Airbnb is poised to publicly list its stock in its upcoming IPO in December 2020 at a valuation of $30bn. Relative to other travel giants like Booking.com ($83bn) and Expedia ($17bn), this valuation may seem high at first glance. However, Airbnb could grow into the most important, if not the biggest travel company in the world, meaning Airbnb’s stock could actually be undervalued relative to its potential.

Subscribe to our weekly newsletter and stay up to date

Why Airbnb’s Unique Competitive Advantage in Single Home Owner Hosts

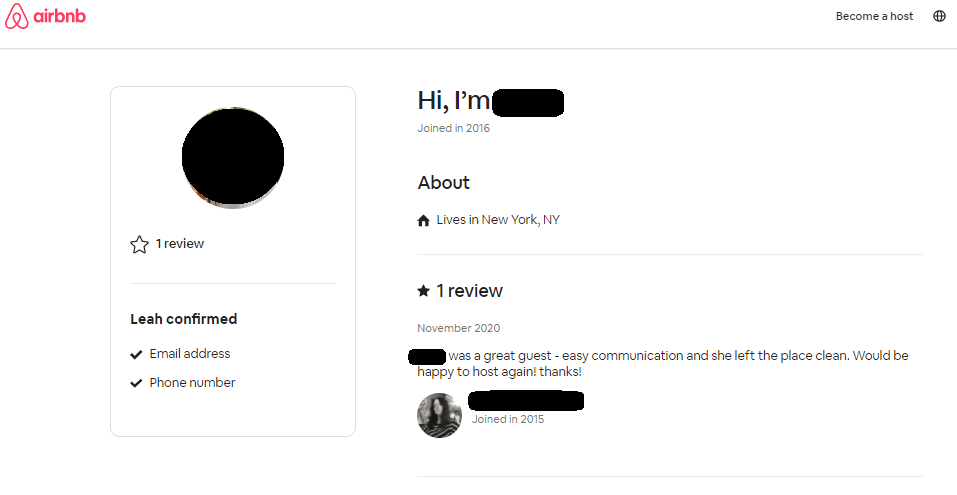

Airbnb’s true strength lies in its unique portfolio of real homes that its users can rent. These are properties owned by single-property owners whose full time jobs aren’t to rent out their homes and maximize their revenue. They have a deeply emotional connection to their properties, and they want to be able to rent it out to people that they can trust. Their priority is not to make sure their homes are occupied 24/7; it is to keep their homes safe while making some money on the side. Airbnb is able to satisfy this need due to its network of 2-sided reviews of both hosts & guests, which allows both hosts and guests to confirm Booking.coms with confidence that they aren’t going to get any negative surprises.

A typical Airbnb listing shows reviews of the properties, hosts and even guests

In contrast, other travel companies like Booking.com have not been able to replicate Airbnb’s success. For example, a quick search of vacation homes on Airbnb and Booking.com for alternative accommodation reveals that Booking.com’s portfolio of alternative accommodations largely consist of “apartment-hotel” type of properties operated by professional, multi-property owners, whose full time job is to operate properties and maximize revenue. In fact, while Booking.com’s CEO Glenn Fogel has repeatedly discussed the importance of building up more traction with “single-home owners” for several years, it’s difficult to find the types of homes that you find on Airbnb that are owned by individuals. While Booking.com has touted great success in its expansion of alternative accommodation business, even beating Airbnb on some figures, it seems to largely consist of professionally managed “apartment hotels,” as opposed to real homes. That Booking has not provided any material updates on their efforts on this front means anything, it may be that what Airbnb has built is indeed difficult to replicate even for an industry juggernaut.