I’m no health expert but, for what it’s worth, I’m pretty pessimistic about this whole thing.

NB: This is an article from Ari Andricopoulos, CEO of RoomPriceGenie

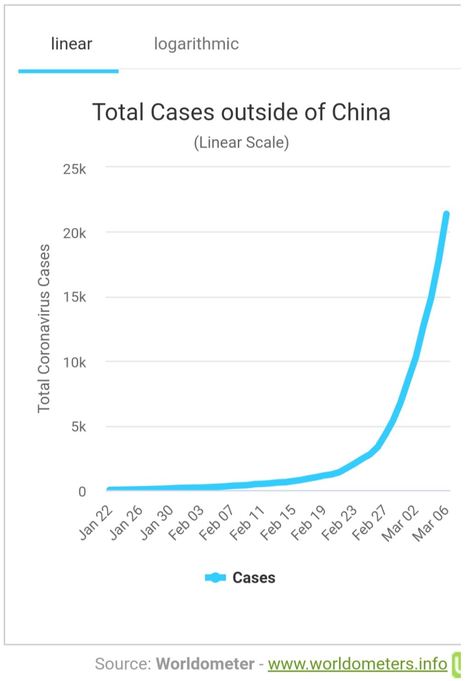

The graph below shows spread so far (to March 6th) outside China, and, as you can see, the cases are exploding:

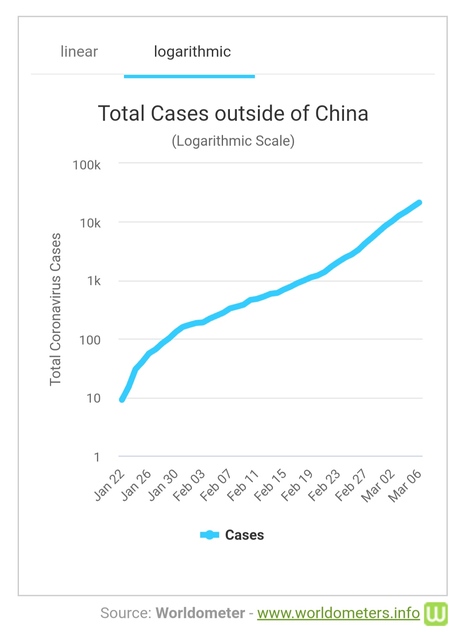

More interesting to me, as a mathematician, is the logarithmic graph which shows the rate of growth:

Here you can see that it is not slowing down. I fear that we have missed the chance to contain it early.

If growth continues at this rate, we will have 1 million cases by the end of this month, and 100 million by the end of April. If unchecked, the total deaths would be in the millions, or even tens of millions.

I will say this many times; I am no expert. But governments will need to act, and I can’t see any way we will avoid some pretty severe containment measures potentially including lockdowns and travel bans. Hopefully, the pain can be kept short and sharp and after a few months we can get back to normal.

But anything of this nature would be a total disaster for the whole hospitality industry and for all the hardworking and wonderful people in it, and we all pray it won’t come to this.

Why hotel group debt could make the problem worse

Something I do know a bit more about than viruses is finance. Before starting RoomPriceGenie, I worked for 15 years in the financial industry. And I am a little worried here too.

In that business, you work within the cycle of boom and bust and get to understand the dynamics. I will not pretend to be an expert in hotel financing, but I will say that there are certain aspects of the growth in the hotel industry over the past 10 years that make it particularly suited for leveraged over-investment.

To start with, the revenues of the global hotel industry have been steadily growing for a number of years. So what? That’s a good thing, isn’t it?

Yes and no. ‘Yes’, because it’s a growing industry and that’s great.

But ‘no’, because financial investors, seeing almost zero interest rates, have been desperately looking for investments with high dividends and growing returns. After a number of years of people investing and making good returns, more and more money follows. And there is a lot of money around to invest.

So just this fact alone makes me worried because when a lot of money flows into something good it can make it go bad. Investors often seem to imagine things can never go wrong. They borrow money and buy assets and then as they make money from their initial investments, they borrow more and invest more. This is almost a law of financial markets. It was the same in mortgages in 2008. It was the same with tulips in Amsterdam in 1637, with the famous tulip mania; said to be the first financial bubble.

So, whilst new investment in a growing industry is a good thing, over-investment is destructive. And the conditions in hotels globally have been perfect for over-investment.

The result? New hotels opening everywhere.

Another aspect of the hotel industry to consider; there is a long lead time between investing the money and the project being completed. So if someone made the decision to start building two months ago, it might be one or two years before the hotel is open. This means that new hotels will continue to be opening even after good conditions stop, thereby exacerbating potential over-supply.

So far, we have had a growing market and all of these new hotels can be sustained; no-one notices a problem.

But what if things go wrong? What if COVID-19 stops people travelling this year and occupancy goes down 30% or 40%?

Owners of smaller hotels are usually not so highly indebted. If things turn bad then they will lose money but will probably survive through it. But highly leveraged investors; here is a different story. They need to make debt repayments on top of the running costs of the hotels. This puts them in a fragile position.

The first thing they may do is drop prices just to get some revenue – in an attempt to take business from the competition. This happened after 2008 but was a short-sighted strategy as everyone else lowered prices too and they had the same demand but less revenue. If this happens again it will be really damaging because hotels fixed costs remain high, and with lower occupancy and lower ADR hotels will suffer.

The next thing that may happen is fire-sale of hotels. This will encourage new investors in at a low price, but, because they paid less, that means that they can be profitable even charging a lower ADR. This will damage the rest of the industry. After 9/11 the budget airlines capitalised on their lack of debt and ability to buy airplanes cheaply to undercut the incumbents.

The economist Hyman Minsky talks about something called the ‘Paradox of Tranquility’. The idea that stability is destabilising. Marc Lavoie, in his book ‘Post Keynesian Economics’ puts it like this:

“According to Minsky, a stable growing economy is a contradiction in terms. A fast-growing free-market economy will necessarily transform itself into a speculative booming economy. In a world of uncertainty, without full information about the fundamentals, a string of successful years diminishes perceived risk and uncertainty. People tend to forget the difficulties encountered in the past… The longer the economy is in a tranquil state of growth, the less likely it is to remain in such a state.”

In other words, the steadier the growth in the past, the less likely it is to remain like that.

My worry is that this wonderful period of growth for the industry combined with the coming of the pandemic have created conditions of a perfect storm for the industry. I hope I’m wrong.