Expedia is trying to enlist a new ally — hotel property owners — in its fight against the moves by hotels such as Hilton Worldwide, Marriott International, and Hyatt to increase direct bookings by offering lower rates on their websites than they give to the online travel agencies.

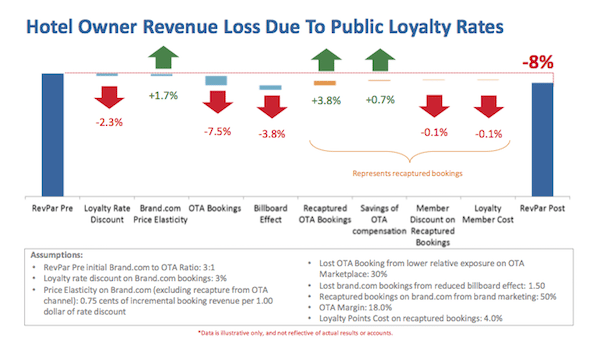

In a chart provided to Skift, Expedia lays out what it calls a conservative estimate on how hotels would be taking a revenue hit of around eight percent because of chains’ decisions to publicly offer hotel loyalty program members lower rates on hotel websites than they give to Expedia, for example.

In essence, Expedia argues that despite property owners saving money on distribution costs from direct bookings, the lower rates they are offering on brand.com sites, their reduced exposure on Expedia sites, a diminished billboard effect and higher loyalty program costs lead to reduced revenue per available room for owners of about 8 percent.

There will undoubtedly be plenty in Expedia’s numbers for hotels, owners, and others to pick apart, including the issue of whether the lost traffic from the billboard effect is overstated, or perhaps Expedia is downplaying the percentage (50 percent) of bookings that hotels are recapturing from the online travel agencies via marketing campaigns.

In fact, speaking on background only, representatives of a couple of chains disparaged Expedia’s numbers. One said these are early days with probably only one quarter of data to measure and direct booking amounts to the cheapest distribution channel for chains as well as owners.

An official from another chain pointed out that Expedia’s assumption that chains get 25 percent of bookings from Expedia is an inflated notion.

None would comment on the record because of earnings’ quiet periods or other factors.

To be sure, Expedia states its chart doesn’t represent actual figures but is directional in nature.

Whether Expedia’s numbers are on the mark or off the wall, the fact that the company went public with its estimates points to the concern at the online travel agency over these latest marketing initiatives within the hotel industry.

It remains to be seen whether a divide and conquer tack in trying to pit property owners against the chains will be effective.

What’s Changed?

Cyril Ranque, Expedia Inc.’s president of lodging services, argues that a hotels owner didn’t have a say in what he considers the chains’ “short-sighted” and “strange” marketing strategy to emphasize direct bookings at the expense of online travel agency distribution.

Read rest of the article at: Skift