Our new quarterly Traveler Insights Report offers valuable takeaways about traveler intent during Q2 2022.

NB: This is an article from Expedia Group Media Solutions

Previously we shared a snapshot of the overall key trends, including how demand is staying strong despite the challenges facing the industry, and how inclusive travel is becoming increasingly important. Now we take a closer look at the key traveler trends in each region: Asia Pacific (APAC); North America (NORAM); Europe, the Middle, East, and Africa (EMEA); and Latin America (LATAM).

Subscribe to our weekly newsletter and stay up to date

Asia Pacific travelers growing increasingly confident

Since last year we have seen the APAC region reopen its borders one by one, and gradually welcome back visitors to help revitalize the local tourism economies. While some countries are still experiencing pandemic-related challenges, our Expedia Group first-party data shows that not only is the area open to receiving international tourists again, but travel shoppers throughout the region are eager to explore beyond their own borders.

To that end, APAC saw consistent week-over-week international search growth throughout the quarter, with double-digit growth in May and June. Looking back to Q1, the region also saw strong double-digit growth—a 30% increase in search volume between Q1 and Q2—while other regions saw only modest growth or remained stable. In addition, following the June 10 announcement that the U.S. was lifting COVID-19 testing requirements, APAC saw another lift in searches, with Australians and New Zealanders showing the most enthusiasm and leading to double-digit growth for searches to the U.S. in the weeks of June 6 and 13. When it comes to lodging performance, APAC again outperformed the other regions, with the strongest, double-digit gains in demand for hotels and vacation rentals, especially in cities like Seoul and Tokyo.

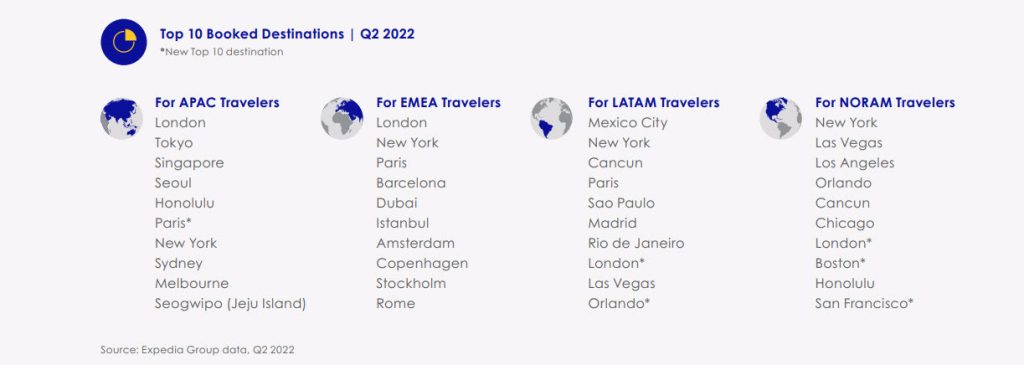

As for where APAC travelers were headed, many of the region’s top booked cities were long-haul destinations. London topped the list, while Honolulu, Paris, and New York came in at No. 4, No. 5, and No. 6, respectively. Paris was actually a new showing on the list, demonstrating further recovery in the market.

Travel to APAC

APAC has also rebounded as a destination for travelers in other regions, particularly single travelers going on adventure vacations. Q2 2022 data shows a 15% increase in demand for single adults traveling from the U.S. and EMEA to APAC, compared to Q2 2019, especially to key adventure destinations such as Thailand, Japan, and Vietnam. To help capture the strong demand for tourism in the Asia Pacific, destination marketing organizations like Tourism Malaysia are partnering with us to inspire enthusiastic international travelers to book that long-awaited vacation.

European destinations popular around the world, despite instability

Like APAC, EMEA also saw a lift in global search volume, though not as high as Q1. And like APAC travelers, those in EMEA also grew more confident after the U.S. pre-departure testing announcement, leading to a 10% increase in week-over-week searches.

Looking at search windows, we saw overall searches in the 0- to 90–day search window increase by 15%. Domestic travel search intent also shifted toward the 0- to 90–day search window, likely as travelers in the region made their spring and summer travel plans.

On the other hand, we saw a 40% decrease in domestic searches in the longer, 91+ day window. Regional instability in EMEA may have played a role in the search window share shift, thereby influencing travelers’ desire to plan for nearer-term travel—domestic and international.

Regional instability wasn’t the only challenge travelers faced; ticket prices are also on the rise, up 30% quarter-over-quarter. Compared to Q2 2019, the global average ticket price was up 20% in Q2 2022, led by EMEA (40%). The fact that travelers haven’t been deterred by these travel challenges points to the industry’s strong recovery.

Travel to EMEA

In fact, travelers from all around the world are eager to visit places in the EMEA region, with London and Paris rising as top destinations for travelers in nearly all regions. On the global top 10 list in Q2, London took the No. 3 spot, and made the top 10 list of booked destinations across all regions. The city is taking advantage of this renewed interest by partnering with us on creative marketing efforts, such as its “Dawn Till Dusk” video series as part of the “Let’s Do London” campaign. Also seeing renewed interest was Paris, which entered the global top 10 list of booked destinations at No. 7, as well the top 10 booked destinations list in APAC, EMEA, and LATAM.

North Americans excited about restriction-free travel

North Americans are also enthusiastic about travel. On the domestic front, the strongest week-over-week performance was during the week of June 6. The start of summer in the Northern Hemisphere likely played a role, but the lifting of testing requirements for international travelers may have also bolstered overall travel confidence in NORAM. Like we saw in EMEA, international searches in the 0- to 90–day search window increased, indicating interest in travel during the summer months.

As for where NORAM travelers booked trips, London made a new appearance on the top 10 list, suggesting growing confidence in long-haul travel. This is also supported by the search data, which saw searches from the U.S. to Italy increasing 10% in Q2, as well as ticket count data. In fact, Q2 delivered 165% year-over-year growth in traveler demand for flights from the U.S. to Europe, with London, Paris, and Rome topping the EMEA destinations for U.S. travelers.

Travel to NORAM

Canada also continued to lead search increases in Q2, as both an origin country and a destination country. Comparing June 2022 to April 2022, inter-province searches were up 10%, while searches from the U.S. to Canada increased 20% during the quarter.

In turn, travelers in other regions were also enthusiastic about visiting North America. Globally, Chicago, Las Vegas, and San Diego saw the strongest growth in Q2 demand between April and June. And as we’ve seen in previous quarters, New York was a top destination for travelers in all regions.

Latin Americans enthusiastic about long-haul travel

Like the other regions, Latin America also saw several positive gains. For instance, LATAM also saw a boost in searches after the U.S. testing requirement was lifted for international travelers. In fact, international searches globally increased nearly 10% week-over-week during the week of June 13, with LATAM leading the way.

Like APAC, LATAM international search share for the 31- to 60–day search window increased 15% quarter over-quarter. Looking at longer search windows as an indicator of traveler confidence, LATAM also saw an increase—of 20%—for the 61- to 180–day search window compared to Q1. The spike in this longer search window suggests more and more Latin American travelers are intending to book trips further out—a positive sign that their confidence is continuing to grow.

As we saw in the other regions, Latin American travelers are also venturing further afield, with London making a new appearance on the top 10 list for travelers from the region. The city’s appearance on the list aligns with Q2 2019 bookings, indicating further recovery in the market. Paris, Madrid, and U.S. destinations such as New York and Las Vegas also maintained a presence on the top 10 list.

Travel to LATAM

As a destination for travelers in other regions, Latin America is maintaining its popularity, particularly among North Americans. As we saw in other quarters, Cancun continues to make the top 10 list of most booked destinations for travelers in North America. To capitalize on this, as well as on Americans’ growing confidence in general, Embratur—Brazil’s official agency for promoting international tourism—teamed up with us to inspire U.S. travelers to visit with its “Wow Experience Brazil Campaign.”

As you can see, despite economic concerns and the ongoing challenges todays traveler is experiencing, travel marketers should feel heartened by the clear signals pointing to continued recovery. People are prioritizing travel and we at Expedia Group Media Solutions are here to help you reach them. Download the full Q2 2022 Traveler Insights Report and be sure to register for our upcoming virtual Insights Summits in September.