You might call it the Booking.com-ization of Expedia.

Expedia’s recent launch of its hotel Accelerator program, which enables properties to bid to move higher in search results on Expedia hotel pages based on paying higher-than normal commissions, is the latest example over the past few years of big business model changes Expedia made to parallel initiatives that Booking.com pioneered years earlier.

Competitors routinely copy features or products that have worked for their rivals but these changes that Expedia has made in recent years are major alterations.

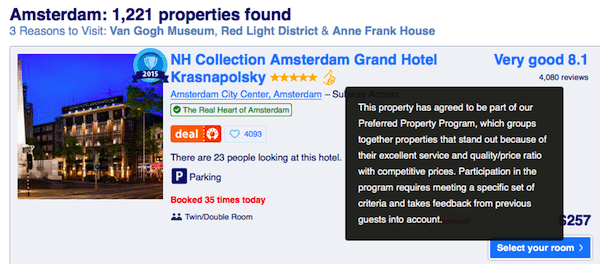

Booking.com’s Preferred Property Program has been around for more than a decade. It enables hotels to move up the sort order when they pay extra commission and, as with the Expedia Accelerator program, meet certain performance requirements. Unlike Expedia, Booking.com identifies participating properties with a Preferred Hotel Partner logo.

Lowering Commissions For Hotel Chains

It may seem counter-intuitive, but Expedia’s introduction of its Accelerator program, which entices hotels to pay higher commissions in times of occupancy challenges, is closely tied to another Expedia business model change that gets it more similar to Booking.com — a drive to lower the commissions that big hotel chains have to pay.

As we outlined in 2012, when describing How Booking.com Turned the Other OTAs Into Converts, Booking.com historically managed to scale its business, in part, by using an agency model with lower commissions than Expedia’s more-complex-to implement and higher-commission merchant model.

As we wrote, Priceline’s two acquisitions in 2005, Bookings B.V. and Active Hotels, “eschewed the merchant model in favor of a retail, or agency, model and replaced complexity with simplicity and efficiency for hotels.”

Expedia officials have acknowledged in recent weeks that the company has lowered hotel chains’commissions, which have traditionally been higher than Booking.com’s and were seen as an impediment to growth.

“… Our strategy with our chain partners is no different than our overall strategy which is to lower our base commissions, so that there is very little friction in working with us,” Expedia CEO Dara Khosrowshahi told analysts on February 11. “And then really any hotel, whether they are a chain or independent can compete in our marketplace for share and this is a big marketplace, the marketplace is only growing and if you got competitive pricing and you got great content and you treat our customers really well and you provide excellence availability along with margins you will do well in the market place.”

So Expedia believes it can grow faster by lowering commissions and thus making its distribution more attractive to hotel chains that are pushing direct bookings.

At the same time, lower commissions for chains could theoretically lead to a revenue gap, which might be reduced by enabling chains and independents to bid their way higher on search results pages through the Expedia Accelerator program.

Whether they lowered their commissions solely to compete better with Booking.com and others or they were pushed to do so by consolidation in the hotel industry and the emergence of TripAdvisor as a hotel-booking channel is open for debate.

Perhaps all of these factors went into the decision.

Lending credence to the theory that Expedia’s commission reductions weren’t solely voluntary, late last year Hilton Worldwide CEO Chris Nassetta went public and boasted of economic and other concessions the chain won.

Or perhaps Expedia planned on lowering commissions all along.

Expedia Traveler Preference Program

In an earlier and related concession to the Booking.com way of doing things, in July 2012 Expedia introduced the Traveler Preference program, which gives travelers the choice of paying at the hotel or prepaying through Expedia. Until then, Expedia overwhelmingly used the more lucrative pre-paid model while Booking.com used the more-hotel-friendly pay at the hotel model.

Read rest of the article at: Skift