Hotel revenue management is on the verge of something of a second renaissance; the field is propelling itself toward the notion of Total Hotel Revenue Management.

NB: This is an article by Pierre Boettner, Founder & CEO of hospitalityPulse

It is one that revenue managers have foreseen—in fact, requested—for many years now, and the idea is that revenue management should move beyond room pricing and channel strategies, beyond Pace reports and market segment reviews, and move to identify profitability gaps and opportunities across the entire operation.

In the introduction to a 2017 Cornell Hospitality Research Brief on the topic, the authors say, “While academics have suggested for some time that RM should be applied to non-room revenue sources, the industry is now moving toward extending the scope of RM practice beyond the rooms division” (Cornell). In fact, the idea is to move beyond revenue altogether toward a focus, instead, on profitability. To replace RevPAR with GOPPAR, the Gross Operating Profit Per Available Room. To look at the lifetime value of a customer, and so forth.

While the trajectory makes sense, in theory, let’s step back for a minute and look at where we are. First, the revenue management department still doesn’t know where it lives. Frequently we talk about it as if it were in the rooms division, but a survey of 400 revenue managers found something quite the opposite. The survey, a separate 2017 report out of Cornell, found that almost half (47.6%) indicated revenue management was part of sales and marketing, 28.3% said it was a separate department, and just 8.1% said it was in the rooms department (Cornell).

There is a problem with this, and it is more than just an industry-wide lack of understanding about where revenue management belongs in the big scheme of hotel operation. The problem is that when we place revenue management in sales and marketing or reservations, for that matter, it stays on the front end of the process, looking at demand forecasts, identifying problems, and setting rates. Then what?

Here’s an example of “then what” that happens more frequently than you’d imagine. Let’s say you have a revenue manager (who is paid somewhere in the $70K range, conservatively). They have invested a great deal of time in establishing rates for a Saturday night and ensuring that the right channel mix is involved to control guest acquisition costs. We all know some amount of OTAs will be in the mix for a long while now.

Scenario A: The Mumble & Groan Scenario

You have a Standard King. It is $180/night. It gets booked on an OTA with a 25% commission. Worst case scenario, right?

In this situation your net revenue is

$180 x .25 = $135

Grumble, grumble, but you put a head in the bed.

Scenario B: The Situation That No One Noticed

Let’s say you have the same Standard King. It is $180/night. The guest books directly via PPC campaign at a cost of $1.50. Net revenue = $178.50. Terrific.

The guest arrives to check in. The front desk has had a hiccup. There are no Standard Kings available because when housekeeping was behind, they gave the last Standard King to someone an hour earlier who had reserved a Double. (Worth noting that they, in fact, wanted a Double, but are willing to shift. So less than 100% happy guest). It’s 3:00 p.m. and this couple that booked your most profitable channel is checking in ready for their King. They won’t settle for a Double, and they’re mad. All that’s available now is a Suite. The Suite costs $250, but the front desk gives it to them for the $180 that was agreed upon after they complain about the Double. (So they didn’t get what they initially wanted, but they get something better, and yet still there’s a been a problem, which isn’t great for customer service.) Around 4 p.m., a man calls to say he’s hoping to reserve a suite for the night (he and his wife just booked childcare and have a rare night out.) But no suite is available at this point, and they move on to the next hotel.

What have you lost?

You’ve now discounted a suite unwisely, and you have a Double room floating around that would have been filled. The loss on the suite is $70, and the loss on the Double room is $180.

So total loss is $250.

Let’s say that you booked the Double room, the King, and the Suite via OTA at the highest commission rate.

$180 x 25% = $45

$180 x 25% = $45

$250 x 25% = $62.50

Total OTA Commissions: $152.50

The OTA costs associated with those three rooms are less than the loss on the suite, so it seems that, perhaps, OTA costs aren’t the only profit problem we have on the property, not to mention the reputation issues it can breed. And it was all due to housekeeping and a manual room assignment problem.

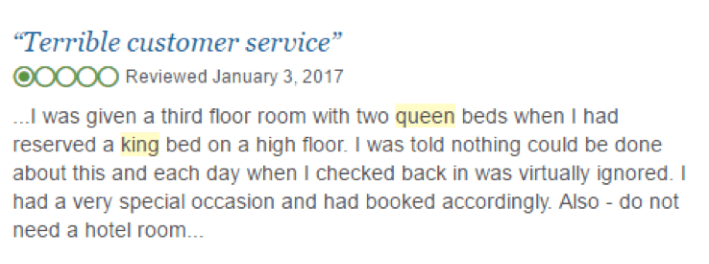

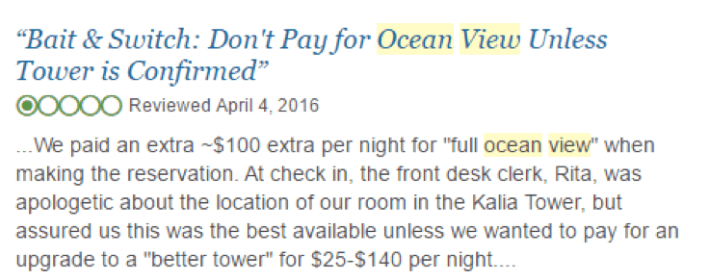

If you think this is a rare problem or that guests don’t mind, reconsider:

The bigger issue, if you can imagine there’s a bigger issue than receiving reviews like these, is that we have invested a substantial amount of money, time, and all-around energy on the topic of revenue management in the interest of optimizing profits. And what happens? The rate gets set, the distribution strategy put in place, sales and marketing gets on board. It’s all going just fine, and then the guest arrives to check in and all of that analysis and technology investment goes out the door.

And the truth is that no one realizes it, because up until the release of insights by hospitalityPulse (a free analysis tool), there’s been no way to see how this happens in the granular way it requires. This has a direct and immediate impact on revenue management, and yet, revenue managers aren’t able to see how their rates get executed when it comes down to getting the “right person in the right room at the right price.” Until we do look closely at the execution of revenue management (i.e., how we get guests into the right rooms) revenue management is all a theory that can easily fall apart at the last step. This isn’t all that surprising considering that the majority of the time revenue managers are in the sales and marketing department.

The first step in making revenue management more effective on the property level is to determine what level of accuracy the front desk has with room reservations. To deep dive into what every day looks like until it’s clear how frequently situations like the above are happening and what the true cost of those problems is, including quantifying the resulting guest dissatisfaction and the impact to loyalty.

The current situation for hotel operators and revenue managers alike is a bit like investing heavily in reading a sometimes painful, sometimes delightful Charles Dickens novel only to discover the final ten pages are missing and to walk away, leaving the story unfinished. There are many solutions needed in order to move revenue management into a more central role and to establish GOPPAR as the new standard measurement of success—all of them are worthy efforts. However, until we address the issue of what happens when we execute on the reservations once the guests arrive, we will continue to be in the same situation.