Imagine for a minute you are a hotel investor seeking after promising opportunities into developing destinations that you consider they have untapped potential.

NB: This is an article from HVS

Looking back at the period 2012-19, Greek tourism was breaking one record after another. Following a nadir of 21 million that was caused to a great extent by the rumors about Greece’s potential economic default and the consequent negative publicity accompanied by political instability back in 2012, foreign tourist arrivals have been constantly growing since then at a Compound Annual Growth Rate of 8.4% to reach 37 million in 2019. Not even the second period of political instability that the country experienced in the first semester of 2015, ending up to a referendum for exiting the Eurozone and the imposition of capital controls, was able to interrupt the positive momentum of the Greek tourism industry.

Hotel transaction activity was vivid (some €500 million in recorded transactions in 2018, slightly more in 2019) with new local players coming into the market and international funds finally finding their way to a marketplace that until then had high barriers to entry due to ownership structure (most Greek hotels are owned and operated by family businesses), combined with an “old-school” business mentality. Including greenfield developments of every kind and size that were recently materialized, or were about to be delivered, one could get the positive outlook of Greek tourism for 2020. In December 2019, perhaps you would consider yourself as belated or even regretful for not having entered this market earlier.

Now imagine, at the very same time in December 2019, you come across a prophet warning you about a future where Greek airports would welcome almost no flights at all, all hotels in Greek cities would close down for a couple of months, while coastal resorts would have stopped receiving reservations since February not because of any major tour operator bankruptcy (although numerous Greek resorts still have the scars to prove the collapse of Thomas Cook in late fall 2019) but simply because the entire world would have been quarantined. What would you believe? How would you react? Would you consider the message or rather kill the messenger?

Scenario planning, as the word implies, focuses on an outlook for the future with which organizations can form an idea of possible future trends and how these may affect their strategic objectives. Event-driven scenarios are among the most common form of scenario planning that organizations undertake and tend to pertain to the impact of an event within a short-term context. The intent of this approach tends to be about how fore- and longsighted an organization might be against such an event, but also how well-prepared they are to react in case a scenario materializes indeed. The critical pitfall with this practice lays in the fact that it fails to capture the full range of future uncertainty because they are usually selected to illuminate one familiar problem within the organization’s “comfort zone”; thus, leaving aside extraordinary or unimagined events. Would you feel skeptical against the aforementioned prophecy or against the prophet himself? It is hard to believe that companies included a scenario of the simultaneous lockdown of countries due to a pandemic in their planning procedure, no matter how sophisticated they were before the COVID-19 outbreak.

Market Simulation

To evaluate the potential impact of the current downturn on hotel values, HVS issued an extremely insightful article last week that has modeled three valuation scenarios based on a hypothetical typical hotel. We wanted to take some steps back and examine how a typical investor would project occupancy levels assuming that he would correspond to the prophet in a serious manner. In order to assess the impact of COVID-19 on hotel occupancy in hotels in Athens and Thessaloniki for 2020, we have developed a market simulation reflecting the range of potential recovery of the hotel sector. The model considers a base-case scenario and two alternate scenarios, which reflect the range of potential impact. Keeping in mind that the operational context of event-driven scenarios is typically near-term, we have tried to make a forecast on occupancy levels only up to year-end 2020.

The dataset includes monthly supply and demand levels for a sample of hotels of various classes in Athens and Thessaloniki, as published by the hotel associations of each city in collaboration with the local partner of STR Global (GBR Consulting). The sample encompasses some 7,300 rooms in Athens and circa 3,700 rooms in Thessaloniki, covering all hotel categories. To conclude on the expected monthly recovery level for each scenario, specific reductions have been applied to the base reference period, which is January to December 2019. Especially for the period January to March 2020 actual data have already been published; therefore, the scenario planning considers the period from April to December 2020.

Then, we proceeded by trying to quantify the share of domestic and international travelers in these specific markets by using the latest data published by the Hellenic Statistical Authority which refers to 2018. We have assumed that domestic and international visitation for 2019 would have been similar to that of 2018. For the region of Athens, data is provided on a monthly basis, while for Thessaloniki, data is published only on an annual basis. Therefore, especially for Thessaloniki, we have applied a steady share of international and domestic visitors each month. This separation provides us with the ability to assume diverse behavior for each market segment (i.e. domestic vs. international). Since all ongoing surveys about tourism forecasts, that we are aware of, show the domestic demand is the one that somehow recovers first (or at least with a faster pace), it has been assumed that in 2020 the hotel sector for both Athens and Thessaloniki will be fuelled mainly by domestic clients. As such we have made different assumptions with regards to the evolution of domestic and international demand in order to reflect the relatively-heavy resilience of the former and the uncertainty prevailing the latter. Especially for inbound tourism, the segment’s recovery is highly correlated with that of the airline industry and tourism in Athens seems more dependent on international travelers than Thessaloniki, which is more conveniently accessed by car from the neighboring Balkan countries.

Additional assumptions made for each scenario are summarized as follows:

Base Case Scenario

This scenario reflects the anticipated recovery of occupancy based on a rather conservative but overall steady approach. While the termination of the lockdown of the hotel market on a national level is still uncertain, we have assumed that the lodging industry will reopen on June 10th and will follow a steady recovery pattern differentiated for international and domestic clientele.

Athens

Based on the latest data published by the Hellenic Statistical Authority, the share between international and domestic visitation for the city of Athens in 2018 was 69% and 31%, respectively, indicating its high dependency on international clientele. For the specific scenario, it is assumed that international travelers will be reduced by 70% in June, as compared to the same period last year, while this declining trend will gradually improve in the following months reaching 30% in December. Domestic visitation is expected to recover faster. More specifically, a decline of 50% is projected in June (in comparison to June 2019) and this decline will progressively shrink to 10% in December. The overall downturn in international and domestic clientele by the end of the year, in comparison to 2019, is projected to reach a total of 46% and 26%, respectively.

Thessaloniki

Thessaloniki is captured room nights are equally driven by domestic and international tourism as reflected by the latest data published by the Hellenic Statistical Authority for 2018. Therefore, the city’s visitation is less prone to any socioeconomic changes that might take place on an international level. However, given that data for Thessaloniki is published on an annual basis, we were not able to make the monthly separation between domestic and international clientele and have consequently applied a steady share of international and domestic visitors for each month. Moreover, since the city is easily reachable by car from the neighboring Balkan countries, we have considered a somewhat lower decline, in terms of international visitation, as compared to the city of Athens. For the specific scenario, it is assumed that international travelers will be reduced by 65% in June, as compared to June 2019, while this decline will gradually diminish the following months reaching 25% in December. Domestic visitation is expected to keep the same recovery pace as Athens’. More specifically a decline of 50% is projected in June and this decline will progressively shrink to 10% in December. The overall downturn in international and domestic clientele by the end of the year, as compared to 2019, is projected to reach a total of 41% and 26%, respectively.

Positive Scenario

According to this scenario, one would anticipate monthly occupancy levels to experience a slower downturn for both segments. It is assumed that effective and more radical solutions towards confronting COVID-19 will arise on an international level and therefore the tourism and airline industries will bounce back faster. The hotel industry in Greece is expected to reopen on May 15th, approximately 55 days following the operational shutdown.

Athens

When compared with the same months in 2019, the international segment is assumed to shrink by 80% for the rest of May, 50% for June, 40% for July, 30% for August, and to gradually reach a 10% decline by the end of the year. Domestic visitation is assumed to recover faster. More specifically, a decline of 50% is projected for the rest of May and this decline will gradually shrink over the following months; from September onwards, it is assumed that domestic visitation will recover to pre-COVID-19 levels. The overall downturn in international and domestic clientele by the end of the year, in comparison with 2019, is projected to reach a total of 33% and 14%, respectively.

Thessaloniki

Similar to the previous analysis, the international segment is assumed to shrink by 75% for the rest of May, 45% for June, 35% for July, 25% for August, and to gradually reach a 5% decline by the end of the year. Domestic visitation is assumed to recover faster. More specifically, a decline of 50% is projected for the rest of May and this decline will gradually shrink over the following months; from September onwards, it is assumed that domestic visitation will recover to pre-COVID-19 levels. The overall downturn in international and domestic clientele by the end of the year, when compared to 2019, is projected to reach a total of 28% and 14%, respectively.

Negative Scenario

According to this scenario, one would assume that although hotels will reopen on June 10th, as in the base case scenario, an extreme decline of occupancy will take place in the following months as the world will still be experiencing the devastating impact of COVID-19 and its related effects on tourism. Even by the end of the year tourism is expected to have partially recovered.

Athens

It is assumed that international travelers will be reduced by 90% in June, and this decline will gradually be contracted to merely 50% in December, while domestic visitation will start with a 70% decline in June and will eventually be diminished to 30% in December. The overall downturn in international and domestic clientele by the end of the year, in comparison with 2019, is projected to reach a total of 65% and 45%, respectively.

Thessaloniki

International travelers are expected to be reduced by 85% in June and this decline will gradually be contracted to merely 45% in December, while domestic visitation will start with a 70% decline in June and will eventually be diminished to 30% in December. The overall downturn in international and domestic clientele by the end of the year, when compared to 2019, is projected to reach a total of 60% and 45%, respectively.

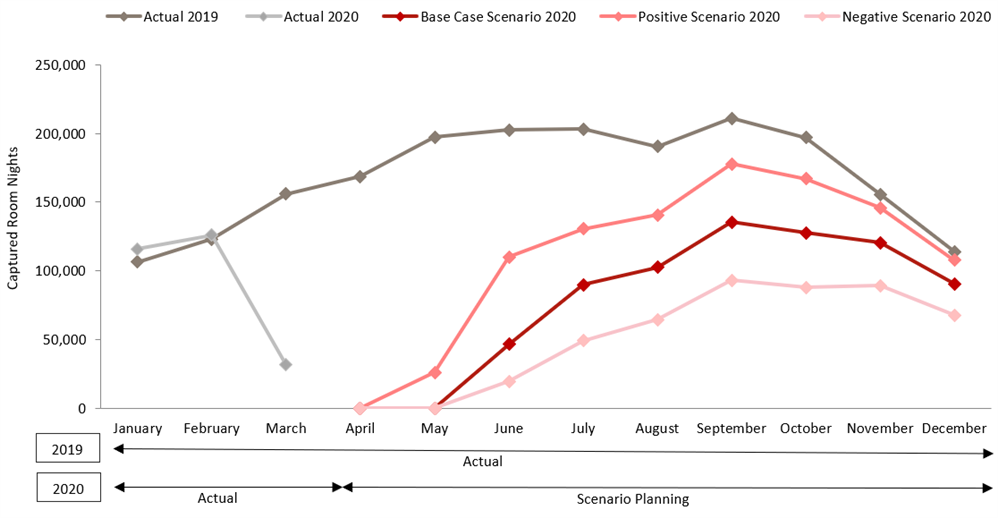

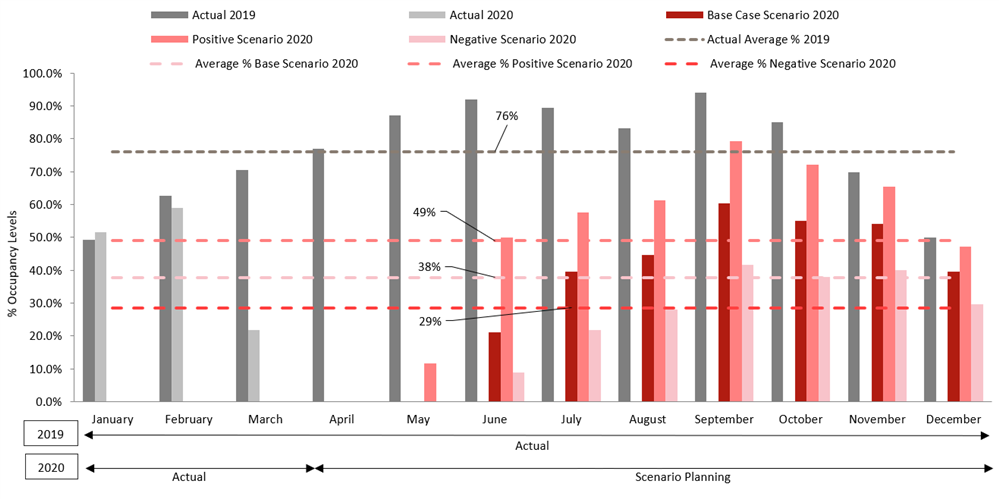

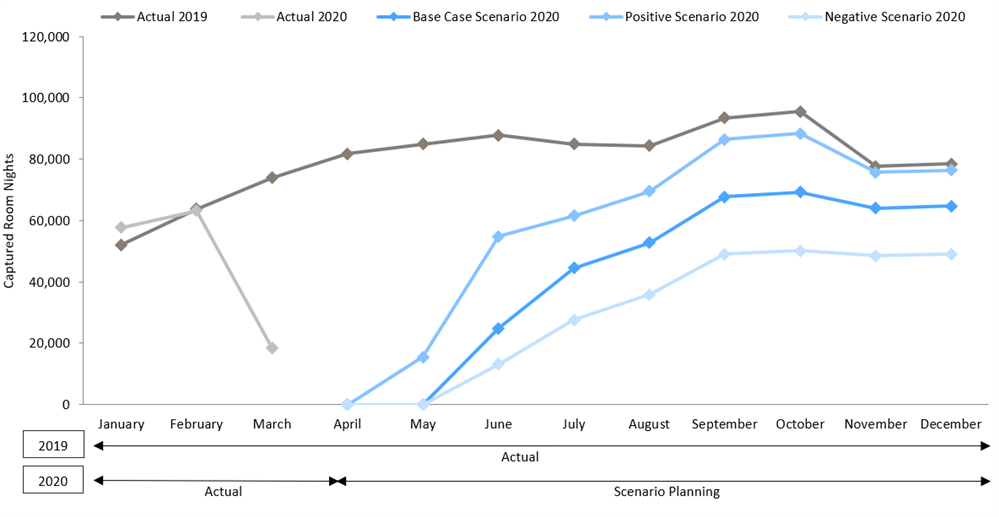

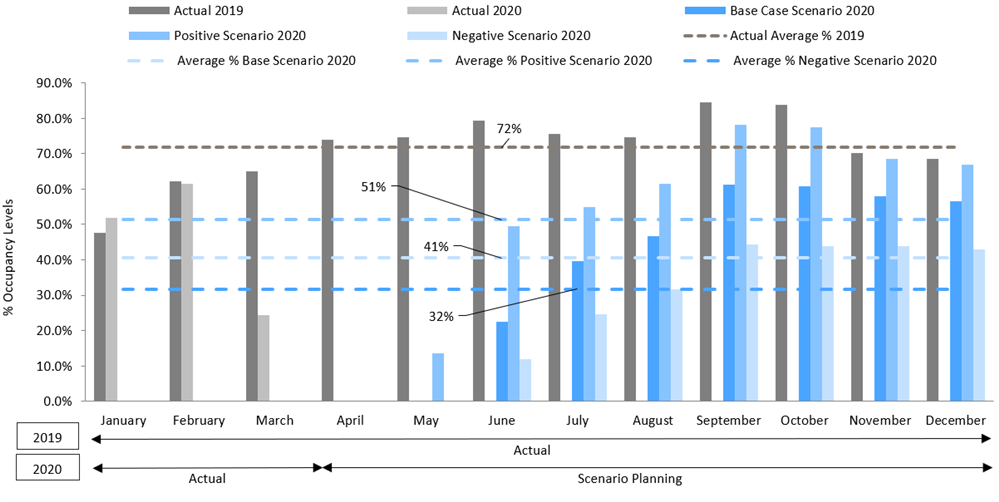

For each examined market, the monthly progression of both captured room nights and occupancy levels, for all three scenarios, is depicted on the following graphs:

Monthly Progression of Captured Room Nights-Athens

Monthly Progression of Hotel Occupancy-Athens

Monthly Progression of Captured Room Nights-Thessaloniki

Monthly Progression of Hotel Occupancy-Thessaloniki

Results

The devastating impact of COVID-19 is evident in each case with the Positive Scenario being the least affected by the outcome of this unforeseen event. As previously mentioned, the scenario planning analysis was made based on data published by the Hotel Association of Athens and Thessaloniki referring to 7,300 and 3,700 rooms respectively, covering all hotel categories. In 2019 these rooms generated some 2.0 million room nights with a total occupancy of 76% in Athens and 1.3 million roomnights with a total occupancy of 72% in Thessaloniki. In the case of Athens, these roomnights were mainly generated by international clientele (representing 61% of the total) with the main feeder markets being the United States of America, France, the United Kingdom, Italy, and Australia. The captured roomnights in Thessaloniki were equally fueled by international and domestic clientele with the main feeder markets being Israel, Cyprus, the United States of America, Germany, and Romania.

Prior to the outbreak of COVID-19 the hotel sector in Athens and Thessaloniki was experiencing moderate growth as indicated by the total number of captured roomnights for January and February 2020 which increased by 3% and 2%, respectively, as compared to the same period in 2019. In terms of occupancy levels, a slight drop of 1% was recorded during the first two months in Athens, partially attributed to the new room supply that entered the market (approximately 4% as compared to 2019) and the fact that COVID-19 had already impacted a number of tourism feeder countries causing a certain level of uncertainty. Thessaloniki’s occupancy levels recorded an increase of roundly 3% while supply levels shrunk by 1%.

March is the first month when the disastrous effect of COVID-19 was clearly depicted, hammering the performance of the hotels in both markets. More specifically, available room supply in both cities was reduced by circa 35%, due to the national lockdown that was imposed on March 22nd; marketwide occupancy levels though were suffering way before the suspension of hotel operations, leading March results to record a severe occupancy decline of 69% in Athens and 62% in Thessaloniki.

From April onwards the outcome is dependent on each of the chosen scenarios included in our market simulation. The positive scenario results in an occupancy decline of 36% in Athens and 28% in Thessaloniki as compared to 2019 while the worst-case scenario projects the most pessimistic results with a total occupancy shrinkage by 62% and 56% respectively.

Limitations

Our examined market was limited to the two largest Greek cities as the vast majority of resort hoteliers do not participate in data collection platforms (e.g. STR Global, HotStats, etc.) while official statistics are not updated in real-time (i.e. data for 2019 are unavailable even at a preliminary level) and they are inappropriate for in-depth analysis (e.g. we do not have monthly data for other cities or islands).The lack of comprehensive data related to the Greek tourism industry is a critical problem for professionals working in the field. Working to a great extent on actual facts rather than reasonable assumptions makes the outcome of every research less speculative and restrained, thus providing even more insights for enhanced decision-making process, not only during turbulent periods like the one we are currently living in but also within the scope of destination management. Two elaborate and well-structured studies (only in Greek) were also published in the last few days from the Institute of the Greek Tourism Confederation (INSETE) and the Hellenic Chamber of Hotels where one can find insightful analysis regarding the impact of the current pandemic on Greek tourism.

Lastly, we should highlight that both Athens and Thessaloniki were about to welcome numerous new hotel properties within the next 12 months. Our market simulation does not account for any future changes in supply as it is highly doubtful when, which, and how many of the proposed hotels will finally enter each of the examined markets.

Conclusion

So what would the investor at the introduction of our article do? Even assuming he could find a willing seller indeed in the marketplace, perhaps with “suicidal” tendency, it would be immensely struggling to define a market value for a hotel property, not only due to the difficulty in projecting income and expense but also due to the liquid valuation parameters. The Royal Institute of Chartered Surveyors reacted in time by providing a practice alert to its members and any potential buyer should be very well informed when it comes to the level of uncertainty accompanying hotel valuations during this period exactly because they are based on an extremely highly volatile future. Our hypothetical investor could base his decision after running various scenarios and choose the one that would be perceived as the “most likely” to happen or even assuming a longer than the prevailing 10-year holding period. In any case, it would be hard to predict sunshine when you are in the midst of the storm.