NB: This is an article from PWC and is part of their Consumer Intelligence Series

PwC’s Consumer Intelligence Series interviewed 1,026 business and leisure travelers to understand how their preferences are influencing investment priorities for the world’s leading hotel loyalty programs. We analyzed their responses to gain deeper insights into four questions that focus on customer loyalty within the lodging industry:

1. Are the loyalty behaviors of the rising millennial traveler unique to this age group or indicative of a larger macro trend among travelers?

2. How does loyalty program currency value drive loyalty, engagement, and ultimately value for brands and owners?—Especially in an increasingly competitive and consolidated hotel market.

3. What do travelers find to be the most compelling aspect of hotel loyalty programs and what can hotel brands do to drive engagement? And if faced with a tradeoff between hard and soft benefits, where should hotel loyalty programs focus?

4. How can traditional hotel loyalty programs compete with the increased presence of sharing economy travel options?

Key implications

1. Millennials are not unique in their attitudes and behaviors toward loyalty programs. In fact, they are quite similar to travelers aged 30+. Rather than targeting millennials per se, brands are well advised to look at all age groups as they shape and implement loyalty programs—since their attitudes and behavior are more similar than they are different.

2. As loyalty programs continue to mature, hotel companies will need to decide how to prioritize investments that drive brand engagement across all consumer segments, while simultaneously targeting the most profitable demographic. Ultimately, brands that drive the greatest engagement will likely accrue the highest revenue gains.

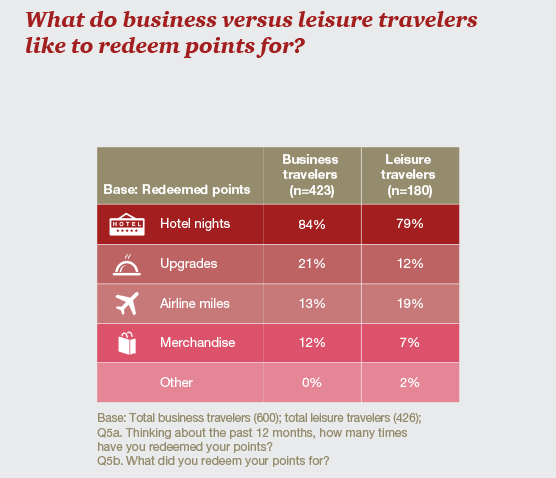

3. After room quality, business and leisure travelers have different criteria for preferences and loyalty programs. Room price is less relevant to business travelers since they’re usually not paying; loyalty programs are important because they mean free nights down the road. Leisure travelers meanwhile, are more price-sensitive. Brands are well advised to tailor benefits and loyalty programs accordingly.

4. While the sharing economy has garnered a lot of attention, most travelers—other than adventureseeking young millennials—are wary of the unknown quality the sharing economy represents. Rather, they want the reassurance that a brand name provides the guarantee of safety, security, and quality. An opportunity may exist for hospitality companies to align with sharing-economy partners; however, many questions around the execution of that model exist.