The media has carried out a widespread diffusion of the story that Airbnb is now offering hotels. The size of this giant company and its potential are well worth the fanfare.

Although it has already stated its low commissions, little has been written about the ticking time bomb for distribution which is the different system of costs and prices, which mixes the agency and the merchant models, adding unique characteristics to them.

This is how it works

Airbnb itself summarises its conditions for hotels in this document:

As an agency model…

- Charges commission to the hotel: 3% (5% on strict cancellation rates). It specifies it does not charge commission on included taxes so that, in order to compare it with the OTAs who do charge it, they must reduce their commission to the same proportion as the percentage those taxes amount to.

It sounds attractive… if it was a pure agency model such as Booking.com or Expedia.

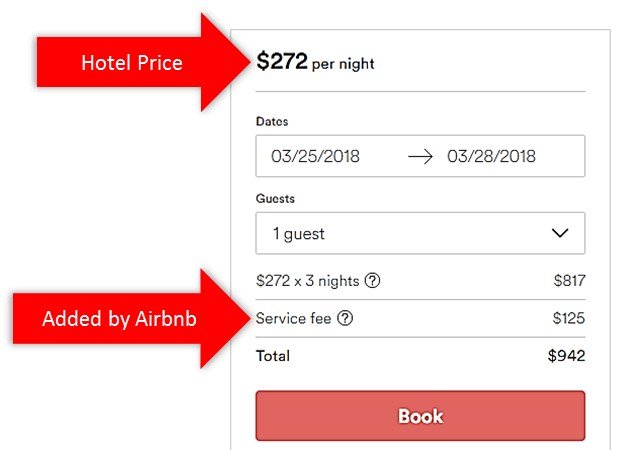

- It transmits the price, as it is, from the hotel to the user. For example, if the hotel charges $272, the client sees $272.

On the other hand, as a merchant model…

- It charges the client and pays the hotel afterwards.

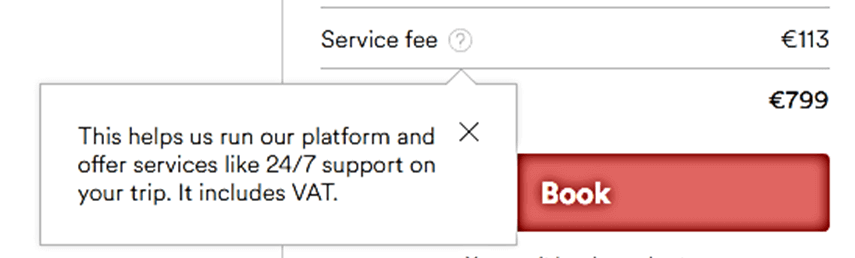

- It adds a markup: Between 5 and 15%. It calls it a “Service fee” but the concept is very similar: an extra amount that the intermediary adds and keeps it entirely.

- The hotel does not know nor has control over the final price. It is Airbnb who decides the amount of this Service fee.

Lastly, it adds unique characteristics which are highly unusual for online distribution:

- It is transparent with the client in regards to its Service fee. Unlike a traditional markup, its Service fee clearly appears broken down and separate from the hotel price. The concept is a novelty: The hotel has a price and the Airbnb service another. Both charged to the client.

Is this open to all hotels?

Hotels with specific characteristics are invited to join: Boutique hotels, B&Bs and, generally, unique accommodation with a personalised service which is close to its clients.

This leaves the door open to a large percentage of hotels, precisely those that, due to their reduced size, are more exposed to commercial powerlessness.

The hotel must request its participation to the connectivity partner (for example Siteminder) and it must be approved by Airbnb.

Four things it already has to impact the industry

Size and potential: Current distribution is a thing of giants. Only another giant could change it. It grows by 40% interannually and its brand value is not just high, but instead moves up places at great speed.

It does not require a contract, something which allows the incorporation of thousands of establishments en masse without requiring a commercial network and slow individual contracts. All it needs is connectivity with platforms, such as the one it has just carried out with Siteminder.