A new study, published today by Guestcentric and Great Hotels of the World, shows that nearly 85% of Hoteliers expect financial recovery to pre-pandemic levels (benchmarked at 2019) by the end of 2022.

NB: This is an article from Guestcentric

Over 35% of Hoteliers surveyed in October 2021 report their business has already exceeded pre-pandemic revenue levels or will exceed by the end of this year.

But, as the winter season begins to sweep over Europe and the US, bringing with it a potential wave of new restrictions, it remains to be seen whether this forecast will hold. In this news update, we share 3 highlights from our latest Hotelier PULSE Survey and the business outlook for November 2021.

Subscribe to our weekly newsletter and stay up to date

1. Over 82% of Hoteliers expect to outperform 2020 Revenue Levels in 2022, and 35% expect to recover financially to 2019 levels in 2021

The number of Hoteliers expecting to outperform 2020 revenue levels in 2021 continues to increase, up from 75% in our September 2021 survey to 82,36% today. Overall, 47,06% expect to recover financially to pre-pandemic levels in 2022, while 35,24% report that their business revenue has already exceeded or will reach the benchmark by the end of this year.

An equal majority share of City Center Hotels (33,33%) expects to financially recover to pre-pandemic levels in 2021 and 2022. As the most optimistic segment, 66,67% of Resorts expect to financially recover to 2019 levels already in 2021, while 80% of Bed & Breakfasts expect to financially recover to 2019 levels, but only in 2022.

2. Over 93% of Hoteliers expect Domestic Business Travel to Exceed Pre-Pandemic Levels in 2022

Although travel is growing and, in some cases exceeding pre-pandemic levels, this recovery has largely been driven by the leisure market. However, our October 2021 Hotelier PULSE survey results show increased optimism on how soon business travel will recover.

Over 93% of Hoteliers surveyed in October 2021 expect domestic business travel to reach pre-pandemic levels in 2022 (vs 46.7% in September 2021). Nearly 47% expect the same for international business travel (vs 32,3% in September 2021).

However, the majority of Hoteliers surveyed expect domestic (73,33%) and leisure (70%) travel to yield the most significant contribution to the industry’s recovery.

3. Resorts register the Highest Levels of Business Optimism for the next 12 Months

The industry’s outlook on business performance is growing increasingly optimistic, ranking 7,24 out of 10, according to Hoteliers surveyed in October 2021. Resorts show the most optimistic outlook for business performance over the next 12 months, at 8,67 out of 10, followed by City Center Hotels (6,17 out of 10), and Bed & Breakfasts (6,8 out of 10).

What is the Business Outlook in November 2021?

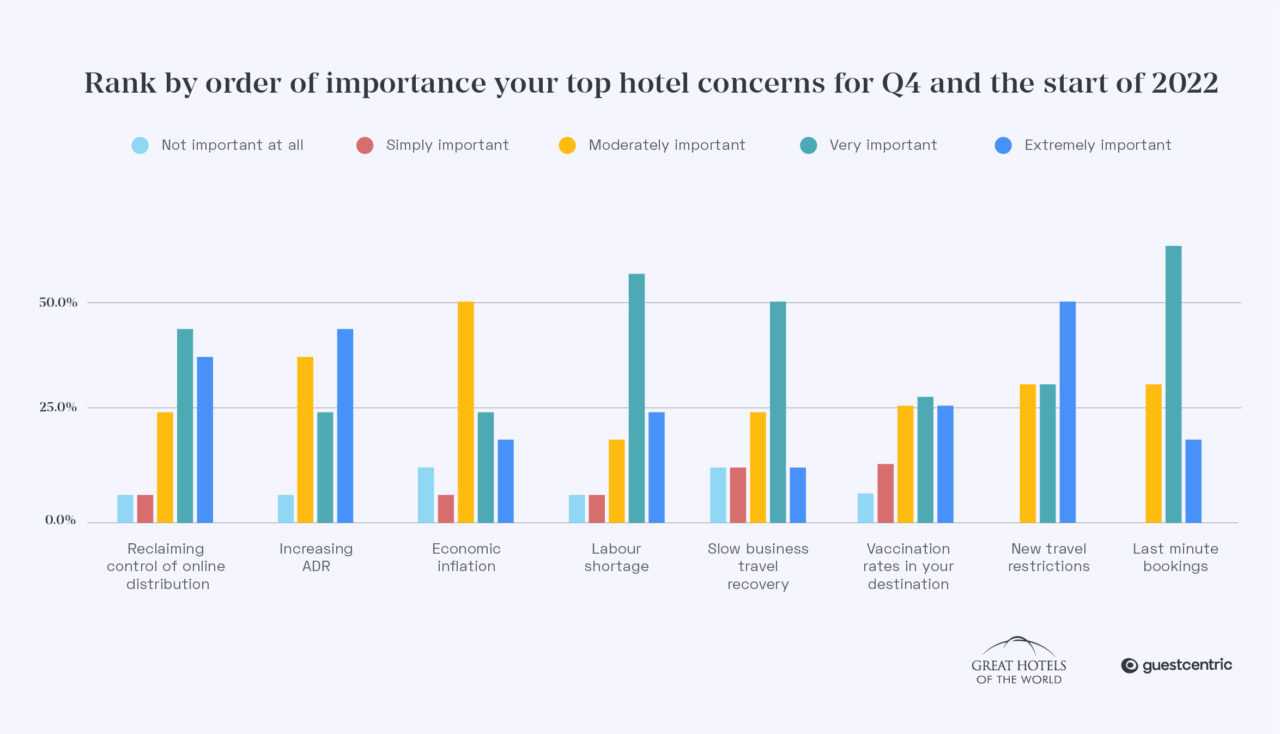

Although our November 2021 survey is still ongoing, we can already gauge Hoteliers’ top concerns for the winter months. In our ‘Question of the Month’ section, we ask Hoteliers to rank, by order of importance, the top industry concerns for Q4.

Over the first two weeks of November 2021, our survey results show that Hoteliers worldwide are most concerned about New Restrictions, Last-Minute Bookings, Labour Shortages, and Reclaiming Control of Online Distribution. Over 72% of Hoteliers surveyed thus far rank these concerns as very or extremely important in Q4 of 2021.

These findings emerge as destinations such as Germany, the UK, the Netherlands, Belgium, and France have brought back some restrictions, or are considering doing so, to combat rising cases this winter. This, despite the fact that they, and most other European destinations, boast vaccination rates above 65%.

What should Hoteliers do Next?

As the tide of travel shows early signs of shifting again this winter, our ongoing research continues to highlight the need for hotels all over the world to be agile. By now, Hoteliers will have had enough practice in adapting to ever-changing market conditions and will likely have tried and tested strategies, ready to roll out

Secondly, with new restrictions potentially disrupting travel behavior this winter season, consumers will continue to value information that efficiently guides their purchasing decisions. Hotels – and indeed all players in the tourism industry – should also focus on providing timely and detailed information to guide and inform their guests.

Lastly, flexibility will continue to be crucial in response to last-minute hotel bookings. Hoteliers will no doubt maintain flexible canceling policies introduced for guests at the start of the crisis in 2020.

We are thus still operating in an uncertain world – a great deal can change, quickly and at any time. The continued need for agility, speed in adapting, and efficient reacting, underscores the importance of hoteliers continuing to stay informed and up to date; collaborating in sharing information, and thus ensuring an effective capture of demand in the upturn.