In the world of consumer marketing, customer lifetime value (CLV) is a metric that is used to determine how much is reasonable to spend to acquire a new customer, or the customer acquisition cost (CAC). But for top-performing consumer-facing companies in the world, CLV is the metric on which business decisions are made.

Here’s why hoteliers should consider the lifetime value of their guests when making decisions about how to spend their marketing budgets:

- Repeat guests represent a faster path to directly-booked revenue.

- It’s an easier path to revenue, as past guests already have a relationship with your brand.

- For both reasons above, it’s a more profitable path to revenue, since less money is spent on OTA/other acquisition costs.

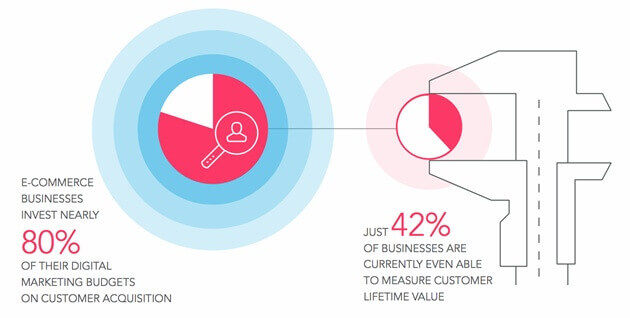

Unfortunately, even in a world where it costs five times more to acquire a new customer than it does to keep current customers, online retailers and other e-commerce businesses are continuing to invest nearly 80% of their digital marketing budgets on customer acquisition, and just 42% of businesses are currently even able to measure customer lifetime value, let alone accurately. Those two stats are more closely related than they seem at first glance.

By simply using some rough approximation of customer lifetime value to justify acquisition spend, consumer-facing companies are focusing on the wrong side of the equation. What they don’t realize is that investing in maximizing CLV is indeed the most profitable—and, increasingly, the fastest—path to revenue growth.

Consider, for example, that for each 1% of shoppers who return for a subsequent visit, overall revenue increases approximately 10%. That means if online retailers retained 10% more of their existing customers, they would double their revenue. Here’s another way of looking at it: Reducing your customer defection rate 5% can increase your profitability 25% to 125%.

Growing revenue by driving up customer lifetime value can also be viewed as the easiest way to do it. Though customer marketing is complex, technology is making it incredibly more manageable and effective. For example, the probability of selling to a current customer is 60-70%, on average, whereas the probability of selling to a new shopper is 5-20%… not to mention returning customers spend on average 67% more than first-time customers!