Today’s typical online travel consumer is exposed to more than 38,983 micro-moments in a 60-day timeframe and visits an average of 18 websites via multiple devices across eight sessions before making a hotel booking (Google Research).

NB: This is an article from hebsdigital

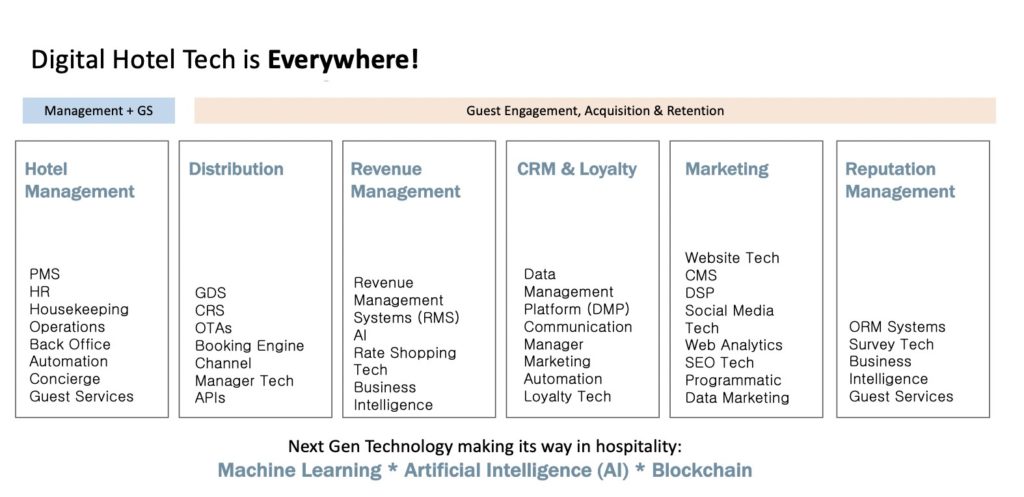

With the explosion of the “digital way of life”, the customer journey has become increasingly complex, forcing hoteliers to overhaul not only their corporate and marketing strategies, but also their technology stack in order to engage, acquire, service and retain these digitally-enabled travel consumers across multiple digital touch points and across all digital channels and devices.

Today’s hospitality is being transformed into a 100% digital technology-enabled industry powered by online, mobile, cloud, IoT, AI and blockchain tools and applications. Digital technology is making its way into every aspect of the industry: hotel operations, guest services, communications, revenue management, distribution, CRM and marketing.

Today’s hotelier must understand, know and use digital tech solutions in their everyday environment, and be able to assess, evaluate, recommend and acquire technology solutions to improve guest satisfaction, operational efficiencies, productivity, customer service and revenue.

TYPES OF GUEST-FACING HOSPITALITY DIGITAL TECHNOLOGY

If we set aside the traditional hotel operations, administrative/back office and HR technology, and the hotel engineering infrastructure and “mechanical” technology (all of which are typically “hidden” from the guests), there are two categories of guest-facing digital technology:

- Guest Engagement, Acquisition, and Retention Technology – these are technology applications focused on engaging and bringing the guest to the property, continuing the conversation pre-, during and post-stay and eventually turning the guest into a loyal and repeat guest.

- Guest Services Technology – these are on-property hardware devices and appliances, and software applications (on-premises or cloud-based) that provide or enhance guest services, improve guest comfort and satisfaction and enable customer service and communications.

Today, the vast majority of hoteliers are primarily focused on and investing in Guest Services Technology, while underinvesting in Guest Engagement, Acquisition and Retention Technology.

Unlike hoteliers, the OTAs are focused exclusively and investing only in Guest Engagement, Acquisition and Retention Technology since they do not have to worry about on-property technology and guest experiences. In other words, hoteliers’ technology focus and investments end where the OTA focus and investment begin.

It’s no wonder that over the last 6 years the OTAs have increased their market share by over 40% at the expense of the hotel direct channel. By investing heavily in technology applications to engage the traveler at all possible touchpoints of the customer journey, OTAs have monopolized the guest relationships and left hoteliers in the dust.

This is particularly true for independent hotels and resorts, smaller and mid-size hotel brands.

1. GUEST ENGAGEMENT, ACQUISITION AND RETENTION TECHNOLOGY

There are crucial aspects of the Guest Engagement, Acquisition and Retention Technology category which the hospitality industry is ignoring, not excelling in, or dramatically falling behind in including:

-

Online Distribution Technology:

Over the past 15 years or so, the industry has become somewhat better at adopting online distribution technology: cloud-based website booking engines (WBE), central reservation systems (CRS) and channel management platforms. Yet, many independent hoteliers still utilize separate WBEs, CRS, and Channel Management vendors. WBEs are used that are not mobile-friendly or have a weak uptime record, and some hotels are even a WBE and CRS provided by an OTA. To reduce friction and lower costs and vendor management efforts, evaluate and select a cloud-based distribution technology vendor that provides all three capabilities: WBE with proven user experience (UX) record, CRS, and Channel Manager, naturally with a two-way API tom your property’s PMS.

-

Revenue Management Technology:

Over 95% of independent hotels, resorts and casinos do not have an adequate Revenue Management System (RMS). An RMS is a predictive analytics tech platform for accurate and often real-time data processing, demand forecasting, pricing and segment optimization, and channel optimization. An RMS allows the property to sell rooms at the right price, at the right time, through the right channels, and to the right customers, which can result in significant increases in occupancy and revenue. Look for a cloud-based RMS which have lower implementation and ongoing SaaS costs, typically priced per room/month.

-

Customer Relationship Management (CRM) Technology:

Over 95% of independents have no meaningful CRM application as part of their hotel tech stack. A CRM technology platform typically provides guest profile data management with ongoing cleansing and de-duping, guest pre-stay communications, in-stay communications, post-stay communications, guest satisfaction surveys, marketing automation, ongoing marketing, loyalty, and guest recognition programs. If your property’s repeat guests are 10% and above, you need a CRM solution to help you double or triple that number. A cloud-based CRM is the best way to go today.

-

Online Reputation Management Technology (ORM):

Monitoring and reacting to your customer reviews has become a must-do in hospitality. An ORM system typically includes sentiment analysis, comp set analysis, reputation monitoring, guest satisfaction surveys, and analytics. Using ORM, hotels can understand what the sentiments of the traveling public are toward their property versus their competition, and can proactively impact their guests’ online reviews and ratings by better understanding their guests and by making improvements that address issues brought up in reviews. By default, ORM services today are cloud and subscription-based.

-

Digital Marketing Technology:

All marketing efforts of the property involve digital technology and applications. Marketing is used to engage travel consumers in the Dreaming and Planning Phases, acquiring them in the Booking Phase, and re-engaging them in the Reminiscence and post-stay phase. The digital marketing tech stack includes:

- SEO technology to manage rankings, monitor competition and provide keyword and ranking recommendations.

- Dynamic rate marketing applications to engage and convert customers who have expressed interest to travel to your destination.

- Programmatic and native display advertising.

- Metasearch marketing.

- Multichannel campaign applications for offers and promotions.

- Audience segmentation applications.

- Demand-side platforms (DSP).

- Email marketing technology.

- Social media management tools.

Typically, independents and mid-size or smaller hotel brands outsource digital technology needs to specialized tech-enabled digital marketing firms.

-

Website Technology:

The property or hotel brand website has become the gravitational center of all hotelier’s efforts to engage, acquire and retain the customer. Any marketing efforts of the hotel today lead the potential customers to the hotel website. Today’s website technology includes cloud-based Content Management System (CMS), comprehensive merchandising suites, reservation abandonment tools, personalization pricing and content, technical SEO, cloud hosting, and robust analytics suite.

Case Study: What Should Your Website Technology Do?

Many hoteliers often fail to understand the crucial role the hotel website and its user experience (UX) plays in the overall health of the property and the bottom line. With nearly 59% of online travelers now visiting the hotel website from mobile devices, a mobile-first website design is a must.

According to Google, 53% of visits are abandoned if a mobile site takes longer than three seconds to load. On average, hotel websites download in 6 seconds or more. Mobile-first responsive website with cloud hosting and CDN (Content Delivery Network) provides far better server response times and faster download speeds.

Your property’s mobile-first website must be backed by a mobile-first website technology platform and Content Management System (CMS) that includes mobile-first functionalities specific to the hoteliers’ needs, such as:

- Mobile-first website design, ensuring an optimum mobile user experience and content access plus best-in-class UX booking path strategy to ensure users can easily complete a booking across devices.

- Automated Schema Markup on the mobile-first hotel website, which help the search engines understand the content and intent of websites, especially dynamic content elements.

- Google Accelerated Mobile Pages (AMP), greatly increasing hotel visibility and creating another entry point to boost mobile visitors and bookings.

- Advanced merchandising technology platform for pushing specials, including last-minute offers for mobile users as well as automatic time-based offers, etc.

- Personalization capabilities to target users with one-to-one marketing messages and promotions, based their demographic info, geo location, feeder market origin, loyalty member affiliation, and many more.

- Secure cloud hosting platform, featuring a full stack of automated download speed- enhancement tools and bandwidth, specifically designed for mobile users.

Today’s hoteliers must create and manage a robust digital presence and engage, acquire, service and retain travel consumers in this increasingly mobile-first world. They must understand and invest in digital technology and marketing that enables the best possible user experience, provides the best customer service, increases efficiencies and boosts revenues.

2. GUEST SERVICES DIGITAL TECHNOLOGY

Until recently, hotels offered better technology and amenities compared to many guests’ own homes. This is no longer the case. Quite often, today’s travel consumer enjoys better technology and amenities at home: high-speed internet, voice assistants like Alexa, streaming media like Hulu or Netflix, smart TVs, and IoT-enabled refrigerators and A/Cs.

From a technology perspective, the challenge to hoteliers is to create a hotel and room environment that at least matches but preferably exceeds their guests’ home environment. In other words, hotel and room technology, amenities, and features should be the same or better than what guests already enjoy at home. These include:

Smart Room Technology:

- High Speed Internet (HSIA): true HSIA of 200 – 500 Mbps

- Entertainment: including big screen 4K, Ultra HD or OLED smart TVs, seamless multimedia hubs to enable the “synching” of the guest-own streaming media accounts (Hulu, Amazon Fire TV, AppleTV, Google Play) with the room TV.

- Voice personal assistants: these natural language processing devices, typically based on Alexa or Google Home, allow the guest to access room service, facilitate guest requests, and manage utilities and amenities such as adjusting room temperature or lights.

- Smart Barista and Beverage Center: hubs that “know and remember” the guest’s preferences and taste.

- RFID keyless mobile device-enabled locks and security.

- Smart Utilities Management: through voice assistants, IoT controls, thermal occupancy sensors or hotel app (ex. Cirq+).

- Frictionless Messaging Communications: with front desk, housekeeping, engineering, concierge and room service (ex. ReviewPro, Zingle, Whistle).

- Issue Resolution Technology: guest incident tracking, logging, dispatching, and follow up. Virtually connect guests to housekeeping and engineering or work order automation (ex. Runtriz, Guestware)

The future of this technology is the Smart Guestroom which will be completely personalized to guest preferences and loyalty member profile. Hilton Hotels via their Connected Room and Marriott via their IoT Guestroom prototypes are already working on synching loyalty member profiles and preferences with the room experience: room temperature, lighting, bathroom accessories, streaming media preferences, beverages, bedding, and more. Recently Hilton CEO Christopher Nassetta stated: “Imagine a world where the room knows you, and you know your room.”

Self-Service Guest Technology:

For DIY-obsessed consumers, self-service kiosks, devices, and mobile applications have already entered the marketplace and are enjoying wide adoption, both by hoteliers and guests. The most common devices and applications are:

Hotel Check-in/Check-out Kiosks: these lobby-based devices typically provide guest Identification, room upgrades and special offers, early check-ins, room selection/assignment, online registration card and signature, acceptance of the hotel policies, credit card payments and keycards issuance.

Mobile Apps: all major hotel chains, and many midsize/smaller hotel brands, provide their loyalty members with mobile check-in from anywhere, room selection/assignment, ability to customize stay, ability to receive alerts (traffic, weather, when the room is ready), get key from Mobile Check-in Desk or mobile key, credit card payments.

Interactive Information Kiosks: these guest information kiosks serve as a 24/7 virtual concierge and information source for both property and destination information, which increases lobby functionality, shortens concierge wait times and enhances the guest experience.

Virtual Concierge: these mobile or website apps allow 24/7 guest interaction via messaging with the Virtual Concierge, which can make suggestions, order services, and track the status of requests. This technology enhances the guest experience and generates additional revenue from auxiliary services and upsells.

Chat Bots: these AI-powered applications have already received wide acceptance and adoption in the marketplace, especially for customer service and call center reservations. All OTAs and major hotel brands have deployed some form of chatbot or AI-powered customer service application. Some OTAs already handle as much as 85% of their online customer service via an AI-powered chatbot, which has led to huge cost-savings and improved customer satisfaction.

Self-Ordering Kiosks: these F&B kiosks typically provide full menu ordering with real-time order information sent to the kitchen, inventory management, credit card payments, and printed or emailed receipts.

WHAT ARE THE MAIN CHALLENGES FOR HOTELS TO ADOPT DIGITAL TECHNOLOGY?

Hoteliers are overwhelmed by the amount of technology, data, and digital marketing silos and the need to work with a multitude of vendors in their guest acquisition and services efforts. The typical hotel uses a myriad of vendors that do not talk to each other, and in many cases do not even know each other. There will be one for CRM, a second for the property website, a third for SEO, a fourth for SEM, a fifth for online media, and so on.

Each property team, from revenue generation teams like RM, S&M, and CRM to guest services teams such as housekeeping, engineering and front desk, operate in isolation of each other. Each team has its own technology tools, databases, and vendors which are not in communication with the other teams.

These are the major impediments to the industry becoming a digital technology-driven and technology-savvy industry:

- Reluctance to invest in digital technology: This reluctance to invest in digital technology comes from the lack of understanding that we are serving technology obsessed travel consumers who demand a hotel technological experience be equal or better to what they have at home. In this digital age, hospitality technology goes way beyond the flat-screen TV or the property PMS, and should focus on guest-facing digital technology applications and devices like streaming media hubs, voice assistants, messaging capabilities, mobile-first property website, personalization technology, and one-to-one pricing and marketing applications.

- Antiquated accounting in hospitality: Most of the cloud Guest Engagement, Acquisition and Retention Technology solutions and many of the cloud Guest Services Technology applications are accounted for from the Sales, General and Administrative Expense section of the property P&L. In other words, these new technologies are not being amortized like capital expenses or considered COGS (Cost of Goods Sold). This singular fact makes many property owners and managers reluctant to invest in new types of digital technology applications, most of which are being sold to the property on a subscription SaaS basis.

- The technology and data fragmentation in hospitality is another big challenge and impediment to progress the industry faces today. Guest data lives in multiple “data islands” that do not talk to each other: PMS, CRM, CRS, Social Media, Web Analytics, Marketing Data, and BI. Very few properties and hotel companies can boast a single view on customer data with live data feeds from ALL touchpoints with the traveler.

Most of the time, CRM data is not being utilized to engage and retain past guests. Quite often different teams at the property use different sets of data in their day-to-day operations, creating a total “data integrity mess,” which directly affects the property’s guest acquisition and retention efforts.

The goal here is very clear: bridge the guest data and technology silos in hospitality and create an end-to-end solution, empowering hotels to acquire new guests, engage current guests, and retain past guests by combining digital marketing, website, and CRM data into one cohesive marketing and personalization platform.

- Lack of proper education and professional development opportunities on digital hospitality technology and the latest technology innovations, trends and best practices. How many hospitality schools today teach hospitality technology courses? Only a few. New York University’s Tisch Center for Hospitality launched a brand-new course on Hospitality Technology in the Spring 2019 Semester, which is a great start to educating future hoteliers on the importance of technology in this industry.

- And finally, we have become an industry of buzzwords and flashy gadgets, in the hope of impressing guests, owners, and investors. These show that your hotel brand is not “falling behind the curve.” Recently, an independent hotel introduced room service delivery robots, which would have been great if the rest of the hotel tech stack were in order. The hotel was still using a 6-year old website and had no CRM technology.

Hotels should first focus on the fundamentals of the technology stack before implementing more advanced things.

FRAGMENTATION IN THE HOSPITALITY TECH SECTOR.

The global hospitality industry a highly fragmented industry with a lot of technology deficiencies and needs that require smart solutions. The U.S. hospitality industry is a $155 billion industry. This provides endless opportunities for smart technology vendors to thrive and service the industry with state-of-the-art solutions.

The technology and data fragmentation at the property, discussed above, is further exacerbated by the fragmentation in tech vendors. The industry needs fewer, as opposed to more, technology vendors.

Due to the increasing complexity of hotel tech, vendors are already in need of significant investments to innovate and scale up. As a result, it’s expected there will be consolidation and M&A in hotel tech over the next few years.

WHAT ARE SOME NEXT-GENERATION HOTEL TECHNOLOGY APPLICATIONS?

Hoteliers need to monitor, proactively inquire about and familiarize themselves with the Next Generation Technologies that are already making their way into hospitality, including Artificial Intelligence (AI), Internet of Things (IoT), Voice Assistants, Chat Bots, Robotics, and Blockchain.

It is up to hotel tech vendors to carry the torch and help the industry overcome its tech deficiencies by embracing the rising tide of digital-obsessed travel consumers. Hoteliers need to embrace, learn about, and invest in the next-gen technologies already being adopted.

Labor-intensive hotel positions that involve repetitive or structured work such as housekeeping, customer service and call center reps, and F&B waiting staff will see wider adoption of robotics, automation, and other AI-powered devices in the years to come.

Over the next 3-5 years we will witness wider adoption and implementation of the following next gen technologies:

- Artificial Intelligence (AI): Customer service (chat bots), personalization (one-to-one marketing, one-to-one pricing), database management (single-view customer data) and loyalty programs.

- Voice Assistants/Voice Search: Integration of major hotel brand CRS with voice assistants like Amazon Alexa, Google Assistant and Apple Home Pod, customer service (voice assistants in hotel rooms).

- Internet of Things (IoT): Customer service (concierge, hotel lobby, room service); hotel security, operations (power and A/C management).

- Robotics: Robots will replace jobs around the property, from front desk to housekeeping to kitchen staff.

Blockchain:

The much-promoted use of blockchain in all aspects of hotel distribution, marketing and operations is another affirmation that we are an industry of buzzwords. Over the past two years, many hoteliers got overly excited by this new technology and its perceived “magic wand” ability to solve industry deficiencies.

In my view, blockchain technology will have the following three potential uses in hospitality:

- Procurement: a mega brand like Marriott deals with tens of thousands of vendors in hundreds of geographies. Utilizing a public or a private version of blockchain technology (like the IBM Blockchain Platform), a major hotel brand can introduce unprecedented traceability and transparency in its supply chain and streamline its procurement logistics.

- Secure Contracting: blockchain can power secure legal contracts between hotel chains and numerous legal parties: from franchise agreements, preferred vendor contracts, and corporate groups.

- Universal Digital IDs: in the future, blockchain could provide travel consumers with Universal Digital IDs which could be used for voice hotel reservations and loyalty program memberships. These could ultimately facilitate easier and more secure online transactions.

One thing blockchain technology is not good for at this point is hotel distribution. In order to utilize blockchain for hotel distribution, any blockchain player has to tackle the complexity of hospitality technology which consists of many moving parts.

Conclusion:

The “digital way of life” adopted by today’s tech-savvy travel consumer is forcing the hospitality industry to accelerate the adoption of digital technologies and become a 100% digital technology-enabled industry.

By being primarily focused on and investing in Guest Services Tech, while underinvesting in Guest Engagement, Acquisition and Retention Technology, hoteliers are allowing the OTAs to gain more visibility and engage, acquire and retain the online travel consumer.

OTAs are focused exclusively and investing in Guest Engagement, Acquisition, and Retention Technology. By investing heavily in tech applications to engage the traveler at all possible touchpoints of the customer journey, hoteliers have the opportunity to take market share away from OTAs and keep guests engaged throughout their lifetimes.