What comes between a hotel or bed and breakfast (B&B) and its client? Not so long ago it could be a travel agent, who added value with their knowledge and took their 10%. Then online travel agents (OTAs) appeared – initially to do a similar job.

Now, though, OTAs are nobody’s ‘agent’. They don’t give the unbiased choice and transparent information consumers think they are getting, and they certainly don’t act as agent of the accommodation owner.

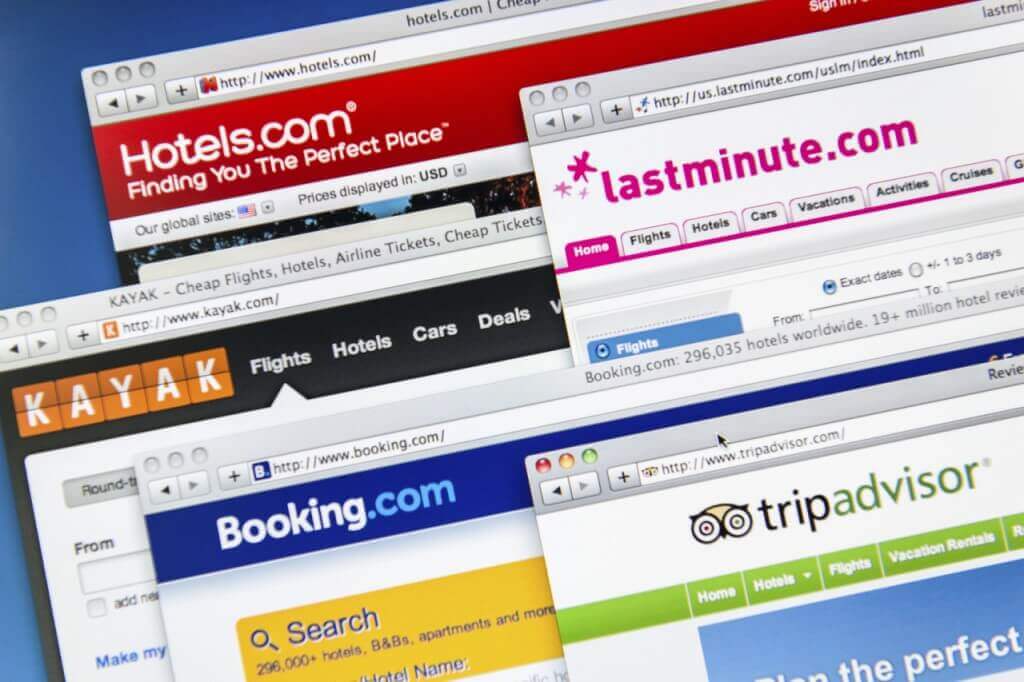

This is now an unequal and unfair relationship, at times verging on the abusive. The two giant US OTA groups – Priceline, which owns Booking.com, Kayak and others, and Expedia, which owns Hotels.com, Trivago and other brands – have some 80% of the market.

The imbalance of power between these two and an independent hotel or B&B is extraordinary. Our B&B members have no negotiation of terms with these global giants – it is ‘take it or leave it’, and what we have to take often seems unfair.

How have these platforms carved out such a dominant position in our industry, extracting such a significant and growing cut from the prices paid by consumers and driving up prices?

These are some of the ways:

- The OTAs use their vast financial firepower to buy the top places on Google search, so the OTA appears under the hotel or B&B property’s name in search results and all clicks on the name yield commission to the OTA – typically 15-18%.

- They invent false discounts to give the impression the room being sold has been discounted by the OTA when it has not (see graphic)

- The OTAs force properties to build the commission they demand into the room price, using rate-parity clauses even where the hotel or B&B sells direct from its own website, allowing the OTAs to claim they “always have the best deals”.