At the start of 2022, we predicted 7 market trends for Hoteliers to be optimistic about in 2022.

NB: This is an article from Guestcentric

After what has truly been a euphoric and record-breaking summer for hotels, it’s interesting to observe which of our predictions came to fruition. More on that in a moment… Now in September 2022, hotels are looking to the future in anticipation and perhaps some concern. The ongoing conflict in Ukraine, rising energy prices, and inflation are just a few factors increasing concerns about what’s in store for hotels in winter 2022 and 2023.

Subscribe to our weekly newsletter and stay up to date

In this article, we revisit the predictions we made at the start of the year to see what we got right, and offer three possible scenarios for hotels to proactively prepare for in winter of 2022/2023.

So, did Hotels really have 7 Reasons to be Optimistic in 2022?

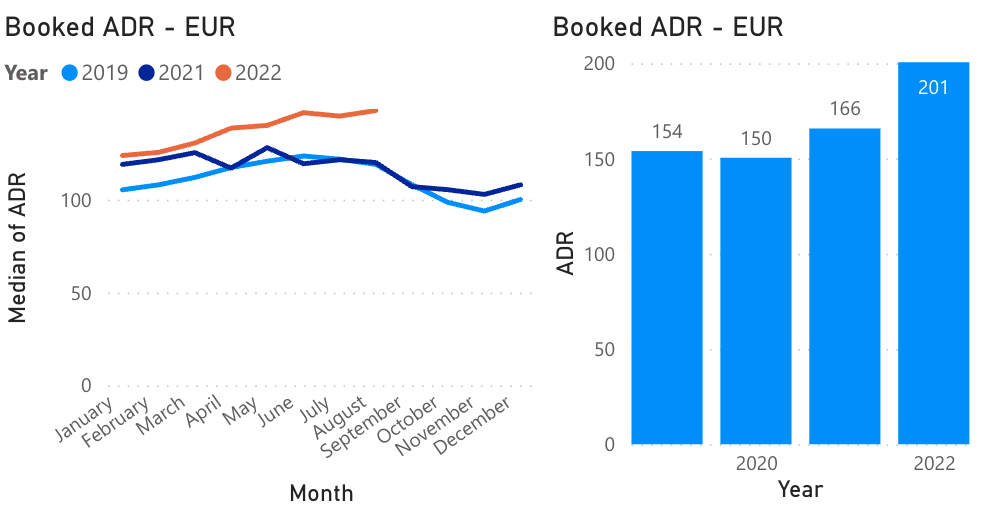

Looking back at 2022 so far, we conclude that of the 7 predictions we shared in February 2022, 6 of them came true! And although occupancy still has not exceeded 2019 levels, record-breaking ADR levels and direct bookings have brought up total revenue significantly in comparison to that period.

Without further ado, here are the predictions that came to fruition:

1. 2022 Could be the Best Year Ever for Direct Bookings

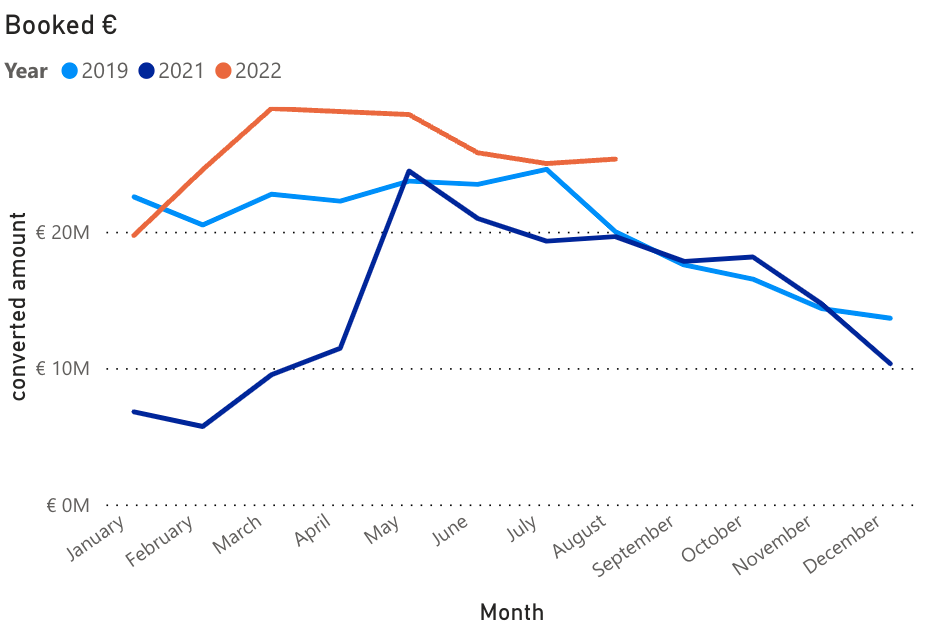

After direct bookings bounced back in 2021, we predicted that 2022 would potentially be the best year ever in terms of direct channel performance. The graph below illustrates just how direct bookings in 2022 significantly outperformed 2019 levels.

2. Demand is back in 2022

Summer 2022 boomed with travel demand! Despite China being practically barred from outbound travel this year, Aviation Expert and Travel & Tourism Consultant Gavin Eccles reported in August 2022 that total seat capacity was just 14% below 2019 levels.

“When you consider that China is not contributing to international travel currently, we can see that capacity and demand recovery is moving far quicker than consultants suggested back in 2020. Currently, capacity is at around 100 million seats per week, which is a threefold increase compared to 2021. Back in 2020, we had around 15,000 aircraft parked, and by February 2022 we were down to around 8,000,” he said.

3. Pricing is through the Roof

Although hotel occupancy has yet to exceed 2019 levels, increased ADR has largely compensated for this. Price, combined with more direct bookings has brought overall revenue approximately 8% above 2019 levels YTD, according to our market data released on September 11, 2022.

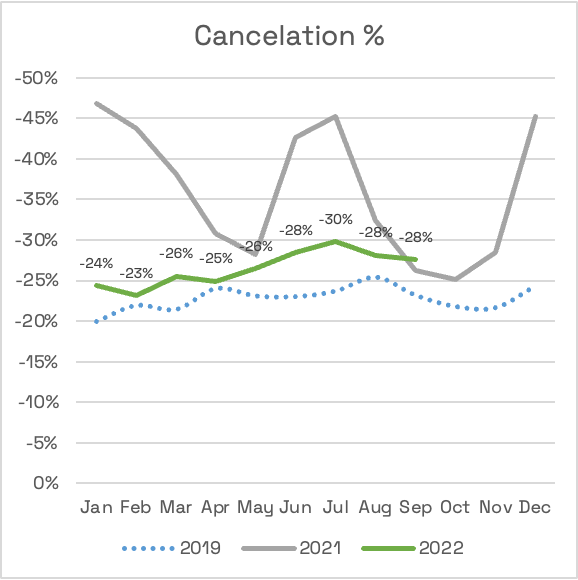

4. Cancellations are back to Normal

We all saw the sensational headlines in the press, of seemingly endless queues at the airport and flight cancellations at the last-minute. But despite this, hotel cancellations remain relatively stable in comparison to 2019 levels, and much less volatile than in 2021.

In terms of flight cancellations, Gavin also noted: “ There has been a great deal of negative press surrounding endless queues, flight delays and cancellations. The reality, however, is that a small number of travelers are affected relative to the bigger picture. Just 2% to 3% out of 100 million passengers have experienced flight cancellations over the summer of 2022. And, it was 1% in summer 2019.”