The current pandemic and unprecedented difficult times have so far dramatically impacted our lifestyle, be it how we work, travel, socialize, meet and greet, connect, etc. and it is only fair to assume that these forceful effects will remodel our behavior and attitude in the midterm and potentially forever.

NB: This is an article from HVS

With all the uncertainty that remains around the duration and outcome of this pandemic, one can confidently assume that there is a shift in consumer mindset, attitude and behavior which we need to learn, understand and consider in any future predictions especially as it relates to the recovery of the travel and hospitality industry.

This presentation summarises the findings of the “HVS Traveller and Hotel Guest Sentiment Survey”. The goal of the survey was to understand current confidence levels, changes in behaviour and preferences, and most importantly the decision making when selecting destinations and hotel stays in the near term. We raise key concerns and questions that are worth reflecting on to address the complex “new normal” that will govern future investments and operations in our industry.

Albeit this survey is by no means an extensive exercise, the findings confirm that the traditional assumptions and rational underlying previous recoveries are challenged and therefore, we strongly encourage airlines, tourism bodies, owners and brand managers to engage in further evaluation of future behaviours and preferences of traveller and guests, which will be key to future forecasting and recovery scenarios.

The survey sample size is 333 respondents and it was carried out between 18-24 April 2020.

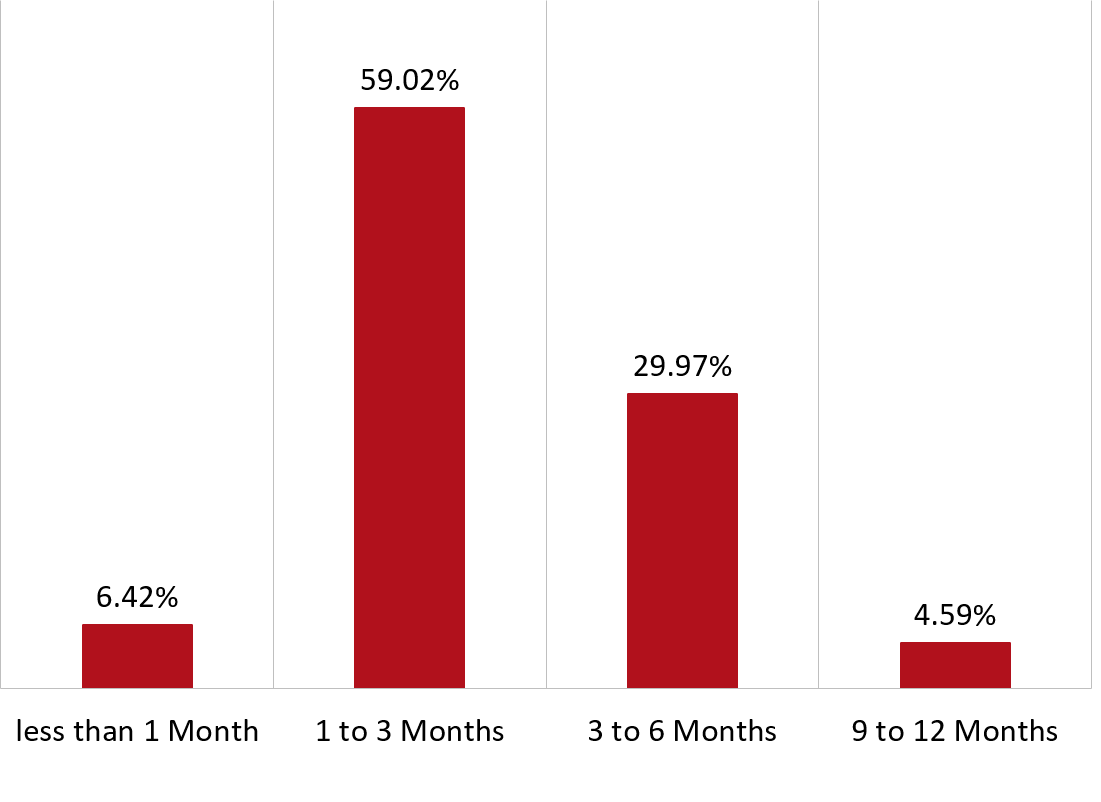

Question 1: How soon will the commercial flights resume from and to the GCC region?

Approximately 90% of respondents consider that commercial travel will resume in the next one to six months, which shows an overwhelming consensus that the aviation industry will take a considerable amount of time to resume normal operations. This further highlights the uncertainty-driven feeling amongst the respondents and therefore it will take time for the aviation industry to re-adapt to the change in travel behavior.

Additional investigation to support future predictions of recovery will require an analysis of, but not limited to:

- Source of visitation and timeline for reopening their respective airports;

- Local versus regional travel;

- International versus regional travel dependencies;

- Purpose of travel;

- Choice of destination;

- Health and safety measures;

- Cost to travel.

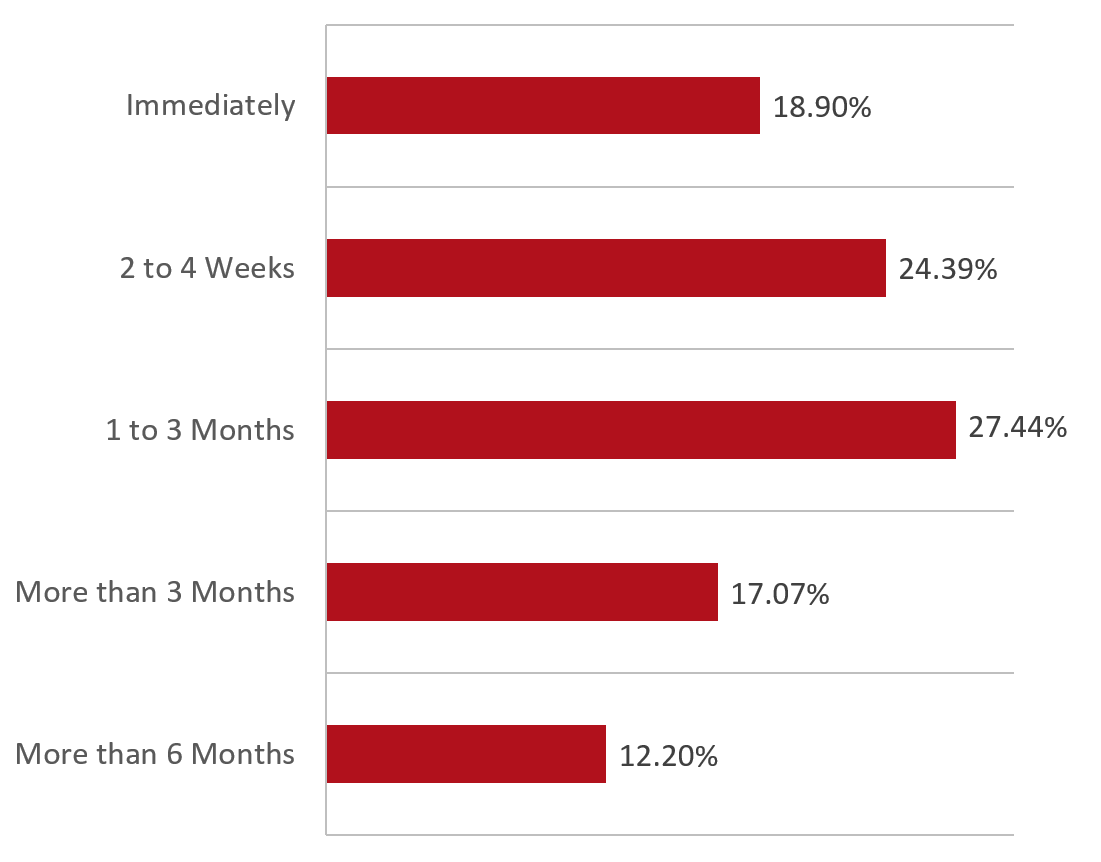

Question 2: Once travel ban is lifted, how soon are you likely to take a flight?

While 52% of the respondents are willing to travel within three months of the ban being lifted, 19% will travel immediately. Approximately 29% are cautious and prefer to wait beyond three months to travel.

Further investigation to understand motive and purpose of travel is important especially as it relates to hotel product and offering (i.e. Resorts, Convention Hotel, Corporate Hotel).

Further analysis of the correlation between airport traffic and hotel stays will allow better understanding of conversion rate and occupancy.

The responses could suggest the following:

- Immediate travel could be correlated to business traveller whose work necessitates traveling or family reconnection/reunion;

- Two weeks to three months may consists of business traveller subject to corporate travel restriction policies, family travellers, as well as those that chose to return home indefinitely;

- More than three months are predominantly travellers who are likely to book a holiday trip.

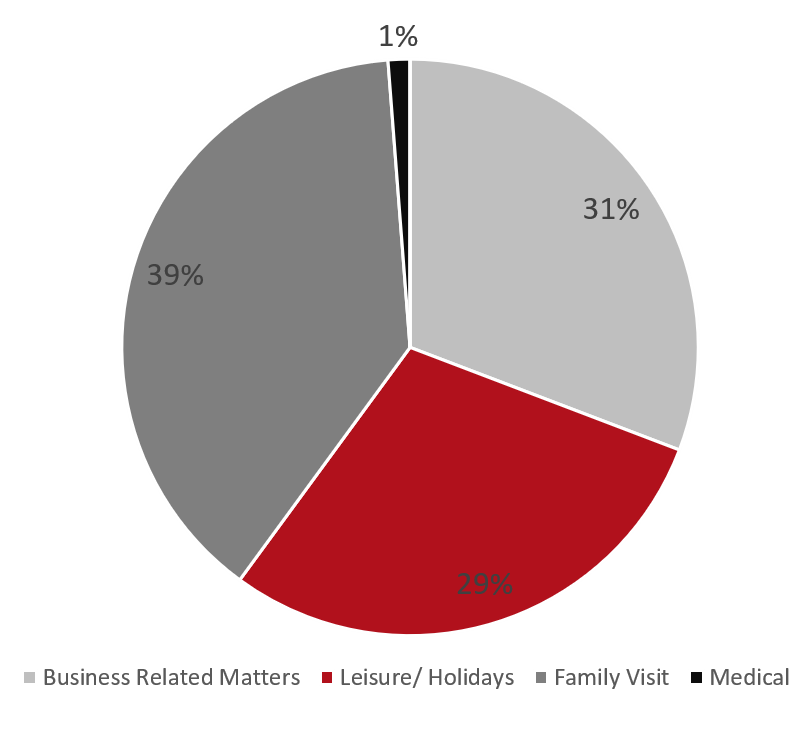

Question 3: Purpose of travel plan will be for:

The purpose of travel post lifting travel ban will impact how we forecast recovery and hotel performance:

- 39% of the respondents will travel for family gatherings/reunion while only 29% will travel for holidays;

- 31% of respondents will travel for business related matters.

It is therefore important to understand and project the likely demand levels from the corporate segment taking into account “corporate travel policies” notably in terms of timeline and spend. It is quite likely that large corporations may defer travel timelines and subsequently have smaller budgets to spend on international/regional travel.

The choice of destination and type of accommodation for the leisure guest will be impacted by a number of factors including but not limited to confidence, spending power, purpose of travel, sense of security etc.

Travel industry pricing strategy can play a role in deferring or expediting travel.

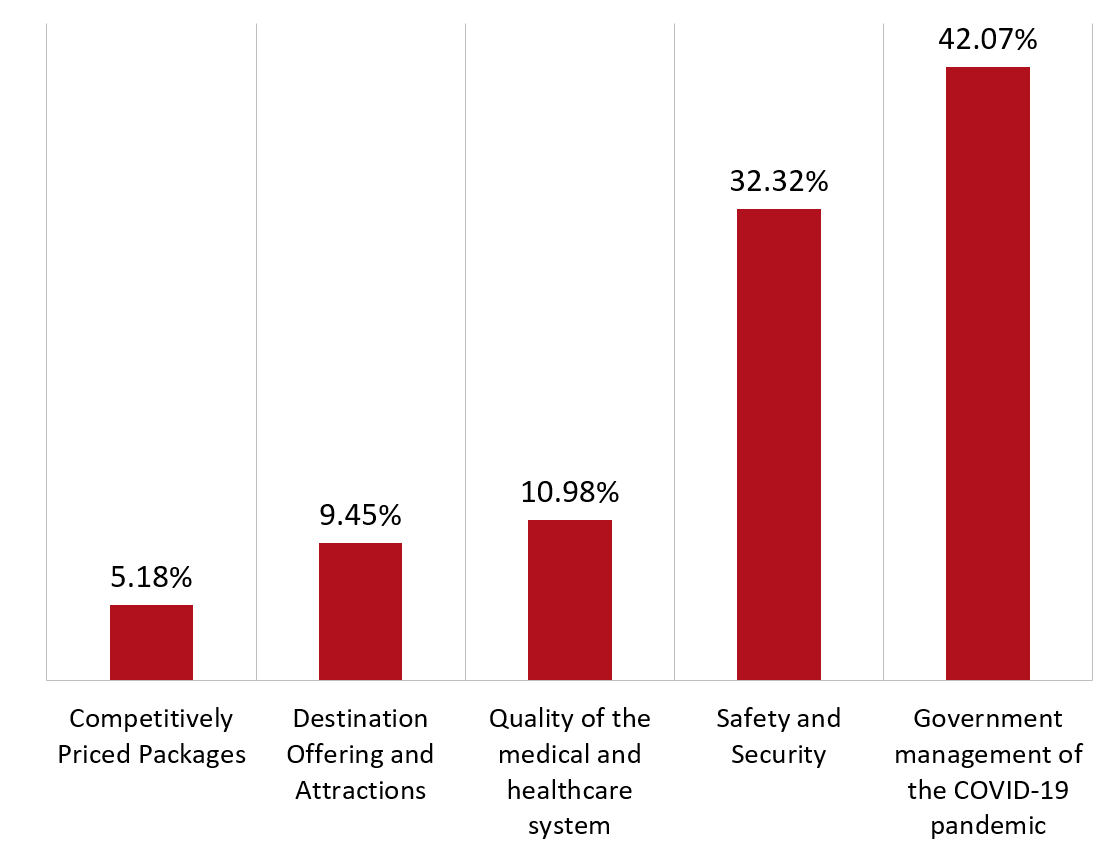

Question 4: What will weigh most into your destination selection?

Future destination selection shows an undoubtful correlation between Government management of the COVID-19 pandemic and the safety and security of the desired destination.

Combined, 85% of travellers will prioritize their travel arrangements according to the reputation and actions undertaken by the governments in keeping good order throughout the pandemic outbreak, safety and security measures as well as the quality of the medical healthcare system.

The findings suggest that governments will play a key role in restoring confidence amongst travellers and that the future will require joint efforts between the private and public sector in order to deal with those key concerns.

While competitively priced packages is least important to the respondents at this stage, hiking up prices will have a negative impact on the recovery.

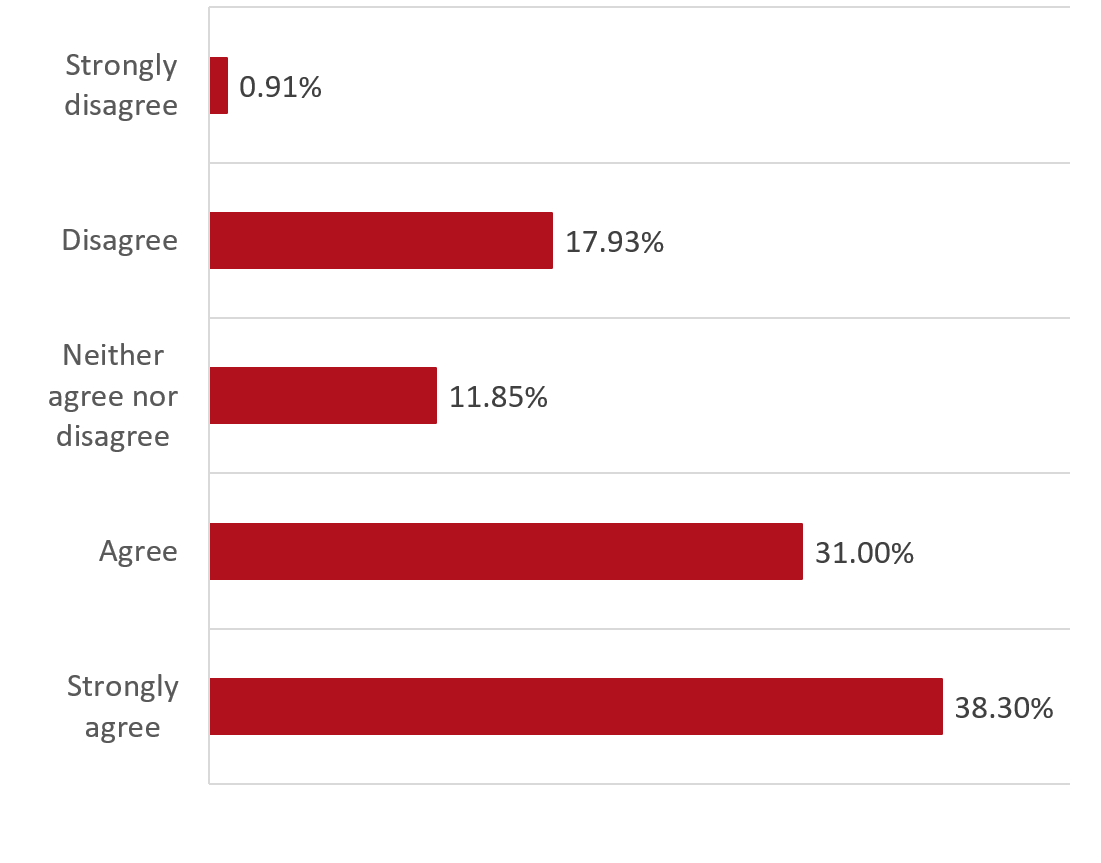

Question 5: The travel Industry will experience a decline of at least 50% in the number of passengers in the year following the travel ban lift.

About 70% of respondents consider that passenger traffic is likely to drop by 50% in the 12 months post lifting the travel ban.

The traditional conversion model between airport passenger movements and hotel stays will require significant adjustment to reflect the reduced passenger numbers but more importantly the changing preferences and traveller behaviour.

Determining the reliance of a destination on international travel and international source of visitation is critical in the near to mid term forecast.

Cities with higher share of local tourism may support faster hotel recovery than cities that depend heavily on inbound travellers.

Staycations may generate substantial business to local hotels subject to rebuilding consumer confidence.

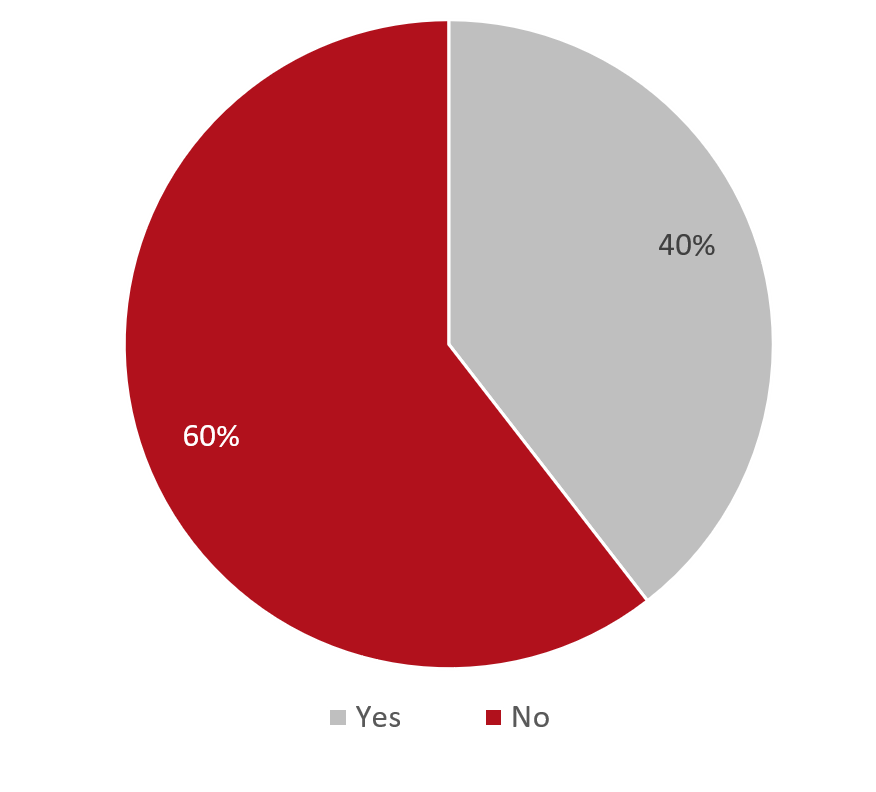

Question 6: Will your travel decision be based on the availability of the COVID-19 vaccine?

60% of respondents are likely to travel despite the absence of a COVID-19 vaccine. It is yet to be observed and evaluated whether the traveller’s choice of airline will be influenced by the measures undertaken by the airlines in testing and reducing the potential associated health risks.

Travel behavioral decisions seem more dependent on a sense of safety and governmental pandemic management than the availability of a vaccine.

40% of the respondents are more comfortable to resume travel once a vaccine becomes available which points to a continued period of low travel demand even after restrictions are eased.

Further analysis of purpose of travel is required in order to determine the potential conversion rate to hotel stays.

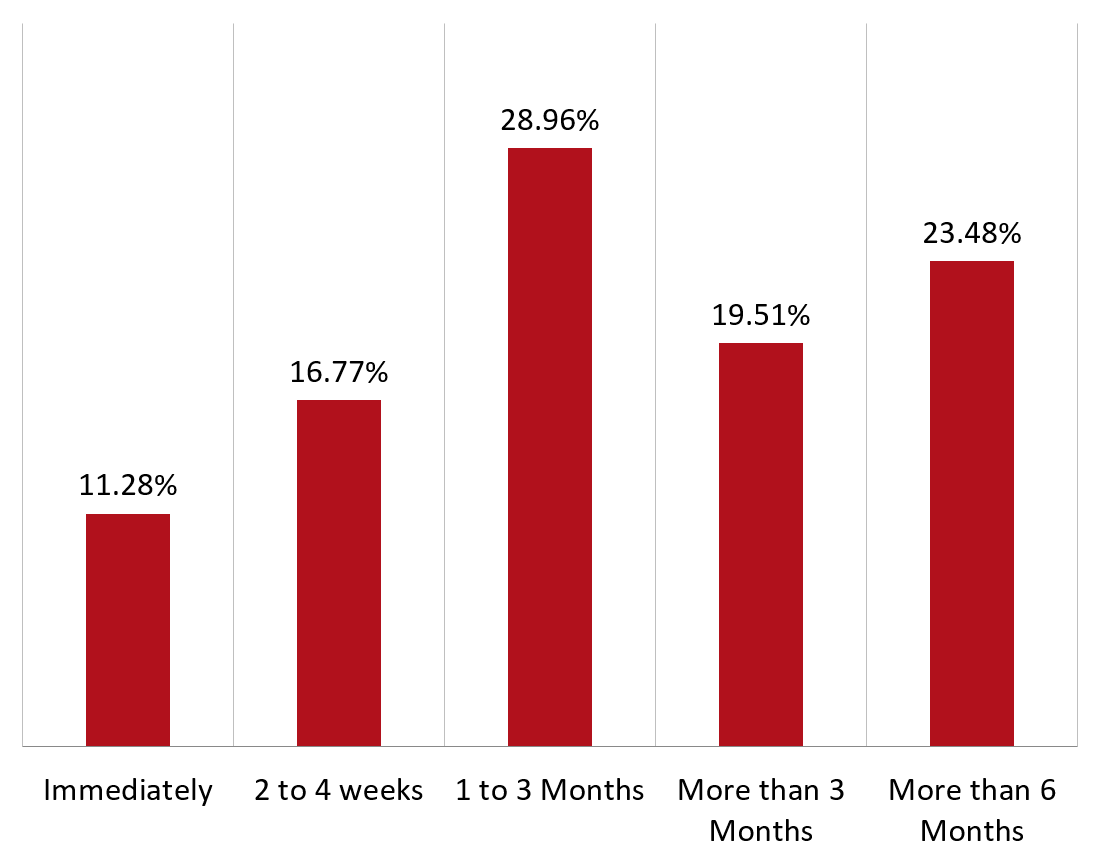

Question 7: How soon are you likely to book and stay at a hotel?

The prevailing sentiment to this question is that more than 28% of respondents will book a hotel stay within one month of the pandemic containment or decline.

- Only 11% will book immediately, while 17% are likely to book within two to four weeks;

- Approximately 43% will wait at least three months before booking and staying at a hotel;

- A large percentage will wait at least six months to stay at a hotel.

This clearly suggests low guest confidence levels which will need to be restored. The level of trust and guest confidence can vary significantly according to the guest motivation and intentions to travel.

Disposable income and choice of spending will also impact the selection of accommodation; if at all.

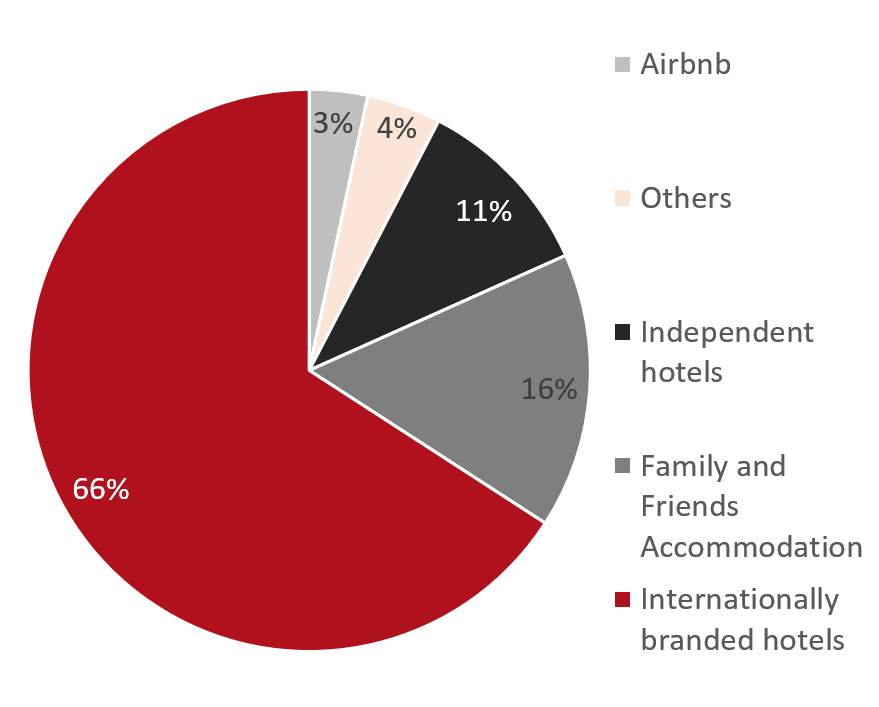

Question 8: What type of accommodation are you likely to book?

An overwhelming 66% of respondents favour internationally branded hotels for their stay. Indisputably, the trust-perception played an immediate reaction to this question.

Many large global operators have embarked on and are implementing revised health and safety protocols at their properties in order to regain guest confidence. It is evidenced that these efforts should be complemented by the government efforts to contain and potentially “eliminate” the health risks as highlighted in the previous questions.

16% of respondents are likely to stay with Family and Friends and will not use hotel accommodation on their next travel trip.

Only 3% of the respondents will book Airbnb accommodation, which presents an opportunity for hotels managers to regain market share, at least in the near to mid term.

Question 9: What are the most critical challenges facing hotel re-openings?

.png)

New health and safety regulations coupled with guest confidence are the main challenges for the brand managers to consider while planning the post pandemic roadmap. It is evident that 75% of the respondents in this survey consider these two factors to be the most challenging.

Consequently, this poses future financial implications for owners to comply with new health and safety regulations and for brand managers to uphold a brand-guest transparent relation to reinforce guest confidence.

Approximately 18% of the respondents consider that cashflow is likely to be a serious challenge and when combining all three factors (>90%), the financial implications may result in additional hotels closing or potentially some not re-opening. This could also be an opportunity for financially solid owners to achieve better results through increased market share.

While only 3% of respondents consider “Talent” not to be a challenge, we consider that the new traveller behaviour will necessitate retraining of staff as well as assessing the impact of the current events on the wellbeing and attitude of our human capital.

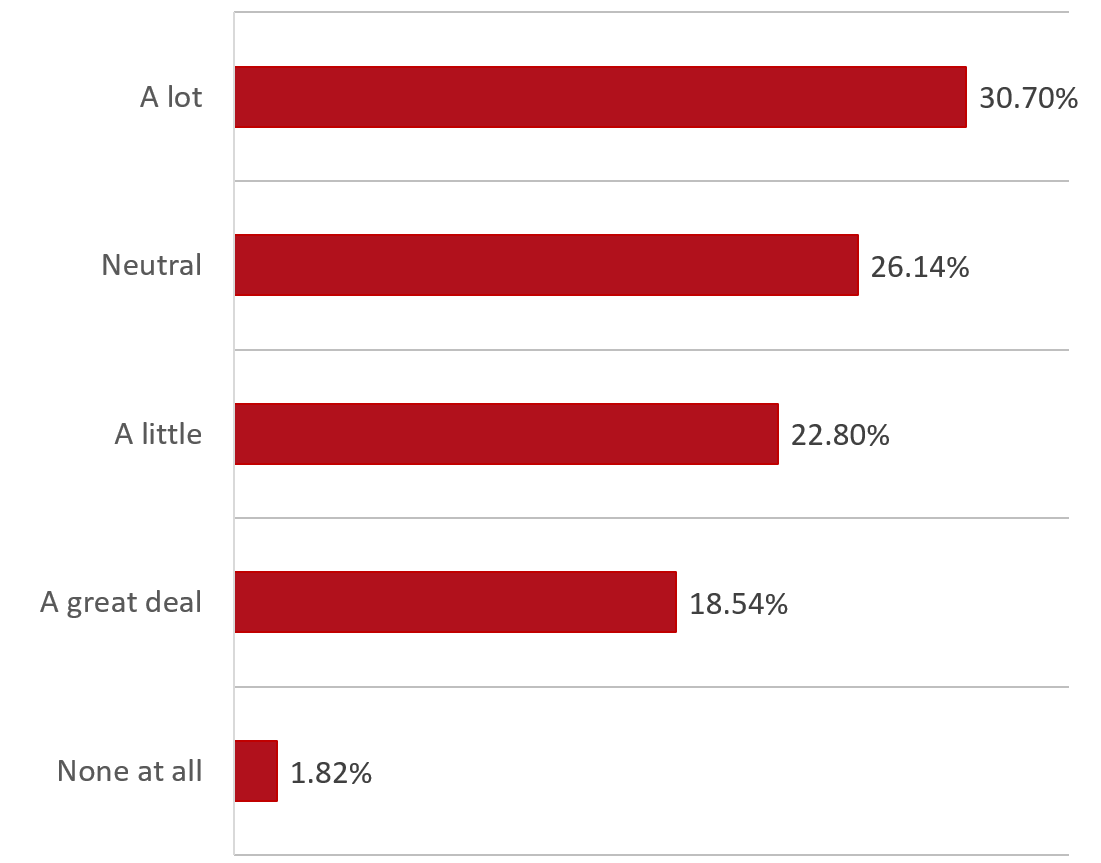

Question 10: Overall, how optimistic are you about the future of the travel and hotel industry?

Optimism is the result of one perception of events, attitude, ability to adapt and resilience. Approximately 50% of respondents remain optimistic about the future of the travel and hotel industry in the mid to long term. This attitude signifies a strong will to adapt to new changes and upcoming challenges.

While 23% are “a little” optimistic and are expecting a hard road to stability and growth, 26% of respondents are neutral and remain uncertain about the future. International tourist arrivals to the Middle East have increased in the last couple of years but constitute less than 10% of world’s arrivals.

We remain confident that the overall outlook for the tourism and travel industry in the region is positive despite the current uncertainty.