With our access to real-time traveler audiences and unmatched visibility into global travel demand, we’re in a unique position to share the current travel trends at the forefront of marketers’ minds.

NB: This is an article from Sojern

We take a look at the data to aid travel marketers in determining their strategy during the COVID-19 crisis. They can use these trends to inform their marketing strategies during this period as the situation stabilizes.

These insights are based on data collected through Saturday, July 18, 2020. We review our data frequently to provide regular insights into consumer behavior trends and patterns. Sojern’s insights are based on over 350 million traveler profiles and billions of travel intent signals, however it does not capture one hundred percent of the travel market.

US Domestic Travel Restrictions Vary from State to State

Travel restrictions in the US differ vastly from state to state. Many states, including New York, New Jersey, and Connecticut have implemented strict travel policies or advisories for incoming residents and out-of-state travelers coming from states that recently suffered outbreaks. The policies require a 14-day quarantine. The list of states subject to the travel policies is very fluid and changes without notice, as states are consistently being added, readded, or removed when COVID-19 hotspots pop up or die down, but totaled 22 states last week. Most of the states currently on the list are located in the Midwest or the Sunbelt regions.

New York’s travel advisory list expanded to 31 states this week, as they saw their lowest death toll and had no deaths in NYC on July 21. On top of the quarantine, New York implemented a $2,000 fine to anyone traveling through New York airports with tracing paperwork that does not meet the requests of their travel advisory. If arriving by car or train, the governor asks that the forms be submitted online. The caveat is for essential workers, like aircrews or medical volunteers, who may be exempt from the quarantine, while all leisure travelers must abide by the advisory. Some states are also giving exemptions to those who enter and test negative after. However, it’s important to note that the Trump administration is not offering assistance in coordinating interstate quarantines or setting national guidelines, meaning that states must rely on their own police forces (in conjunction with county health officials) to enforce these policies.

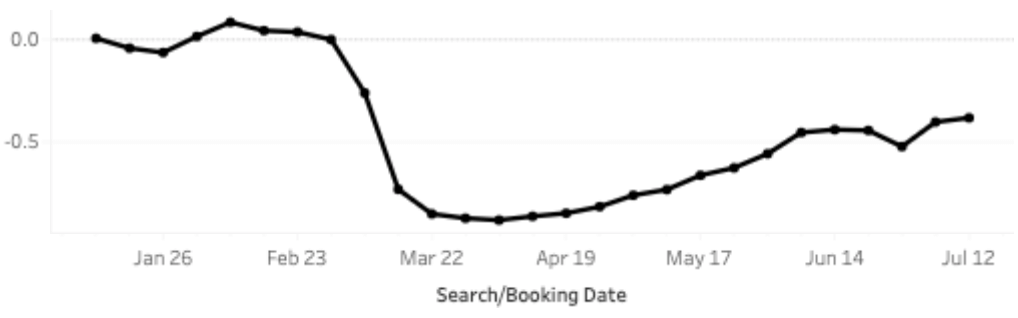

Domestic US Hotel Searches and Bookings Continue to Rise

Though the US hasn’t seen true travel bans from state to state, the indirect bans such as the 14-day quarantine upon arrival or the closing of any businesses that are nonessential could deter some people from travel. However, despite some state’s extra precautions and enacting travel advisories, our data shows consistent growth in domestic hotel searches and bookings with a single-week dip in mid-June when states began to close down again, proving that people are still planning to travel. However, our data does show that growth in the US is far flatter than what we see in Europe and Asia, possibly indicating that a majority of US citizens are still remaining cautious about traveling due to the high number of COVID-19 cases.

US Domestic Hotel Searches (Indexed to January 5, 2020 to show pre-COVID-19 to current)

US Domestic Hotel Bookings (Indexed to January 5, 2020 to show pre-COVID-19 to current)

One of the possible reasons for US domestic travel growth could be due to the international travel bans placed on US citizens. As the US recently surpassed 3 million COVID-19 cases, only a handful of countries are still welcoming tourists from America. The Bahamas, for example, opened up to international travel on July 1, but due to growing US COVID-19 cases, restricted travel to US citizens again beginning this week.

The CDC has also recommended that no one travel internationally unless it is essential. All of these factors seem to be keeping most US travelers close to home this summer, preferring short-distance road trips to international air travel. A GlobalWebIndex survey in mid-May asked respondents about what types of vacations they planned to take in the next 12 months–46% said a domestic vacation, and 20% said a “staycation” in their local area. This tracks with what we’re seeing in Sojern data–the trend that road trips and domestic rural destinations remain top drivers for travel right now.

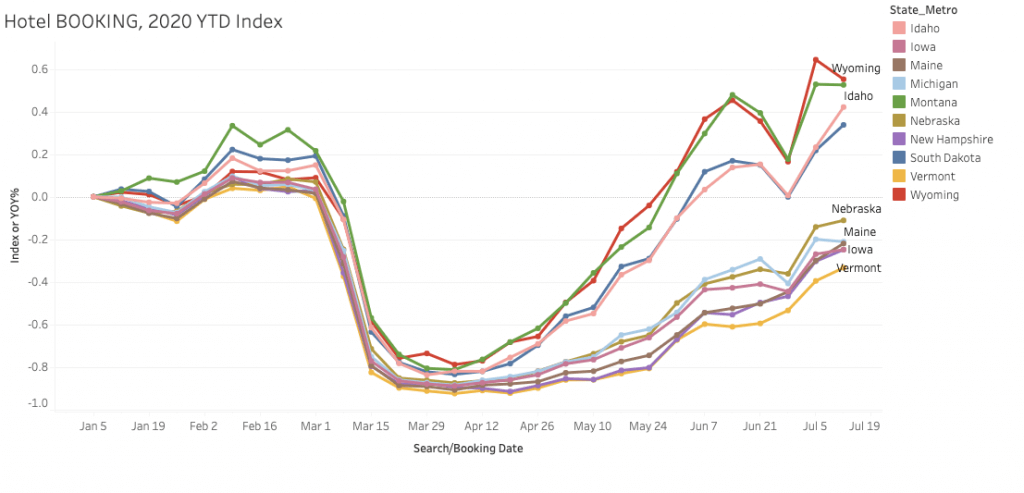

Vermont, Maine, Montana, South Dakota, Idaho, Wyoming, New Hampshire, Nebraska, Michigan, and Iowa are the most improved states for hotel bookings since the low point of April 5, 2020, pre-COVID-19. These states have several rural areas within them, offer a lot to do outside, are heavy drive markets and finally, for the most part, have reported lower COVID-19 cases than major hotspots. In the Northeast in particular, the reopenings have not been paused or reversed, so people are allowed, and in some cases encouraged, to travel there.

In Maine, visitors from New York, New Jersey, Connecticut, New Hampshire, and Vermont are exempt from the quarantine and testing requirements due to improving case numbers, which encourages drive market traffic within the region. In Vermont, restrictions were lifted almost entirely: beaches and pools are open, retail is operating at limited capacity, and indoor dining is permitted. South Dakota never had a statewide stay-at-home plan and Idaho is currently in phase 4 of reopening, meaning bars, waterparks, and pools can operate, though capacity must be limited. When we look at where some of the restrictions currently sit in these states, we can understand why they continue to drive hotel bookings during the pandemic.

Top 10 US Domestic Most Improved States for Hotel Bookings (Indexed to January 5, 2020 to show pre-COVID-19 to current)

Key Takeaways

Our data, coupled with the information from the resources above, shows us that drive markets and rural destinations are seeing the most growth in travel right now. As a travel marketer, it may be beneficial to focus your advertising efforts in the near-term on those markets considered drive markets in your region.

We will continue to share more US insights as we monitor the situation and find interesting trends to help travel marketers shape their strategies as the industry recovers from this outbreak.