As guest behavior shifts and economic uncertainty prevails, how hotels price their rooms – and how that pricing stacks up against the competition – has never mattered more.

NB: This is an article from Duetto

Subscribe to our weekly newsletter and stay up to date

For revenue professionals, that means doubling down on our understanding of price elasticity, booking windows, and, most importantly, how guests perceive the value we offer.

One trend, however, is throwing a wrench in the system: reverse yielding.

What is reverse yielding?

Reverse yielding refers to the practice of setting high rates far in advance, only to drop them as the arrival date nears. It’s essentially the opposite of traditional yield management, which starts with lower rates that climb as demand increases.

But here’s the thing – reverse yielding isn’t a strategy. It’s usually a sign of something deeper: poor forecasting, low confidence in pricing decisions, or internal misalignment.

To better understand how this plays out in practice, let’s take a look at one of our key markets: Las Vegas.

Viva Las Vegas: A closer look

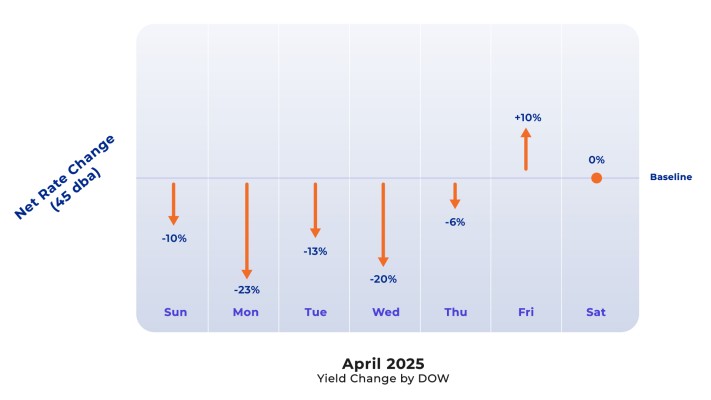

Let’s zoom in on Las Vegas in April 2025.

Specifically, we compared rates set 45 days out from the stay date with the actual final rates at night audit (the day of arrival).

Why 45 days?

Because that’s roughly the average booking window for transient guests in the market.

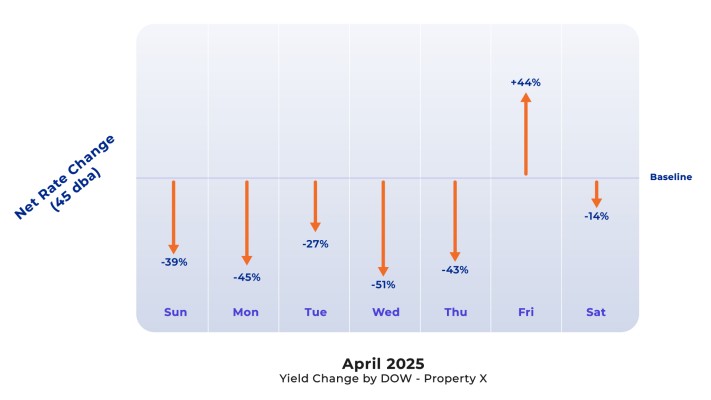

In this first chart, we see a general decline in prices – a clear indication of reverse yielding at play. But since this chart averages out all properties, it masks how extreme the drops were for some individual hotels.That’s where the second chart comes in. Here, we will zoom in on a single property – a resort on the Strip with strong market presence.

Its rate behavior is a textbook example: guests who booked early paid significantly more than those who booked closer to arrival.

Why does it happen

Several factors contribute to this trend – and most of them are rooted in deeper issues than just price.

That’s where the second chart comes in. Here, we will zoom in on a single property – a resort on the Strip with strong market presence.