This article is part 1 and looks at how to identify your competitive set and apply the right activities to achieve a better market position and greater profits, while at the same time raising the quality of the offer without affecting the price dumping.

NB: This is an article from Fabrizio La Volpe, Trainer & Consultant at Hotelperformance

How often does the hotel owner analyse its competitors? The problem is that it is often difficult to identify the competitive set clearly and correctly. Without making the necessary preliminary assessments, the risk is that the analysis are carried out in a superficial and not always adequate manner. Analysis which, in order to establish a real market position from the customer’s point of view, is varied and not always immediate.

I begin by saying that competitive sets – all the resulting analysis and final positioning – should be more than one.

Every market has its own demand but, if necessary, it would be useful to have several competitive set:

• one for Business Groups – if the hotel is equipped with meeting rooms and has, in fact, a business clientele;

• one for “Public Unqualified” demand;

• one for the other possible Unique Selling Points (USP) – for example hotel with swimming pool, hotel with restaurant, etc.

The analysis of competitors cannot ignore the concept of segmentation, since this is one of the key principles of Revenue Management.

The analysis includes a tactical part – quantitative and qualitative analysis – and a strategic part, including the choice of competitors, understanding of their behaviours, positioning and benchmarking.

We begin our research by putting ourselves in the shoes of our best customers. By analysing and interpreting the available data in the best way, it will be necessary to identify three main segments, for example, in terms of production and try to understand their needs. Doing this, collaboration with the marketing manager is essential. What are, for example, the filters that customers would set on Booking / Trivago / Expedia / Tripadvisor / etc.? Geographical location? Services (restaurant, swimming pool, etc.)? Type of beds? Stars? Minimum score? What results would these researches give us?

Narrow the list according to the objective of the analysis, remembering an important principle: different segments, different needs.

Let’s focus on 6 choices – maximum 10 – to have a more focused view and avoid too general analysis that would give us data influenced by potential false competitors.

We could also decide to set a bottom and a top: a competitor much smaller than us, as a reference for our minimum price; a better one, reference for the maximum price.

Selling a room does not involve a physical sale but simply a rental. What characterizes this sale is the service. The service should also differentiate the sale of the hotel room from the sale of the apartment. For example, if the hotel competitor is a guesthouse, perhaps it will be necessary to concentrate on other aspects before establishing a proper competitive set.

The maintenance, the breakfast, the room cleaning, the reception and a thousand other features do not make the guesthouse substitute but complementary to the hotel room. In some particular periods, for example of low demand, it may be necessary to steal market share from that particular market. A correct and farsighted Revenue & Marketing strategy – distribution, segmentation, promotion, etc. – however, it must be able to remedy the problem in a preventive manner.

Moreover, given the continuous evolution of the sector, the competitive set should be reviewed at least once a year to ensure the relevance of the data.

Below are some key factors to consider:

Fair Share Market (Capacity Share)

Rooms available in terms of quantity. It would be illogical for two hotels with very similar services but very different number of rooms to point to the same customer. A 15-room boutique hotel with a pool and restaurant should aim for a different customer than the one that a much bigger hotel with the same services aims for. Likewise, their pricing strategy cannot be comparable.

Product / services features

If the target to be monitored is the business client and the hotel is located on the outskirts (near a connecting hub), having parking or being outside of restricted traffic areas is a great advantage. By monitoring the leisure customer, on the other hand, the geographical position may not be the greatest strength of the structure.

Having said that, if I was looking for the competitors of my hotel with golf courses, I should probably look for them outside the region.

Once competitors have been identified, we proceed with the customer-centric qualitative analysis.

How are our competitors perceived? What are the scores for each characteristic recognized by the application?

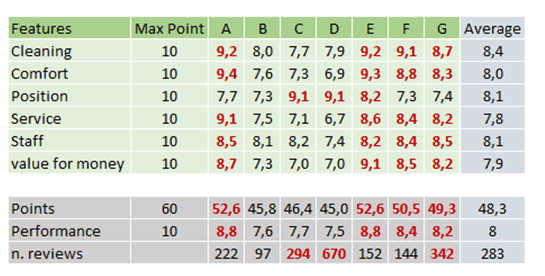

The table below can help in understanding:

The number of reviews helps us understand how the position of each competitor in the market is consolidated.

To complete the qualitative analysis, we must proceed with the SWOT Analysis, which consists in determining for each competitor strengths, weaknesses, opportunities and threats.

Reading customer reviews we could highlight:

- Strengths (ex: excellent view, comfortable beds).

- Weaknesses (ex: high parking costs, noisy rooms).

- Opportunities (ex: new stadium opening nearby, meeting rooms after the recent renewal).

- Threats (ex: opening a similar hotel in the area, no more flights from China, price war between competitors).

It is at this point that we must try to understand the attitude of our competitors.

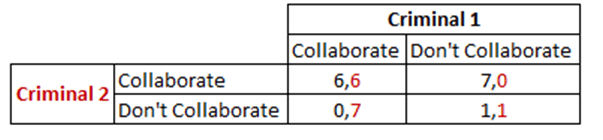

Then let us apply the Prisoner’s Dilemma. For those who do not know it, I explain it briefly: two criminals are accused of committing a crime. The investigators arrest them both and lock them in two different cells, preventing them from communicating. Each of them is given two choices: to collaborate with justice or not.

It is also explained to them that:

1. if only one of the two collaborates, he avoids the penalty but the other is sentenced to 7 years in prison;

2. if both collaborate (accusing each other), they are both sentenced to 6 years;

3. if neither of them cooperates, both are sentenced to 1 year, because they are already guilty of illegal arms.

Summary in this matrix:

With the best choice for criminals (read competitors), you get Pareto’s efficiency: the minor damage. The two criminals do not cooperate with justice (allying) and do not accuse each other. At this point we are faced with an efficient resource allocation situation.

However, Nobel Prize John Nash has realized that the economic market is often competitive: my life, your death. This balance, in addition to triggering a devaluation of the product / service placed on the market, triggers logical conclusions.

Let’s get into the position of criminal 2, in red.

If the other collaborates we have two choices: to collaborate (6), not to collaborate (7) … two unfortunate choices but better the first.

If the other does not cooperate we have two choices: to collaborate (0) or not to collaborate (1). Both choices are excellent, but the first one would certainly be preferable.

With this short-sighted vision, both would arrive at the unfortunate choice to accuse each other (6,6).

The coopetition – the fusion of competition and collaboration – is now increasingly important and in some sectors determines a real barrier to entry.

At this point we will already have a more precise idea on what our real competitors are and, above all, on what aspects we can / need to compete on and which are not. Because a competitor is almost never “tout-court”. Obviously there will be other activities to put into practice, but the reasoned identification of a competitive set is already an excellent starting point.