Many markets in the U.S. have experienced substantial increases in inventory, with some recording year-over-year supply increases of 5.0% or more. Thus far, occupancy levels have generally remained strong, as most markets have seen demand growth keep pace with supply. The same cannot be said for average rates. The first signs of market saturation are often found in the average rate trends. Why? The short answer to this question is yield management.

Yield management is the practice of adjusting the price and availability of inventory in response to changing market conditions, including consumer preferences and demand patterns, as well as macro and micro economic trends. Yield management falls under the broader rubric of revenue management, the goal of which is to maximize revenues. Originally brought into widespread use by the airline industry, yield management has become a key strategy in the hotel industry, and most hotels either employ a revenue manager or subscribe to the revenue management services offered by their management or franchise company. For full-service hotels, a well-executed yield-management strategy includes consideration of all sources of revenues at the property (e.g., food, beverage, and meeting room revenue), not just room revenue.

Effective yield management is an ongoing process that begins with setting prices a year (or more, particularly in the case of group demand) in advance. Based on a review of historical demand patterns and current trends, the revenue manager forecasts the levels of demand for a particular night or period. The available inventory is then allocated between different segments and price points, with the goal of achieving the maximum overall average rate (ADR) for that period, at the desired occupancy level. The initial prices and allocations are revisited regularly, as rooms are booked, and changes are made in response to the volume and pace of the bookings. This process continues until the date in question, or the hotel is sold out.

In hotel terms, yield management is most commonly described in the context of strong market conditions and is one of the primary methods used to achieve year over year ADR growth. Price increases are obviously also a factor, but these are often facilitated by effective yield management. When a hotel’s yield-management strategy has resulted in a high proportion of the room inventory being sold at retail (as opposed to discounted) rates, the groundwork is laid for price increases.

Inherent in most discussions of yield management is the premise that it is an offensive strategy. This is not incorrect, in that yield management is a strategy that enables hotels to take control of their business. However, yield-management tools are not only applied in rising market conditions, and in fact are even more critical in markets that are under competitive pressure. In these circumstances, yield management becomes a defensive tool. The goal of maximizing revenues remains the same, but in the context of a stressed market, the strategy takes on a more protective posture: how to sustain occupancy without sacrificing ADR.

How Yield Management Influences Average Rate

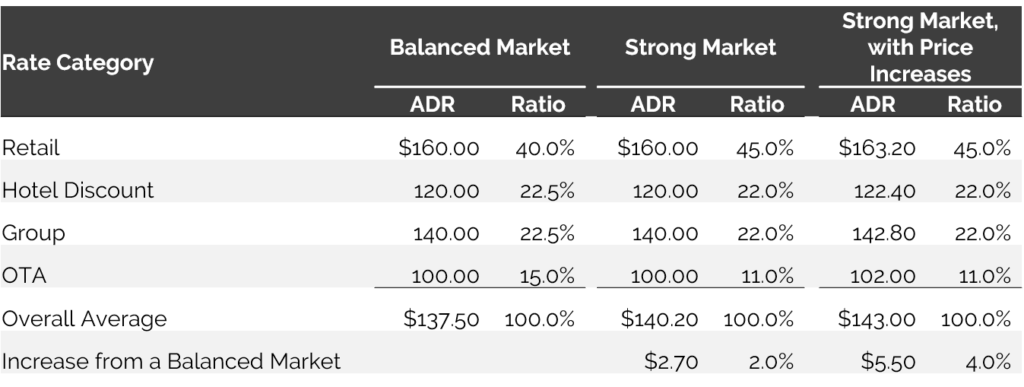

To illustrate how yield management can influence a property’s overall ADR in both strong and stressed market conditions, we have developed an (admittedly simplistic) illustration, which is detailed below. As the goal of this example is to illustrate the shifts in ADR that can result from yield-management techniques, we have assumed that the occupancy remains the same in all scenarios. In reality, occupancy is as much a consideration as ADR, and an effective yield-management strategy considers both factors.

For the purposes of this example, we have simplified the numerous market segments into four primary categories. The retail category comprises the highest tier of rates in the transient segment, including BAR (best available rate, previously referred to as rack rate), Corporate, and Consortia. The hotel discount category includes packages, AAA rates, and other hotel- or brand-sponsored transient rate categories. These rates reflect a discount from retail levels but are typically not as discounted as online travel agency (OTA) rates, which represent the third transient category and comprise demand generated by the online travel agencies such as Expedia and Hotels.com. In this example, all group demand (meetings, conventions, tour groups, etc.) are included in the group segment; realistically, the various group subsegments are characterized by disparate rates and demand patterns and are usually considered individually.

The first column illustrates the ADRs and ratios of demand for each segment in a “balanced market.” A balanced market is defined as one where supply and demand are generally at equilibrium, and revenue managers are responding to consumer and economic forces without undue competitive pressure. In this scenario, this sample hotel derives 40% of its demand from the retail segment and 15% from the OTA segment, which is used to fill the slower periods of the week and year. The remaining 45% of demand is split between the group and hotel-discount segments.