Owners and operators are dead set on obtaining more direct bookings for their hotels to maximize their profits. Revenue management and marketing, more than ever, must align in order to achieve what their owners are asking for.

I recently had the opportunity to sit down with Clay Jackson, director of sales for nSight Travel Intelligence, to discuss what travel intent data is and how hotels can utilize these insights to gain a competitive advantage and drive more direct bookings.

BM: There is quite a bit of buzz around market demand data in the revenue management industry, specifically forward-looking data. Can you tell us a little bit about the importance of this data, what nSight offers its clients and why it is so unique in the marketplace?

CJ: To understand the importance of “intent” data in the hotel industry, we need to talk about how it currently functions. The best tools use historical data as their foundation to make pricing and inventory recommendations.

Traditionally, the two most reliable pieces of information revenue managers use to manage future trends are price and inventory (which is broken into a variety of segments). In all cases, revenue managers know their inventory and pricing. However, while they don’t necessarily know their competitors’ remaining inventory, they do know their competitors’ pricing through rate shopping services. The relationship between what we know, what we don’t know and the assumptions we make drives decision-making in the hotel industry.

In the unknowns, revenue managers make educated guesses for the demand available by segment (unconstrained demand) coming into the market on a given day. They must then model the levels at which they (and, in turn, their competitors) will absorb that demand.

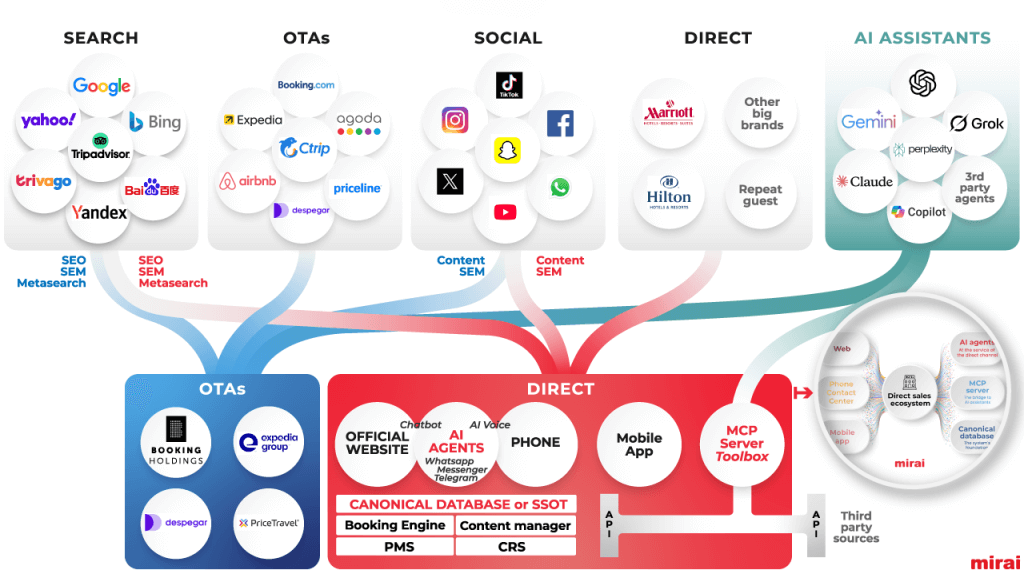

This brings us to “travel intent data,” which can actually begin to quantify demand for future dates. Every day millions of consumers from around the world conduct millions of searches and bookings for hotel rooms on thousands of internet sites. By capturing this data, and standardizing it in a way that makes sense, we are now able to better map the levels of unconstrained demand for a hotel, its competitive set and its destination for any future travel dates.

nSight uses search and booking data from third party booking sites and OTAs as “intent data.” In the transient customer’s purchase cycle, the OTAs and other third party channels are where the vast majority of transient customers search for the hotel they want to book.

In other words, while it may not be magic, it can be compared to that coveted crystal ball.