The sale of an overnight hotel stay is a perishable product. If the room remains unsold, the opportunity to sell that particular room on that particular night is lost forever.

NB: This is an article from Global Asset Solutions

Unlike other products that can be stored and sold later, the prices of hotel room nights often fluctuate based on supply and demand, with prices typically rising during peak seasons or when major events are happening and falling during slower periods.

Subscribe to our weekly newsletter and stay up to date

This ability to flex room prices gives hoteliers a significant advantage they do not have in other areas of their business. The rates UK hotels were charging this March were similar to peak season July rates, according to the RSM Hotels Tracker.

“With high inflation during the post-pandemic period, the good thing – let’s say – about hotel rooms has been that you can increase your prices to cover higher costs,” observes Dimitris Mittas, chief executive of hotel and hospitality asset management firm Global Asset Solutions.

“With food and beverage (F&B) it is much more difficult to change because the pricing of menus is less dynamic,” continues Mittas. “This causes an issue with the profitability of F&B. Let’s say you have a guest staying for 10 days. You can’t increase the price of the beer every other day. There are some ways of doing it – you can anticipate the cost increases, reduce your portions or negotiate with suppliers, but the options are more limited than with room pricing.”

So, flexibility has been an important advantage of room pricing in recent years, but when a hotel opens for the first time, how does the owner establish the right prices to charge?

A feasibility study is typically required to secure investment. A consultant will prepare a detailed document looking at the business case for the new hotel that includes trading forecasts. There are usually three profit and loss forecasts to reflect central, optimistic and conservative outlooks for the new business, with average daily rate (ADR), occupancy and revenue per available room (revpar) estimates changing accordingly.

Market rates

“The market will determine what an acceptable price level is and that’s really your starting point,” says Patrick Angwin, director of boutique hospitality consultancy Clanalytix. “It’s not a question of how much you want to charge, it’s a question of how much the market will support and where you are going to sit relative to the competition.”

If your new hotel is opening in a mature market, such as the centre of Edinburgh or Manchester, there will be competitive market data available for purchase from organisations like Hotstats and STR. Ideally, you would want to reference three or four years of monthly occupancy, ADR and revpar data.

If your property is the first boutique or lifestyle hotel in a small Yorkshire town, your competitor set would not be geographically limited but would include comparable properties in other regions.

Understanding the market for a new hotel and what guests are willing to pay usually involves primary research into the main sources of business (leisure, conference, groups, business, meetings and events) and finding out what the new hotel’s market penetration index will be.

“Ultimately there will be a revpar that the market is able to support. Where do we think our proposed project is going to sit within that, taking into consideration the type and style of the hotel, the number of rooms, the service, the location, and whether it is branded or unbranded,” explains Angwin.

“Are we going to be able to outperform the market or not? Are we going to outperform it on rate or occupancy or both?”

To make the trading forecasts, room prices are added to all other ancillary revenues to give the top line calculation. Then you can start looking at what your cost base is going to be. Again, if available, competitive set profit and loss data can help here, or you can build up a picture by estimating your various cost lines: payroll, property tax, costs of sales, etc.

Once you have established your net profit, you can start to weave in your financing and build costs, the cost of the land, the developer’s profit and professional fees. Then you can work out how long your payback is going to be. Angwin adds a necessary word of caution: “[Opening a new hotel] is not as simple as coming up with a calculation that will cover your costs and provide you with a profit. This is not how the real world works. I’ve done many feasibility studies where, in the end, the numbers didn’t stack up. It is not a question of ‘build it and they will come.‘”

Looking at the percentage of elderly people in the local population may give you a fairly clear idea about the need for a new care home, for example, but understanding the demand for a new hotel is more complex because people visit hotels for many different reasons. That’s why the best way to build a business case is by starting with existing market data and pricing.

Real time comparison

Once hotels are up and running, what can we understand from looking at their prices? Let’s compare two hotels: the full-service Hilton and the limited-service Premier Inn in Angel, Islington, which are almost next door to each other. For a same day mid-week booking in May, the cheapest room at the Hilton is £260, while the Premier Inn flex rate is £255 (the non-flex, pay now, no change rate is £217). We might expect a bigger difference in price, but there’s not much in it.

Location is an important factor here and the Premier Inn rate in Angel is higher than for Premier Inns in nearby King’s Cross. Another factor to consider is business on the books and booking pace. The Hilton is probably not very full on that day, so it has dropped its price, while the Premier Inn might have decent occupancy, so it is charging more for the last remaining rooms.

Mittas offers another possibility: “Maybe the limited-service hotel is just going for rate and they don’t care, which is not a bad idea sometimes. This is another way of doing revenue management. You just go for the price without really caring about the occupancy. What are the risks there? You might end up with very low occupancy and you won’t be able to cover your costs.”

This relates to the traditional strategy of having a bedrock of group bookings, which tend to be sold at lower negotiated rates in return for providing high volume. As more rooms are sold on top of the group bookings, there is the opportunity to increase prices too.

However, when using dynamic pricing there tends to be an established limit to how high prices can go, which is related to the hotel or brand identity.

Darren Sweetland, chief executive of Mollie’s, the motel and diner concept created by Soho House, says: “We promise our guests our signature ‘budget-luxe’ stay experience. This means we always want to keep our rates within a certain range, even if market demand may allow us to push them up. We’ve been able to set up the Atomize revenue management system in a way that it automatically suggests prices in line with both our brand promise and our business interests.”

Occupancy versus rate

Hoteliers typically see high levels of occupancy as a good thing, although being full all the time can result in higher operating, maintenance, and refurbishment costs.

Some costs, such as washing and changing bedsheets, vary with occupancy, while others, like flower displays in the lobby, do not.

In the following example of two 100-bedroom hotels, Tim Kolman of consultancy Neoteric Hospitality illustrates the balance hoteliers must strike between pricing and demand, underlining that the hotel with the higher occupancy and lower room rate is less profitable.

Red hotel

80% occupancy at £100 per night

80 x £100 = £8,000

Costs per occupied room = £20

80 x £20 = £1,600

£8,000 – £1,600 = £6,400 profit

Blue hotel

100% occupancy at £80 per night

100 x £80 = £8,000

Costs per occupied room = £20

100 x £20 = £2,000

£8,000 – £2,000 = £6,000 profit

If we extend the above over a year, the difference in profit is £146,000. Although this is an oversimplified example, it illustrates that some high occupancy situations can lead to lower profits if occupancy is prioritised over rate. In the pre-internet age when most marketing materials were printed, hotels typically set two room rates for low and high seasons. Today, many hotels still have fixed pricing structures, for example, leisure hotels that have large allocations of rooms booked via tour operators. There are still variations in their pricing but not on a daily basis. Typically, there will be a different rate for each month throughout the summer.

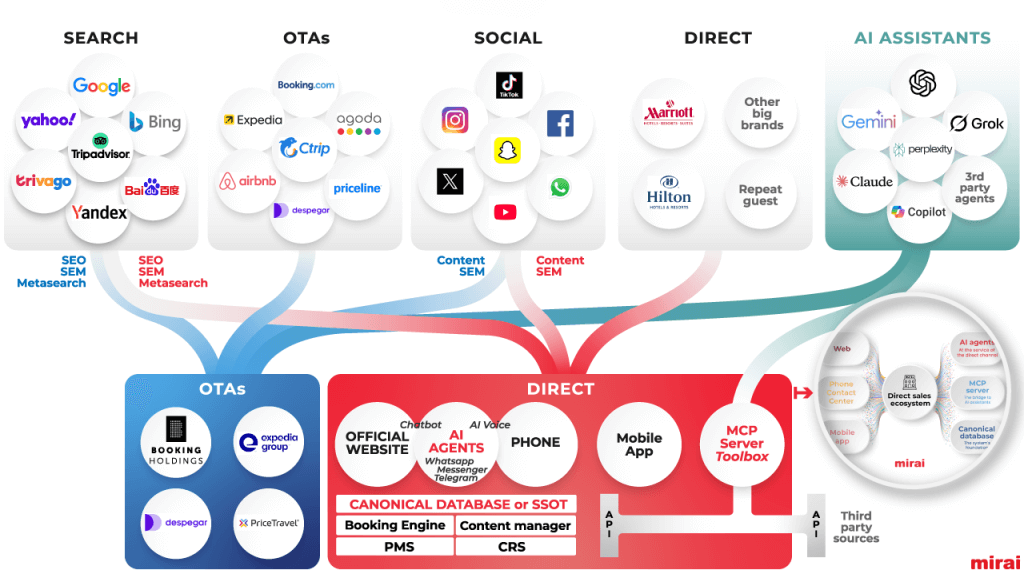

Many consumers book their holidays via online travel agencies (OTAs) which brings us to the issue of rate parity. Hotels that sell their rooms through OTAs sign an agreement not to sell their rooms at a lower rate on their own website than on the OTA’s website. It is the responsibility of a revenue manager or a reservation manager to maintain rate parity, either with the help of software or manually – a hotel typically changes its rates once or twice a day. This does not stop hotels selling below their advertised dynamic rates. They do this with negotiated corporate rates and group bookings which provide bookers with lower rates per night per person in return for guaranteed volume for the hotel.