When travel will recover is no longer a question of consumer demand, but when restrictions will be lifted.

NB: This is an article from Guestcentric

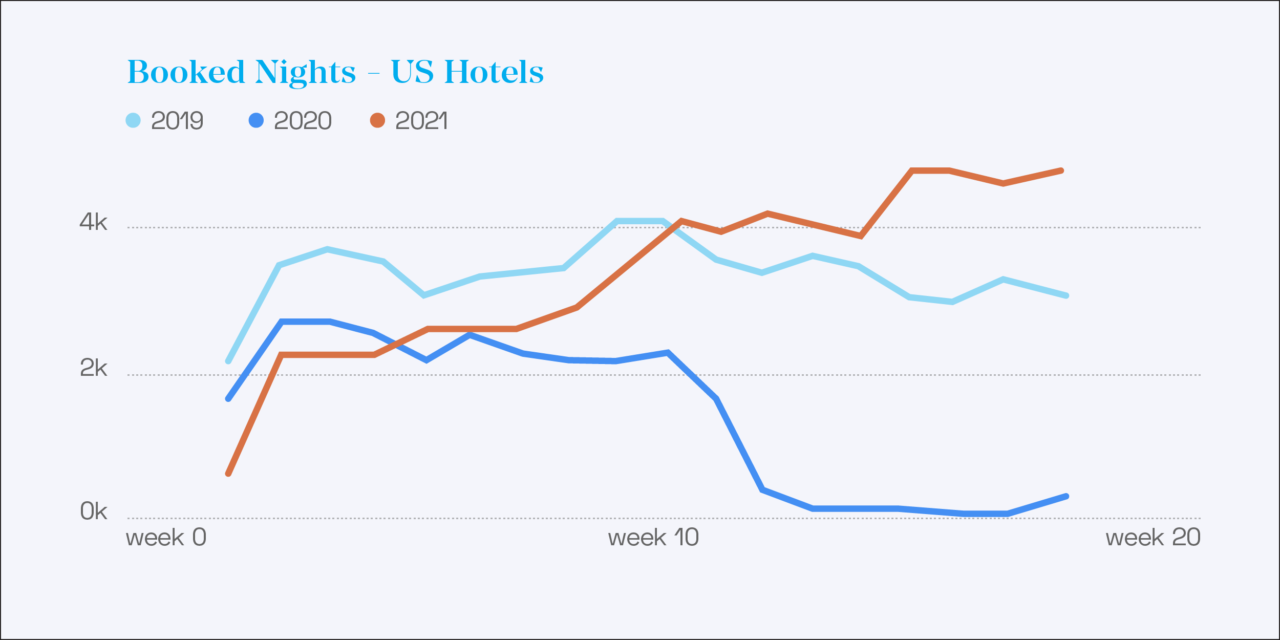

In the US, vaccination is progressing at a swift pace, with most states fully reopened for business and hotel bookings exceeding 2019 values. In Europe however, tourism is still anxiously awaiting when local governments will end travel bans and fully reopen destinations.

As uncertainty prevails, it is vital for all sectors within tourism to share information and collaborate on the road to recovery. In this article, we catch up with Aviation and Tourism expert, Gavin Eccles to explore the current status of consumer demand and the driving factors. He also shares how all tourism sectors from hotels to airlines should collaborate for a more agile response to changing restrictions and a stronger recovery in the upturn.

Subscribe to our weekly newsletter and stay up to date

When Travel will Resume – No Longer a Question of Consumer Demand

In February 2021, swift vaccination and partial reopenings in the US and UK triggered a boom in travel confidence, reflected in both flight and hotel bookings. According to Guestcentric’s hotel CRS data, published in the March 2021 edition of The Hotelier PULSE Report, US bookings in February 2021 rose to 95% of those over the same period in 2019. Meanwhile, UK hotel bookings rose to 76% of those over the same period in 2019.

In April 2021, the US appears to be all but fully reopened. Vaccination is progressing at a steady pace, and public gatherings such as Spring break have returned with a vengeance. Guestcentric’s market trends analysis also shows that between March and April 2021, hotel bookings in the US reached and exceeded 2019 levels.

However, ongoing vaccination hurdles and restrictions in Europe and the UK mean that bookings are still lagging significantly below 2019 levels. Only now in April are hotel bookings beginning to overtake those over the same period in 2020. However, bookings hit rock-bottom over this period last year, therefore the industry in Europe is still recovering slowly.

And yet, market signals also indicate that consumers are eager to travel again, yet reluctant to book trips due to rapid changes and restrictions. In March 2021, The International Air Transport Association (IATA) announced results from its latest poll of recent travelers, revealing growing confidence in a return to air travel, frustration with current travel restrictions, and acceptance of a travel app to manage health credentials for travel.

According to the survey responses, 57% expect to travel within a few months of “COVID-19 containment” (up from 49% in September 2020). This is supported by vaccine rollout, which indicates that 81% of people will be more likely to travel once vaccinated. However, 84% of travelers will not travel if it involves quarantine at the destination.

What is Influencing Consumer Confidence to Travel?

Although travel confidence spiked following the UK’s roadmap to reopen the economy, announced in February 2021, travel confidence soared, it has since declined.

Highlighting the key factors influencing consumer confidence during this time, Gavin Eccles, Consultant & Professor of Aviation & Tourism said, “Although demand was booming, the wave of optimism was soon followed by a number of negative signals that significantly impacted consumer confidence. From UK Government alterations to the roadmap, sensationalist media coverage, and the recall of the AstraZeneca vaccine across various destinations in Europe.”

“Even the BBC had to rephrase a headline which boldly announced “No Travel this Summer!”, because the government had never agreed this would be the case. But despite the correction, some damage had been done. This doesn’t mean consumers don’t want to travel. Rather, they are understandably skeptical about booking trips abroad with so much uncertainty,” He continued.

Despite wavering restrictions and fluctuating consumer confidence, overall hotel bookings net of cancelations in March 2021 more than doubled bookings over the same period in 2020, according to the market data published in the 13th Edition of The Hotelier PULSE Report.

Hoteliers surveyed in March 2021 also seem increasingly confident in significant pent-up consumer demand once local governments lift the travel bans. Previously dominant issues such as health & safety concerns, tighter consumer budgets, and flight capacity are no longer expected to be a barrier to travel when borders reopen.

How can Tourism Capture Pent-Up Demand?

With pent-up demand on the horizon, it is essential for all facets of tourism, from hotels to tour operators and commercial airlines to keep an open line of communication and coordinate efforts. Businesses will also have to uphold competitiveness in order to capitalize on the demand. “How hotels or airlines capture the returning demand will depend on what businesses do to remain competitive, as well as the level communication and coordination across the wider tourism industry,” says Gavin.

Below are two key factors the tourism industry will need for a stronger recovery in the upturn: