What do successful weekly Smith Travel Research (STR) reports across regions and hotels have in common? A well-executed group strategy, which answers the question, “What amount of group business, along with all other segments, constitutes optimal mix for your hotel?” Of all the market segments that make up a hotel mix, group segments form the strongest foundation for most hotels’ pricing strategy.

Group segment trends for 2018

1. Shorter booking windows and increasing Average Daily Rate (ADR)

As per STR reports, group segments are growing slightly faster this year when compared to last year and the booking window is tightening. This gives hotels the opportunity to increase rates or offer alternate dates to unforecasted groups that fit the short-term optimal segment mix.

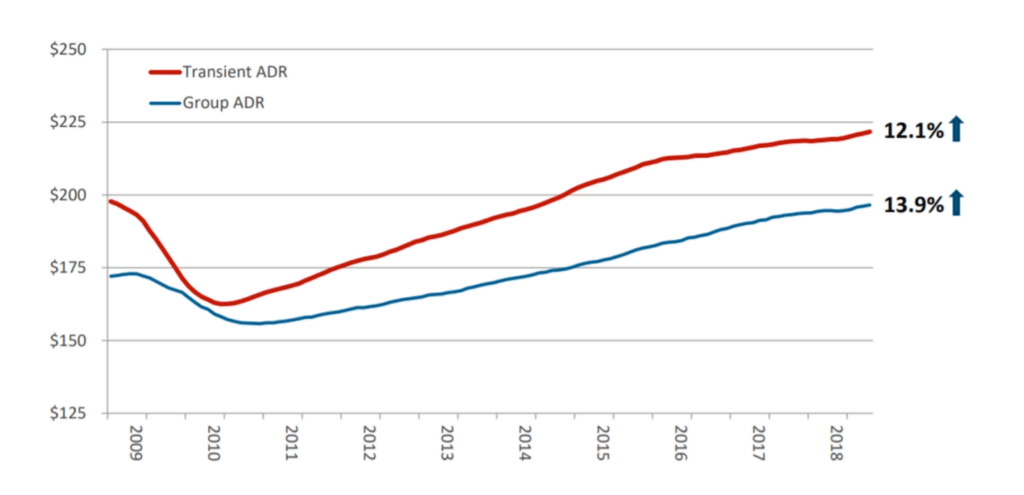

Another opportunity within this segment is that group ADR is trending at a 13.9% increase, nearly two points higher than transient ADR growth.

Group ADR trending up at +13.9% YOY

2. Rising group acquisition costs

With several external group booking platforms, hotels are now paying close to 15-25% of guest-paid revenue in total customer acquisition costs. By 2022, this number is forecasted to increase to 20-30% of guest-paid revenue*. Increasing group acquisition costs make a strong case for the use of hotel data as a source of lead generation for groups.

*Source: Lead Strategies report by RainMaker and Social Tables

3. Embracing digital technology

A recent Skift article noted that hotel acquisition, labor, and staffing costs are increasing along with third-party expenses associated with traditionally sourcing and hosting group business. As a result, you should embrace innovative methods of lead generation to save time and find the right fit for your properties.

Deciding to accept or deny group business

For all group business, pricing is based on internal and external demand data. Internal data includes hotel occupancy, pace compared to last year, and forecasts. External factors include congestion in the city due to conventions, events, and competitor data in group performance.