With our access to real-time traveller audiences and unmatched visibility into global travel demand, we’re in a unique position to share the current travel trends at the forefront of marketers’ minds.

NB: This is an article from Sojern

In this blog series, we’ll take a look at the data in order to aid travel marketers in their assessment of this worldwide event. They can use these trends to inform their marketing strategies during this period, as the industry stabilises.

These insights are based on data collected on the 15th June, 2020. We will be reviewing our data on a weekly basis in order to provide a regular view of trends and patterns in consumer behaviour. Our insights are based on over 350 million traveller profiles and billions of travel intent signals, however it does not capture one hundred percent of the travel market.

Travel Intent and Demand Sees Continued Improvement Across Most of Europe

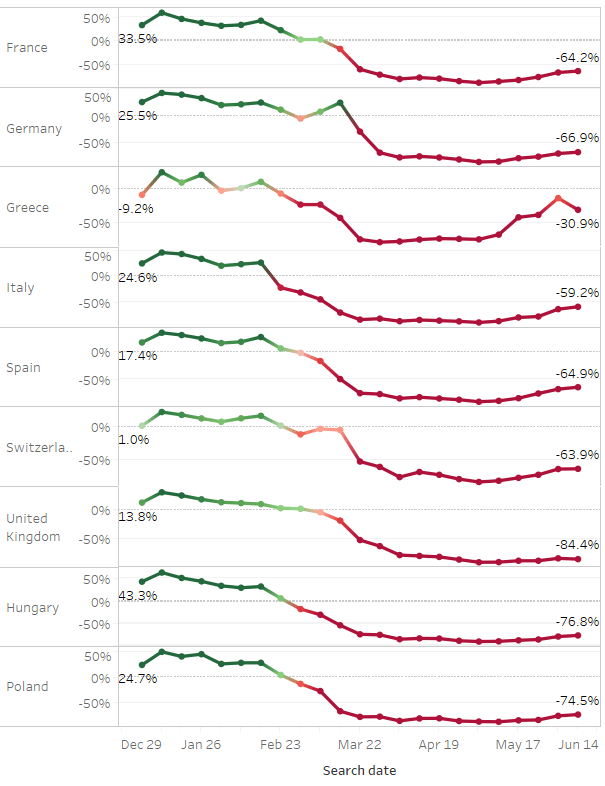

We continue to see upticks in global travel intent to many countries across Europe, as countries start to reopen their borders to inbound travellers. While numbers are still down on 2019 levels, they are up considerably from April, when COVID-19 was at its peak in Europe. In particular, it’s worth noting that Italy and Spain, which were impacted first and hardest by COVID-19 in Europe, have seen positive increases in travel searches. Intent to Italy is now only down 59% YOY, and Spain down 65%.

The UK continues to be the exception, where inbound travel searches remain low. This is likely due to the 14-day quarantine that the government has imposed on most arriving passengers. With most other countries in Europe not implementing these types of restrictions, travellers seem to be looking elsewhere for their next trip.

Global Flight Searches to Key European Markets

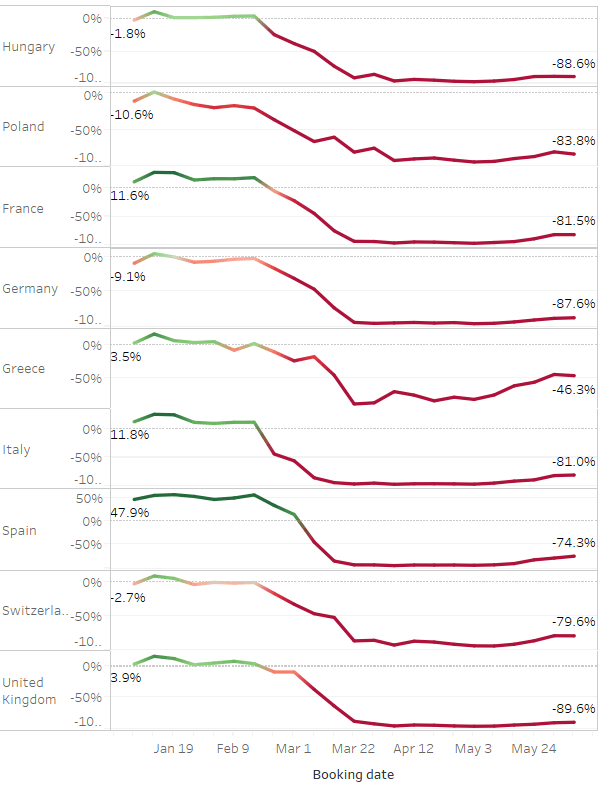

When looking at bookings, they remain lower than searches, which is still to be expected. The UK remains the country with the lowest amount of travel confidence in our sample, again, likely due to quarantine restrictions.

Global Flight Bookings to Key European Markets

France Allows EU Travel, Though Travellers are Eager to get Away to Their own Backyard This Summer

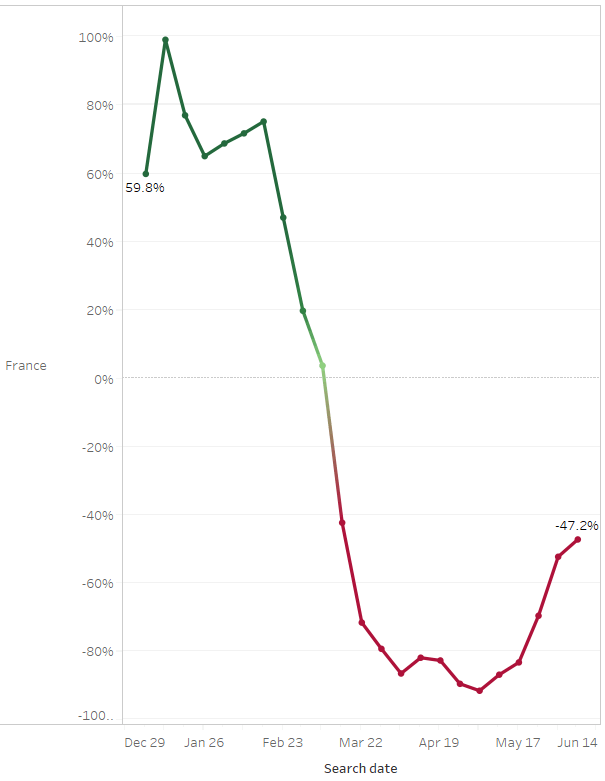

One week earlier than expected, French President Emmanuel Macron has announced that a number of coronavirus restrictions are being lifted this week. As of this week, restaurants, bars, and hotels are now allowed to fully open without any further restrictions. In addition to this, travel to other European countries is now allowed, ahead of the larger opening of wider EU borders on the 1st of July—great news for inbound tourism, particularly for hotels and attractions. And while this is a positive sign, early indications are that French travellers are looking to stay locally rather than travel abroad. In fact, there has been anecdotal evidence that many French people will spend their summer holidays locally this year. Domestic flight searches are only down 47% from 2019 levels, well up from April and May.

Domestic Flight Searches France

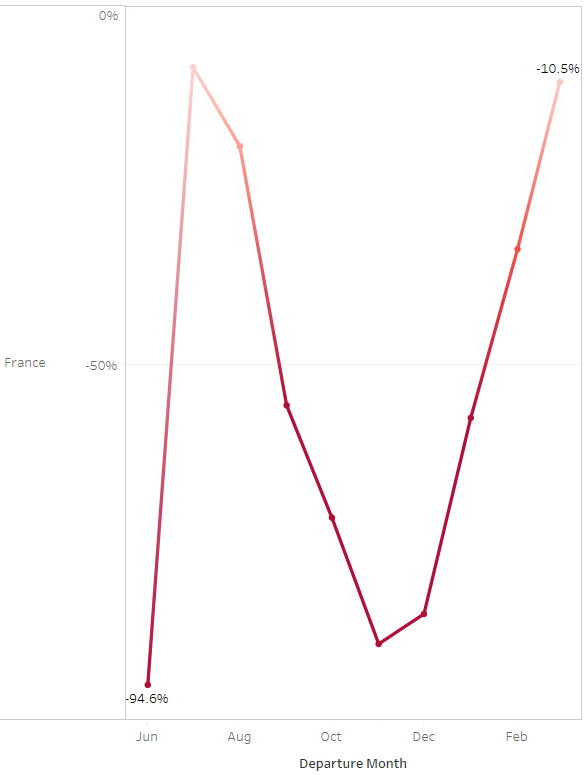

But perhaps more importantly, we see that domestic travel bookings have improved immensely over the past couple of weeks. When we look at bookings from the past couple of weeks, we see a massive uptick in domestic bookings for July and August (down only 8% and 20% YOY in those respective months), showing that the French are still eager to get away for the summer, even if it’s within their own borders.

Domestic bookings from the last 14 days to France

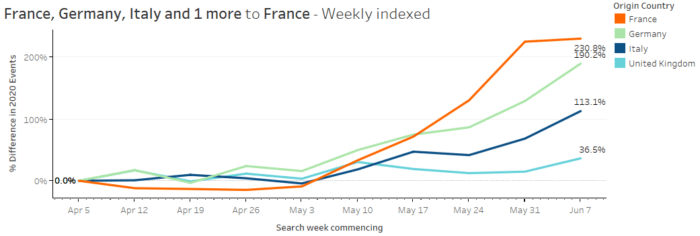

We’ve indexed the below graph to the first week in April, when Europe was perhaps in the worst phase of the virus, lockdowns were strictest, and travel intent was at its lowest, in order to see the recovery and where it is coming from. Again, the domestic travel market is dominating interest—with demand up over 230% from early April. Intent from Germany comes a close second, up over 190% from the same period.

Travel Searches to France, Indexed to 5th April

We will continue to share more insights as we monitor the situation. What remains clear is that summer recovery will be dominated by domestic travel, followed intra regional travel. These forward looking insights will hopefully help travel marketers shape their strategies as the industry recovers from this outbreak.