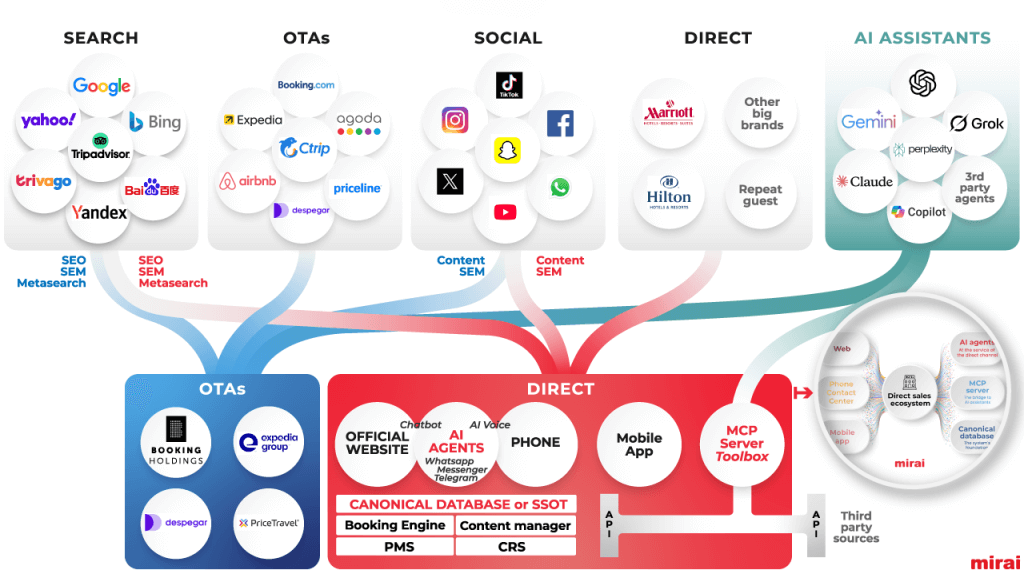

The first is Alternative Accommodation. A few weeks ago, I wrote an article about AirBnb and how I felt that their offering would disrupt not only the very obvious leisure market but our valuable corporate market as well. Even since that article was written, AirBnb has made significant improvements to their corporate offering, so not to harp on, but they are not going away anytime soon…

This week however and courtesy of Cleveland Research, Booking.com published their Q2 findings and the headlines make for some very interesting reading:

- Room nights were better than expected at up ~12% (following 1Q up ~10%), driven by a better than expected June from lapping the 2018 world cup and unfavorable weather in Europe. Alternative accommodations continue to grow faster than the core hotel business.

- Europe sounds to be tracking ahead of modest expectations and could be a point of risk tied to Brexit in October. Rest of world continues to grow faster than Europe. 3Q room nights are guided to decelerate from 2Q, but after adjusting for a number of factors/compares, core growth looks fairly stable.

- The company appears to be easing brand marketing spend growth in the back half (up 41% in 2Q following 61% in 1Q) as returns in the near term are not meeting desired ROI’s, which points to good discipline but raises questions on the ability to continue to drive direct bookings (growing faster than overall bookings) in this manner. Performance marketing growth remains modest.

- Lastly, management spoke to long term vision on the “Connected Trip” where enabling payment across all relevant options sounds like a key component as the company invests in payment/merchandising capabilities. Attraction offerings also accelerated during 2Q through the acquisition of FareHarbor (now 100k+ bookable activities globally).

If can ask you to focus on the very first point:

ALTERNATIVE ACCOMMODATION OFFERINGS ARE GROWING FASTER THAN THEIR CORE HOTEL BUSINESS.

Sorry for screaming in capital letters, but this news is HUGE. I am not saying that every hotelier can rush out and build Teepee’s in their garden, but shouldn’t we all be sitting up and taking notice? If one of the biggest online providers is showing a fundamental shift in buying behaviour, shouldn’t we all be learning from that?

My advice is to sit down and look at your offering? Our customers are demanding more and to combat this threat (and yes, it is a threat), we need to be ready and responding to change.

Get it right with personalisation, loyalty, service & product offering. Understand what your guests what to do outside your hotel and consider a way of partnering and packaging with third parties to make your product look extremely attractive.

The second announcement this week was from the UN, advising our global population to eat less meat. https://www.nature.com/articles/d41586-019-02409-7

We all know, that animal emissions are one of the biggest contributors to global warming and that the deforestation for grazing cattle is contributing hugely to a rise in global temperatures. The absolute fact of the matter is that peoples attitudes are changing.

Many of us want to make a difference, to feel that we are doing the very best we can to contribute. Reducing single-use plastics, ditching the humble straw (and hopefully someday soon, hotels will catch on to my ‘ditch the duck’ campaign) – all of these have been driven by our customers and I am a firm believer that your menu offering should be the next to change.

Vegetarians and Vegans will vote with their feet (and their wallet), so if you haven’t considered this fundamental change in customer behaviour, then my thoughts are that you should soon.

Customers are already making choices based on a desire to have an ‘alternative product’ and the days when your vegetarian menu options will have an effect on your revenue strategy are right around the corner.