Hotels may receive few to dozens of group requests daily from various partners, however with limited capacity and a need to optimize total revenue, hotels must carefully decide which groups they should make an offer for and which they should decline.

NB: This is an article by Marin Knez, Senior Revenue Manager at berner+becker

So, what factors should a hotel consider when analyzing a group request? Before analyzing the request, it is important that the reservation agent and/or sales manager obtains as much information as possible for the request:

- What is the purpose of visit and the dates in question for the group? Is it a trade fair group? Sporting event? Leisure or business group? Could the date give any indication, and would they be willing to pay high rates with strict cancellation policies?

- What is the budget of the group (In order to get an expectation, even though this figure may be deflated)?

- Company/agency information and historical patterns with the hotel if applicable, such as conversion, cancellation, payment history etc.

- What is the estimated total revenue contribution of the group?

Once we have gathered as much information as we can, from a revenue perspective, I have outlined 3 important steps below that I follow when making group quotations. Naturally, the long-term goal should always be to optimize total revenue.

Market knowledge and historical trends

This is probably one of the most important factors. It is imperative that a hotel is aware of what is going on in the market in order to anticipate the level of demand and set the correct pricing strategy. Is there a large exhibition taking place in your market or a popular sporting event which is expected to attract a lot of visitors? Has the fair or event occurred in the past? Or, is your hotel located in the city center in a high demand leisure destination? Which days of the week or periods are most often requested based on historic patterns? In order to match expectations and forecast with an optimal offer, we need to have:

- Demand for the past and future periods for your market, as well as neighboring markets in case there is an impact. For e.g. the synergy between Cologne and Dusseldorf when there are large events in either city, there is overflow from one to the other

- Benchmarking data to compare our performance to that of our competitors and the market over the period in question

- Statistics should be collected not only for rooms but also Meetings and events (M&E) and food and beverage (F&B) if applicable in order to optimize total revenue

- Accurate and reliable group statistics from the Property Management System (PMS) in order to analyze company/agency historic trends, conversion, room wash factor, and other relevant data

Without this information, a hotel is very likely going to miss out on a revenue opportunity by offering too low rates and thus not achieving their potential. Or, offering far too high rates and missing out on important conversion, thus leaving “money on the table.” Likewise, without considering M&E and F&B revenue, if applicable, a hotel might miss out on revenue by selling their rooms to transient guests or groups without meeting space. As the rooms are then already sold, the hotel loses out on any additional group requests who are potentially looking to book meeting space and dinner, resulting in money left on the table.

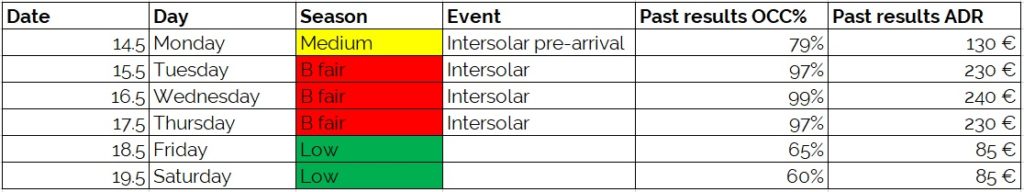

See below an example of a demand calendar a hotel has established for an upcoming event:

- The hotel has clearly defined the days that the Intersolar fair is occurring, considering the pre-arrival date too as a substantial number of exhibitors / attendees may arrive earlier to prepare for the event

- They have specified the seasonality per day for the week of the fair, clearly displaying that Tue-Thu inclusive are extremely high demand, classified as “B fair” which refers to a certain RevPAR range the hotel can reach.

- The hotel knows that the B fair dates must be protected; therefore ideally they would offer groups staying at least 3 nights, Tue through to Thu. Likewise, they also know it could be risky to offer groups Mon-Wed or Wed-Fri as this would leave 1 of the strong fair dates vulnerable to low occupancy

- The shoulder nights are not expected to be strong therefore the hotel may price aggressively on those dates to convert groups

Now that we have covered the base, let’s move on to the next step:

Forecasting and competition

Secondly, what is your current on the book situation and what are you forecasting per segment for the period in order to achieve total revenue optimization? What are the expectations for M&E and/or F&B sales if applicable? Is there enough demand for meeting space and additional restaurant sales without rooms?

Are there shoulder dates that are weaker that perhaps need a stronger discount in order to sell due to aggressive market prices? In order to set clear expectations, we need to:

- Define the segmentation and meeting room sales that we are targeting/forecasting for the period, including any additional revenue we may expect.

- Identify the strong and weak shoulder days for the period to avoid selling out the high demand days too soon and focus on converting business on shoulder days

- Ensure a healthy balance between group and transient business to minimize the risk of cancellation and not being able to re-sell group rooms, and at the same time drive high rated ADR with transient business

- Monitor competitor pricing both online and for groups by using rate shopping applications, as well as calling to request information

It is important to forecast expectations and growth rates, particularly when dealing with trade fairs, as planning is the key to successful total revenue optimization. As a rule of thumb, you do not want to sell out a trade fair far in advance as this usually results in lost revenue.

Frequently hotels are finding themselves in these situations where a significant portion of their inventory is already booked for groups for a fair coming up in 2 years, while their competitors are still available and are selling rooms at far more than the value of the group.

Let’s move on to the third step:

Total Revenue Contribution and Displacement

Finally, total revenue displacement is an important factor to consider when making a group quotation. Is the group commissionable and are they only requesting the peak nights of a trade fair? Or does the group stay several nights that contribute to your weaker shoulder dates, despite having a lower budget? Will the group’s total revenue contribution be higher than selling out your peak nights to transients at very high rates? In order to accurately assess this, it is imperative to:

- Measure total revenue contribution, what else is the group booking besides rooms that will bring the hotel additional revenue?

- Consider the cost of sale (commission, etc.)

- Could you sell this period to higher priced transients with minimum length of stay restrictions and gain more total revenue? Or, would it be better to wait for another group request that may have a higher budget and total overall revenue contribution?

- Consider different profit margins on different revenue streams in a hotel to optimize total revenue (largest profit comes from room sales, industry average of approx. 70% profit margin)

By considering costs and displacement as well as total revenue contribution, hotels may achieve a better result than originally budgeted or forecasted for the period.

It is quite common for hotels to be largely focused on basic benchmarking metrics which look at room sales KPI’s such as occupancy, average rate and RevPAR without considering the total revenue impact and net profit. This often results in revenue optimization actions not being considered for all revenue centers of a hotel, thereby leaving money on the table. Depending on a hotel’s size, location, facilities, below are examples of several different revenue centers within a hotel and an example of how revenue optimization could take place:

- Room sale optimization (adjusting prices)

- M&E sale optimization (modifying meeting package offers to create 4 price points with different inclusions)

- F&B sale optimization (drive restaurant sales through room packages and/or adjusting menu content/prices)

- Parking revenue optimization (introduce special parking rates for low season days, for example weekends)

- Rental revenue optimization (in-house marketing to sell hotel services in guest rooms etc.)

When total revenue optimization is considered, the opportunity and potential for revenue growth is higher while minimizing the amount of money left on the table.

Conclusion

Group quotations can be extremely time consuming and difficult if a clear structure is not in place. By following the guidelines, I have outlined in this article, I have found the decision-making process to be more time efficient, and at the same time a valuable educational experience as you learn more about the different revenue and cost streams of a hotel. So, make sure to follow:

- Market knowledge and historic trends

- Forecast and competition

- Displacement and total revenue contribution

At the end of the day, remember, the best satisfaction comes from achieving results and positively impacting bottom line profit.

Read more articles on berner+becker’s newsroom page and follow berner+becker on LinkedIn