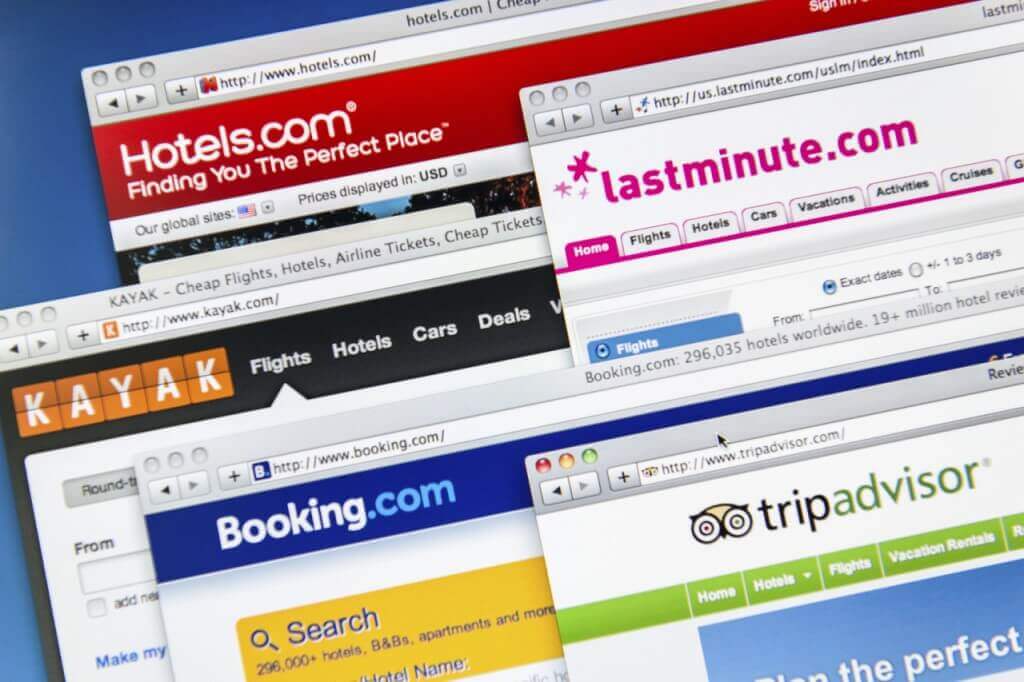

Wall Street prefers the term ‘headwinds’ to ‘problems’, and there are an awful lot of them in the travel stories coming out of brokers at the moment. The numbers show that the Big-Three, but especially Expedia, are being hit heavily by marketing and technology costs at a time of rising fears of the threats from the major tech groups – Amazon, Airbnb and Alphabet.

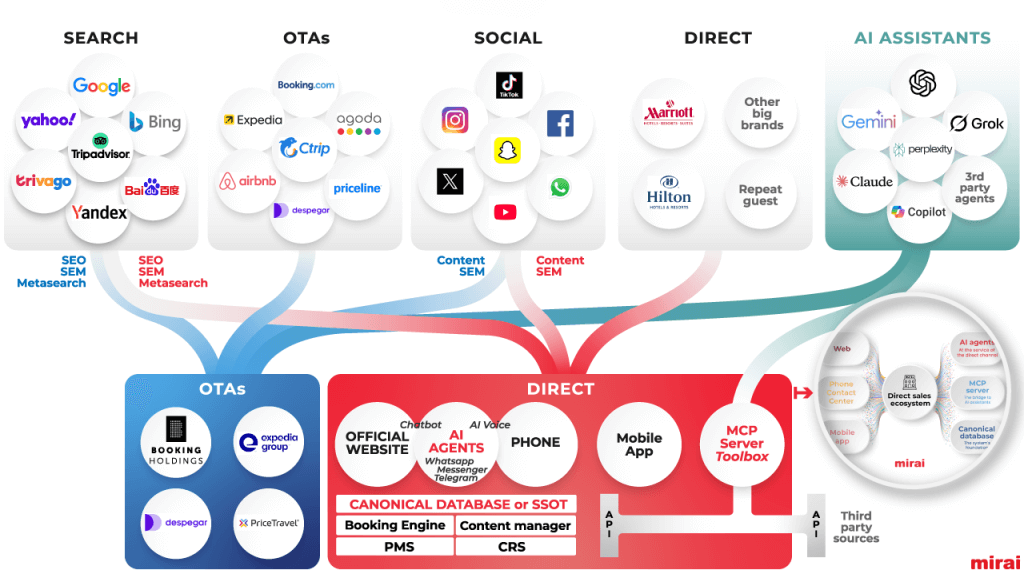

The ‘headwinds’ include that the vast major OTAs are deemed to be approaching hotel market saturation points, while the major hotel groups are increasingly working on avoidance tactics and direct sales to their guests. Another is that Alphabet, the parent company of Google, recently shut down an airfare data tool used by the OTAs. Also, Amazon is expected to follow Alibaba’s lead and tie-up with bigger hotel chains to sell hotel bookings and Airbnb is spreading its interests across the travel industry.

The Big-Three-Expedia, Priceline and TripAdvisor – are spending something over a billion dollars a quarter each on marketing and ads and the numbers are rising. So, while this is bringing revenue growth (albeit at a slowing rate) it is not enough to maintain a rise in profits. As industry commentators at the website Seeking Alpha say, “return on advertising spend has been noticeably down across the industry”.

Pressure cooker

Taking a look at Expedia, Seeking Alpha comments that the company has warned of “increased sales and marketing spend, which will continue to ramp up in 2018, without any evidence of association growth…” The warning, which came with less detailed guidance on future trading than comes from the other OTA’s, did not go down well.

In a quick run around the numbers at Expedia, which seems to be under the most pressure of the Big-Three, operating expenses were around 65% of sales in Q4 2017, compared to 51% in the previous quarter. That fall brought operating profits down by 43%. Looking ahead, management expects the cost of marketing and technology – investment across the industry in cloud is heavy – to rise faster than sales. It forecasts 2018 profits growth of 6-11%, but Wall Street is a bit sceptical.