As hotel asset managers, we are able to work alongside hotel owners and operators to guide a hotels’ recovery from COVID-19.

NB: This is an article from Global Asset Solutions

We can use our expertise to guide and create a re-opening action plan, bring back the hotel’s property value, and enhance communication between the owner and the management team. This article will outline the key areas where hotel asset management can come into play to improve and adjust your operations post COVID-19. Hoteliers, owners, you are not alone.

1. Meet the New Normal

As lockdowns are lifted and shelter-in-place eases up, businesses may be required to adhere to a new set of standards. Hotel asset managers can provide advisory services to navigate the new regulations and guidelines tailored to your specific property’s location and facilitate the implementation throughout the operation. With our experience across many countries, we can also go above the newly instated local regulations and offer additional measures to put your customers at ease and bring back occupancies in a safe environment.

2. Develop a Re-opening Forecast and Guide in Investment Decisions to Avoid Liquidity Risk

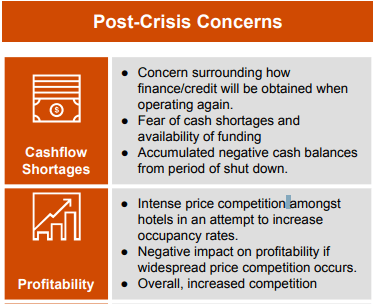

The closure of properties caused a working capital issue for owners and operators. Many governments activated different mechanisms to relieve the financial pressure across three main areas: protecting the livelihood of workers, fiscal support, and injecting liquidity. However, these efforts may not have been enough to sustain every business, and access to this aid was often limited. Hotels will likely have two main concerns post-COVID-19 when faced with re-opening: cash flow shortages and profitability issues.

Undoubtedly, both owners and operators are suffering during the closure, worried about the current inactivity and long-term impact it will leave. Determining the re-opening forecast scenarios, re-opening date, and breakeven point can open up many conflicts between both sides. On the one hand, the onus is on the owner to provide sufficient working capital during the disinfection, retraining, and ramp-up period. On the other hand, the operator will mostly be concerned with implementing new brand standards and hygiene regulations and making sure the property is as attractive as possible compared to its nearest competitors.

Hotel asset managers act as impartial arbiters when these challenges arise. For instance, in terms of payroll, we work with the operators’ team to ensure adequate re-opening staffing levels and ensure progressive ramp-up, organise onboarding of furloughed and new employees, ensure new operating standard training is delivered, and prioritize certain departments (e.g., housekeeping, maintenance). We make sure that the forecast is as streamlined as possible with the volume of business.

We will evaluate the necessary investment required for the re-opening. Hotel asset managers do this by providing additional oversight with regards to liquidity management. For example, during the re-opening stage, one industry best practice restricts the operator’s access to the full agreed-upon operating cash injection at any one time. Instead, distributing a predetermined amount to the operator monthly helps to ensure the operator stays within the agreed amount and allows better cash flow monitoring.

The role of the hotel asset manager includes making sure the funds are being spent where it makes the most impact by reviewing the operator’s proposal and negotiating what is fair and necessary for the hotel owner. Furthermore, hotel asset managers assist in funding decisions by analysing the risks, negotiating with lenders, maintaining monetary and reputational capital, and eventually optimizing the capital structure. Additionally, this re-opening is also the perfect time to re-adjust the business model, identify new opportunities, and estimate the potential returns.

3. Cleaning Standard Operation Procedures: A Key Factor for Re-opening Success

Hotel asset managers will roll up their sleeves to guarantee top safety and cleanliness measures are fully implemented throughout the property. These measures will be necessary to restore guests’ and stakeholders’ confidence in the hotel. We will review current standards to determine critical actions that need to be reinforced to ensure proper sanitation and prevention efforts are taking place. This will be the crucial focus point for the post-COVID-19 era.

Over time, the lodging industry may be required to implement new standards and additional levels of sanitation, hygiene, and social distancing measures. Our internal approaches enable us to be familiar and remain up to date with the current regulations. We can also go above the newly defined regulations and proactively initiate aditional housekeeping measures to put your customers at ease in order to succeed upon your re-opening.

4. Revenue Management and Sales and Marketing

Another key role of hotel asset managers is their contribution in establishing and controlling room rates, setting up an efficient channel mix, and bridging the gap between the Revenue and Sales and Marketing departments.

With our industry currently at a standstill, there is no previous precedent, no historical data to refer to. Revenue Management software systems do not have reliable data to process: they will simply not work. Furthermore, most of revenue managers positions probably did not exist during the last major business downturn, the 2008 Financial Crisis. In order to advise hotels on this matter, hotel asset managers work with robust revenue anagement experts and monitor the trends of several metrics. These metrics include analysing the general market prices beyond the comp set, Google analytics, macroeconomic indicators and more to assist in the room’s price mix strategies. The operator will most likely place an emphasis on the occupancy rate and adjusting the prices to attract the available demand. However, owners are generally more focused on monitoring the profit and cash flow performance, and less concerned with the occupancy rates.

To help both parties achieve their goal, maximize total revenues, and minimize costs; overhead costs, F&B covers, meetings and conferences, retail and so forth must be considered. Therefore, in addition to RevPAR, hotel asset managers also include other metrics such as GOPPAR and flow-through as key performance indicators. These additional metrics help monitor the the hotel operations and financial performance.

5. Food & Beverage service

Many independent restaurants and bars will have to close due to the difficulty of supporting the operational costs with limited capacity and low occupancies. As hotel F&B outlets already have the building, space, facilities and operations in place, with the right adjustments and guidance from hotel asset managers they will be able to survive the re-opening, resume cash flow, and increase their market share.

Over the last few years, however, the social space trend has driven many restaurant concepts. Lobbies have been converted into popular bars, and hotels have put an emphasis on larger social areas and smaller guest rooms. These trendy concepts will come to an abrupt halt upon re-opening, and new concepts involving social distancing will have to be implemented. Hotel asset managers can assist with smoothing the re-launch phase, planning, and adjusting the F&B operations neatly and according to new standards and regulations.

Hotel asset managers offer a good understanding of the F&B opportunities and trends. They can assist in developing new menus designed to minimize stocks and reduce waste while demand slowly recovers. They can also adjust the standardized systems in place, such as the buffet, to the new normal. This will involve improving the food service, guarantee quality, and offer advice with additional services such as food delivery. Hotel asset managers share the profitability focused perspective of owners, and also share the F&B expertise with operators regarding concepts, trends, and designs. Their perspective will be very useful in transitioning F&B outlets into the post-COVID-19 era.

6. Customer Relationship and Reputation Management

The way the re-opening is communicated and executed is crucial to earning your customers’ trust and bringing back business. Hotel asset managers can provide efficient solutions for creating memorable experiences and adding personal touches to appeal to current and new guests. We are hospitality professionals that know how to put customers first. Maintaining hotel reputation is imperative; therefore, hotel asset managers design practical templates to monitor customer satisfaction and track key performance indicators. These templates can assist the operator to improve their customer journey, and eventually carry the impact down to the bottom line.

Conclusion

Hotel asset managers play an important, non-intrusive role by providing additional guidance, hospitality expertise, and financial advisory for the re-opening, ramp-up, and stabilized operations. We work closely with the operations team by monitoring their performance and implementing solutions in order to adjust and prepare for almost any situation.

Hotel asset managers will also be involved in the COVID-19 aftermath. We believe that to save the bottom line, certain key actions need to be taken. These include allocating funds when and where they are really needed, and reviewing the needs of the operational departments in order to resume efficiency and increase quality. Safeguarding opportunities also need to be created for the revenue management and sales & marketing strategies.

The hospitality industry was hit hard and there is still a long road ahead towards recovery. The owner, local operations team, and corporate management need to work together and increase communication to ensure everyone is on the same page. As hotel asset managers, we will lead the communication and guide the recovery period to restore the hotel and introduce it to the new normal.

Read more articles from Global Asset Solutions

Written by

Eliana Levine, Larina Maira Laube, Vani van Nielen, Zhaoyu Zhu and Paloma Guerra

Ecole Hôtelière de Lausanne Students and Alumna

Global Asset Solutions, your key partner in hotel asset management, has partnered with a team of five students and one alumna from Ecole Hôtelière de Lausanne, recognized by industry leaders as the best hospitality school in the world. Together, we are working on compiling the best practices to help hotel owners and operators navigate through the COVID-19 crisis. By combining diligent research, expert opinions, and our own experiences, we will be publishing the best practices on the most current topics facing our industry. Team APAC is composed of Paloma Guerra and Zhaoyu Zhu, while Eliana Levine, Larina Maira Laube, Lorraine van Ninjen and Vani van Nielen make up our Team EU & US and Remy Rein (EHL Lecturer).

Co-Published with Alex Sogno (CEO – Senior Hotel Asset Manager at Global Asset Solutions). Mr. Sogno began his career in New York City after graduating with honors at Ecole Hôtelière de Lausanne, Switzerland. He joined HVS International New York, and he established a new venture at the Cushman & Wakefield headquarters in Manhattan. In 2005, Mr. Sogno began working for Kingdom Hotel Investments (KHI), founded by HRH Prince Al-Walid bin Talal bin Abdul Aziz Al Saud member of the Saudi Royal family, and asset managed various hotels including Four Seasons, Fairmont, Raffles, Mövenpick, and Swissôtel. He also participated in the Initial Public Offering (IPO) of KHI at the London Stock Exchange as well as the Dubai International Financial Exchange. Mr. Sogno is also the co-writer of the ‘Hotel Asset Management’ textbook second edition published by the Hospitality Asset Managers Association (HAMA), the American Hotel & Lodging Education Institute, and the University of Denver. He is the Founder of the Hospitality Asset Managers Association Asia Pacific (HAMA AP) and Middle East Africa (HAMA MEA).

Sources of Information

Figure 1: https://www.pwc.ie/publications/2020/hospitality-sector-covid19-impact-and-options.pdf