As hotels begin to re-open, it is crucial that they’re mindful of their Break Even Point (BEP) to understand their cost levels and to determine what RevPAR level is necessary to re-open.

NB: This is an article from Global Asset Solutions

COVID-19 presented many challenges for hotels who are currently striving to merely break-even instead of maximizing profit as usual. While hotels usually aim for 35% occupancy threshold, many are hoping that COVID-19 cost reductions will lower the break even threshold.

How can a hotel understand when it is the right time to resume operations? What occupancies and rates should they be aiming for? How has COVID-19 effected the BEP considerations? Through calculating a hotel’s BEP, Hotel Asset Managers are able to determine when is the optimal time for a hotel to reopen or if it may be better to remain closed until higher occupancy levels are attainable.

Analysing a hotel’s concrete cost structure is the most challenging aspect for hotel operators to calculate their BEP. As it is well-known, a hotel’s expenses have one component that is fixed and another that varies directly with occupancy or facility usage, which both need to be considered in the BEP calculation. Fixed costs will be more difficult to cover or decrease during a temporary closure, whereas variable costs will ultimately cease as operations do. However, because hotels were temporarily closed for the first time in history, operators and owners could clearly identify their fixed costs.

While the BEP is not a revolutionary cost analysis tool, it has become harder to calculate as historical data is no longer a reliable benchmark. COVID-19 will impact many of the current industry norms and these factors (discussed below) need to be considered in any future BEP calculation.

Below are the key areas to focus on when establishing your BEP. These should be monitored closely as COVID-19 may impact and change them.

Payroll

While fixed payroll (salaries found in A&G) will be more difficult to minimize, payroll that is operationally distributed such as rooms and F&B staff will be reduced alongside the limited operations. It is suggested that F&B staff requirements are based on daily calculations of each outlet’s profitability.

Little staff was needed during the temporary closure and operational staff can remain limited until higher occupancies return. Efforts should be made to re-integrate the minimal personnel level, operating on an as-needed basis, in order to minimize the use of available cash and use the government aid provided while fulfilling its conditions. It is important to keep in mind that once a hotel is fully re-opened, the operation may lose access to its governmental subsidy which will affect the Break Even Point.

It is crucial to monitor payroll closely until the hotel is fully reopened given the considerable expense. Asset managers should request a weekly HR report detailing Full Timers v Demand-based payroll to compare the operator’s reforecast with their pickup. Regular tracking is necessary to avoid high salary costs that are not currently affordable which is likely to occur should an asset manager only rely on the P&L report provided the following month.

The “new normal” COVID-19 norm may also require less staff as guests will prefer less interaction and a more digitalized experience.

F&B Expenses

It is likely that F&B expenses will be reduced as it will become a more planned and less spontaneous operation. Restaurants will need to strictly control how many patrons are served and seated in the restaurant at a time. Many F&B operations may become pre-ordered systems, allowing hotels to plan better and increase their cost control. Buffets, a very costly and wasteful operation, have become a thing of the past which will aid tremendously in cutting down F&B expenses. However, alternative F&B operations may require more staff than a buffet. Staffing level should be considered carefully as this could increase expenses instead of minimizing them. F&B expenses can also be controlled by reducing the menu offering in order to reduce stock and minimize waste.

Rooms Expenses

It is still unclear whether room expenses are expected to increase or decrease as a result of COVID-19. On one hand, there will be stricter standards and more sanitation required. Additionally, the public areas will need to be cleaned at a higher frequency than before. On the other hand, housekeeping schedules and turnovers have been reduced as a result of COVID-19 in an effort to limit exposure and contact. This will have a large effect on the housekeeping labor requirements and payroll expenses.

Other Operated Departments

Operators will need to determine if there are sufficient demand and occupancies to operate a spa or other leisure facilities. To achieve break-even, it may be more beneficial to remain closed while the costs exceed its potential revenues and if the risk of re-opening is deemed too high.

Review All Contracts and Monitor Supplier Payments

- Simplify the number of suppliers in F&B, reduce expensive stock (e.g., the wine cellar)

- Check all historical contracts which shouldn’t be renewed (e.g., interim staff providers)

- Limit monthly contracts that are not 100% useful (e.g., PR agencies), and renegotiate commissions (e.g. local OTAs)

- Review and negotiate large contracts (e.g., laundry, dry cleaning), especially those that don’t impact the hotel’s operations directly (e.g., energy, insurance)

- Software licenses & HR (external payroll management agencies)

- Don’t rely only on the operator’s Profit Protection Plan as it is often only easy-to-pick savings. The approach should be similar to a ‘zero based budget’

It is the right time to clean up this part of the hotel business. Once revenues come back, we can always reassess the situation.

Calculating your BEP

Once the hotel has a clear idea of the cost structure and understands what areas are crucial to focus on, the calculation can begin. All that is needed is a basic profit and loss statement that excludes the hotel’s occupancy levels as this data is the most difficult to estimate during uncertain times.

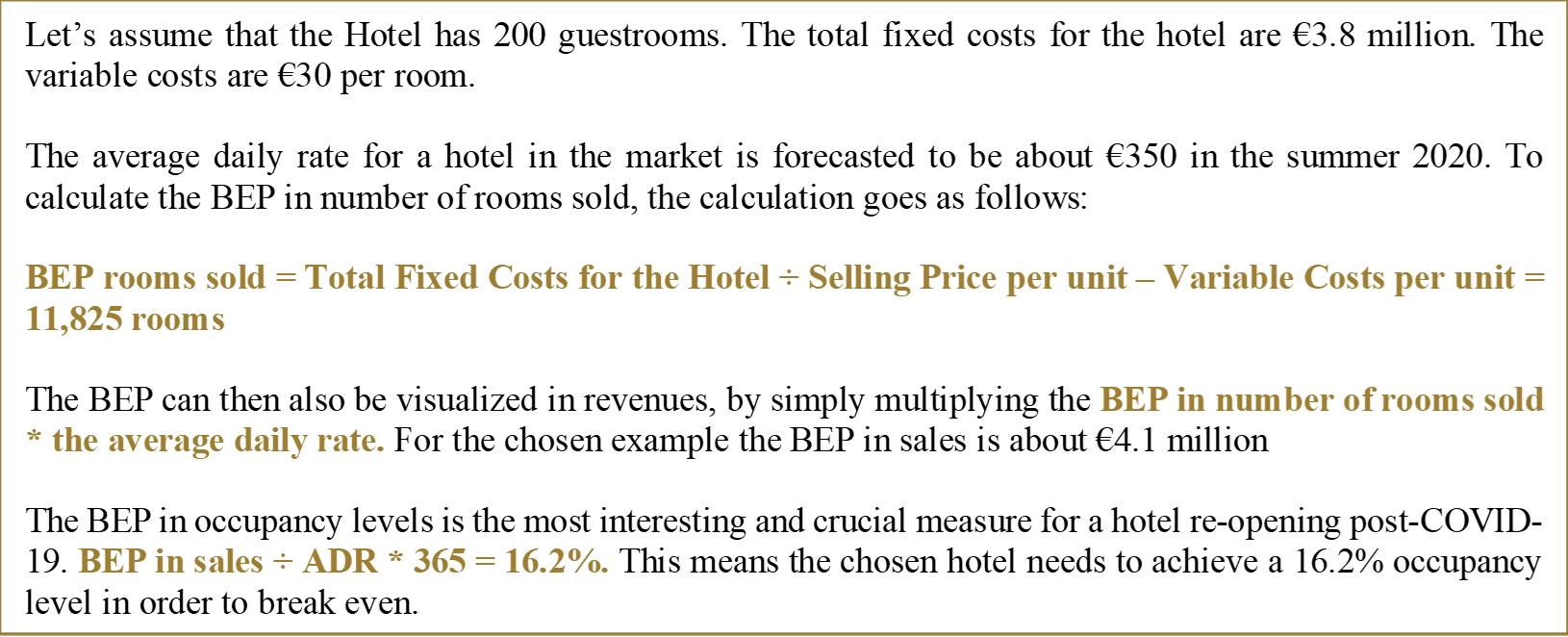

Below is an example of how hotels can quickly and easily assess their Break Even Point in terms of sales and occupancy and discover what occupancy they should strive for.

The example uses a 200 key luxury hotel in a European capital and calculates the Net BEP. It can be adapted to individual circumstances as needed.

How to Keep Costs Low and Break-Even – Some other examples:

Temporarily Close Down Low-Traffic Areas of the Hotel

This could be entire floors, public spaces that are not utilized due to social-distancing measures, or specific F&B outlets. Conversions are also possible through leveraging technology to convert traditional F&B outlets into delivery options for guests and externals alike.

Improve Energy Efficiency

By conducting a thorough analysis of utility costs, the hotel can find areas where costs can be reduced by employing more energy-efficient automation technologies, such as light timers and LED light bulbs.

Reviewing Cancellation Policies

With travellers being more cautious when complete bookings far in advance, the hotel can attract more guests by being more lenient with their cancellation policies. For example, in the case of a cancellation, the hotel could offer the guest the option to rebook at the same hotel within one year.

Read more articles from Global Asset Solutions

Sources of information

Stayntouch. (2020). COVID-19 and Hospitality: 7 Alternative Ways to Cut Costs and Save Your Business…BEFORE Resorting to Layoffs. Retrieved from: https://www.stayntouch.com/resources/articles/covid-19-and-hospitality-7-alternative-ways-to-cut-costs-and-save-your-business-before-resorting-to-layoffs/