Well past the second anniversary of the pandemic, business travel is showing its first significant signs of recovery.

NB: This is an article from STR

As that recovery gains momentum, a new landscape has formed with the presence of both traditional and new forms of business travel. Amid this new landscape, however, there remains mixed consumer sentiment toward business travel as well as a large gap between current volume and pre-pandemic comparables.

Subscribe to our weekly newsletter and stay up to date

Not just leisure anymore

Until this point, recovery was almost completely leisure based. That segment came back sooner than expected with solid summer travel in 2020 and the summer of pent-up demand in 2021 setting the stage for the anticipated “summer of all summers” in 2022.

Business travel has of course been slower to return, but recovery in the segment is evident across the landscape with traditional business travel for sales, consulting, trainings, conferences and conventions as well as new business travel from digital nomads, more “bleisure” trips, and remote workers making trips back to their company headquarters because of increased work from home.

The overall outlook is “less bad”

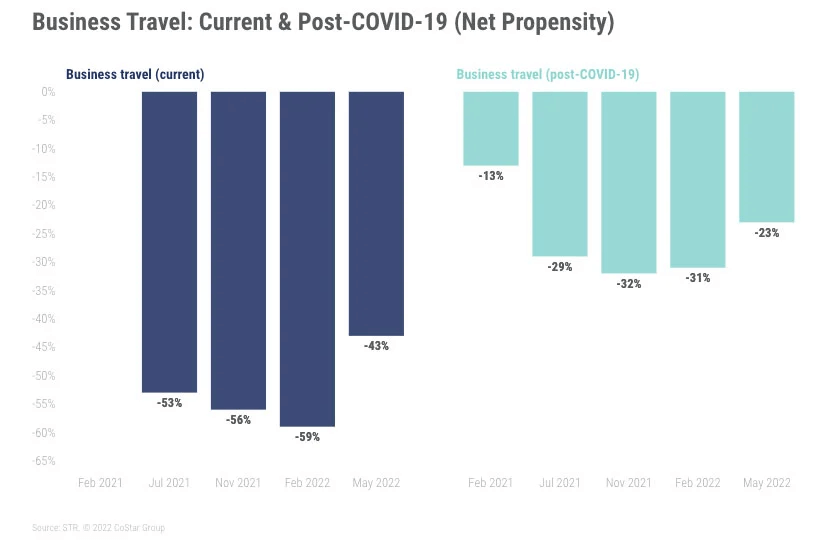

When roughly 500 global business travelers were asked to think about their likelihood to travel for business both now and when the pandemic is “over,” the results, while negative, were significantly less negative than past readings.

Almost half (47%) of consumers are as likely or more likely to travel for overnight business now compared with pre-pandemic levels, while a higher percentage (60%) are as likely or more likely to travel for overnight business when the pandemic ends. Additionally, net propensity to travel, which is the difference between those more likely and less likely to travel is -43% for business travel today and -23% for business travel post-pandemic. Among business travelers in the U.S., business travel intentions are not quite as pessimistic, although they are still well into negative territory at -12% net propensity post-pandemic.

The cost savings realized by companies in 2020, with most of the workforce connecting from home, and the success of video technology as a substitute for face-to-face meetings are significant reasons for this lack of optimism, according to STR research conducted last year. That sentiment can also be connected to increased efforts to limit travel frequency as sustainability initiatives are gaining momentum. So while the outlook is muted, the good news is business sentiment appears to have finally turned the corner with the least negative sentiment scores since COVID began.

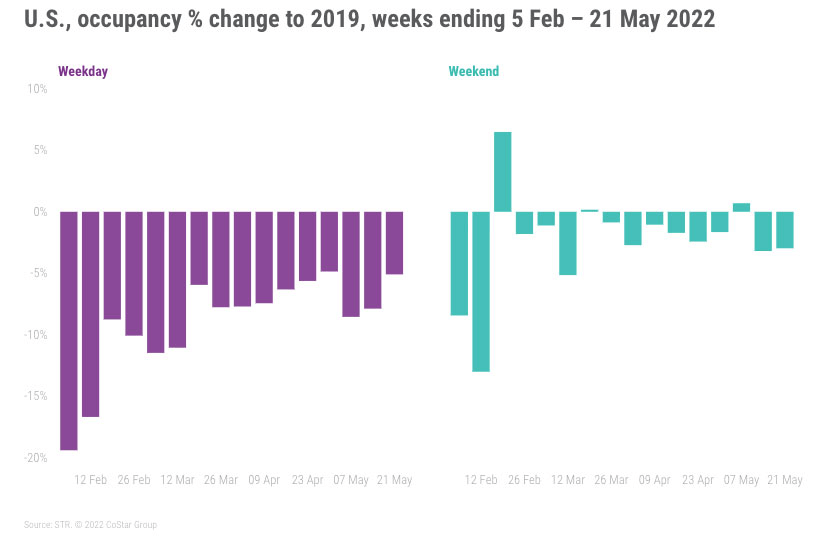

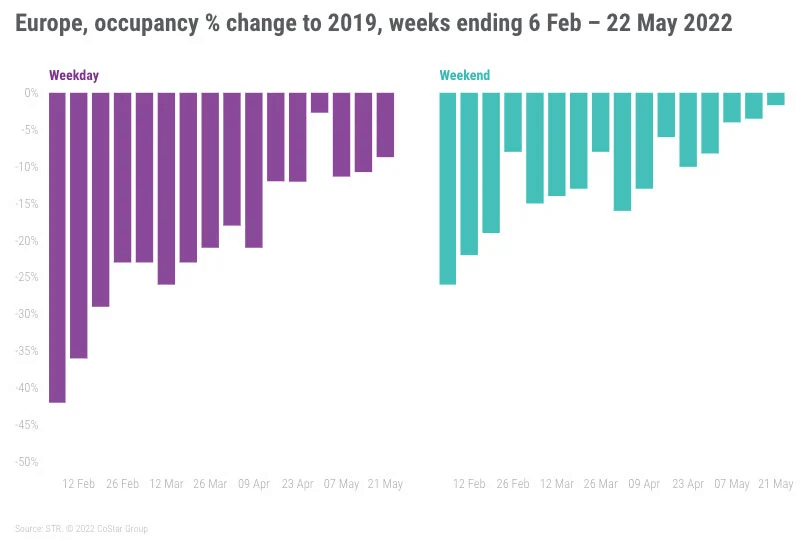

Business travel pickup evident in midweek and urban hotel performance

Further indication of the return of business travel is seen in the significant improvement in midweek and urban hotel demand in the U.S., U.K., and Europe. Weekday occupancy has been rising steadily since February 2022 on both sides of the Atlantic. May weekday occupancy has been close to pre-pandemic levels as demonstrated in the two charts below.

Likewise, urban markets in the U.S. and U.K. have been closing the gap to 2019. Weekends and small town/rural destinations were strong in recent years because of leisure travel. This recent improvement in midweek and urban travel demand, when most business travel occurs, is a further sign of optimism for business travel.

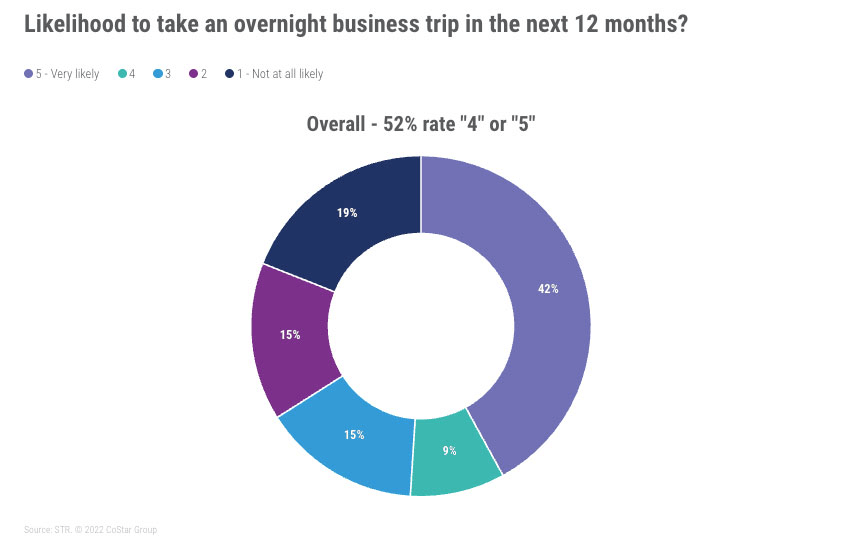

The future is looking up for some, but not all business travelers

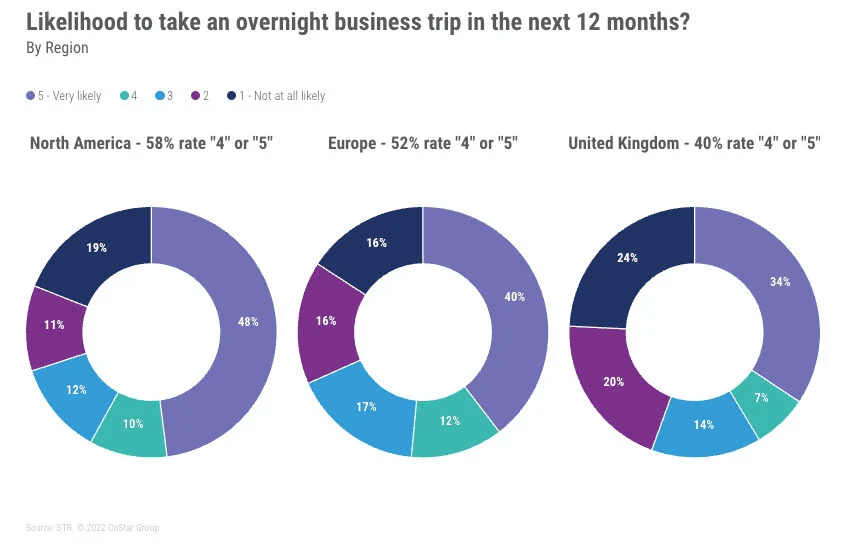

Looking to the future, just over half of business travelers expect to undertake an overnight business trip in the next 12 months. This positivity is somewhat muted by the fact that one-quarter (24%) of business travelers are not likely to take an overnight business trip in the next 12 months. Some employees who traveled for business in the past are not yet allowed to travel due to corporate policies and concerns from legal departments over duty of care if an employee contracts COVID-19 while traveling. Additionally, the earlier mentioned cost savings companies are realizing are likely still stifling some business travel.

Regionally, North Americans are the most likely to travel for business followed by Europeans and Brits. This pattern of North Americans and Europeans showing greater optimism toward future travel compared to Brits is similar to what was reported for leisure travel in earlier STR research. Notable is that the restrictions in the U.K. were more severe than the U.S., and this translated to a slower travel recovery across both leisure and business travel types.

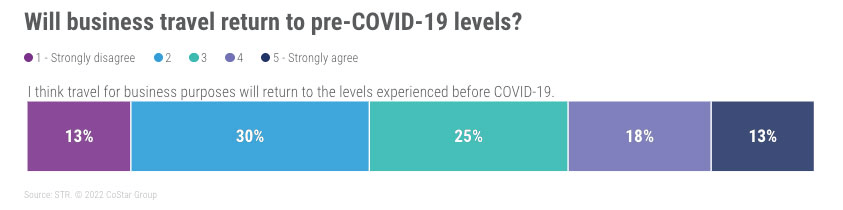

A complete business return remains TBD

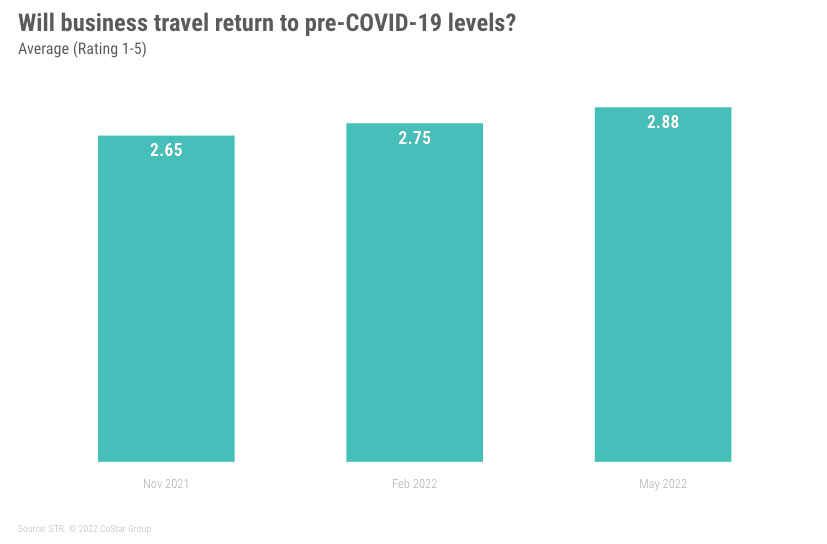

Signs of muted optimism about business travel is echoed elsewhere in our research. Just under one-third of those who traveled for business before the pandemic agreed that travel for business purposes will return to pre-COVID-19 levels. On the flip side, a plurality (43%) disagreed, resulting in a polarization of opinion. On a positive note, overall agreement, as demonstrated by the average measure, has increased steadily over the three waves of this research from 2.65 in November 2021 to 2.88 in May 2022.

Green shoots of hope amid a new business travel landscape

Business travel is recovering, although a complete recovery remains a way off. And the changes in the workplace and workstyle, not to mention the fact that COVID is still a factor, reveal a new business travel landscape. The opportunity for the hospitality industry is to embrace this new landscape with the same adaptability adopted during the pandemic, knowing there is a basic human need for in-person encounters and that business travel is a necessity.